UK House Building and House Prices Trend Forecast

Housing-Market / UK Housing Aug 20, 2019 - 08:02 AM GMTBy: Nadeem_Walayat

UK House Building 20 Years Shortfall

UK House Building 20 Years Shortfall

The Tory government has once more pledged to build 300,000 homes per year to address Britain's chronic housing crisis which is set against the current pace of construction of about 200,000 homes per year. However, every government of the past 20 years has made similar promises to increase house building to targets of anywhere between 250,000 to 400,000 homes per year and ALL have FAILED to deliver! Every house building manifesto promise BROKEN! That's by Labour, Coalition, Tories, and our current DUP/Remain barely able to open a tin of beans government. So the first message is to take government house building targets with a giant pinch of salt!

However, against this consistent mantra of increasing house building is the reality of the real agenda which is actually not to increase house building to meet demand but rather one of leveraging house prices as being one of the primary drivers of the UK economy and thus the chances for electoral success, so forget opinions polls it is house prices that are one of the most accurate predictors for the outcome of UK general elections.

UK House Prices the Most Accurate General Election Forecast Predictor

Where the post financial crisis agenda has been further skewed towards inflating mortgage debt backed bank assets i.e. property values, which has been the primary objective of Governments since the financial world was brought to the very precipice of financial armageddon that scared the worlds governments and central banks shit less including the Bank of England, hence the policy of inflating asset prices so as to ensure that the insolvent banking crime syndicate does not collapse, hence the Bank of England has been busy funneling some £650 billion into the banking sector through a myriad of means the most prominent of which is Quantitative Easing or QE, that currently stands at £450 billion.

This is my latest analysis in a series that aims to conclude in a new multi-year trend forecast for UK house prices. Where analysis to date suggests to ignore mainstream press hysteria warnings of impending doom for Britains housing market, perpetrated no less than the Government and Bank of England which has warned to expect a 30% CRASH in UK house prices should the UK LEAVE the EU without a deal.

Instead my analysis so far continues to paint a picture for UK house prices to remain on an overall upwards trend trajectory.

- Current State and Momentum Analysis

- UK House Prices, Immigration, and Population Growth Trend Forecast

- UK Ageing Population Demographics and House Prices Trend Forecast

So let's take a look at one of the fundamental drivers of UK house prices, HOUSE BUILDING, to see what has happened to date and what is likely to happen over the coming years and what it means for house prices, the facts rather than the manifesto bullshit promises of every government.

UK House Building and Population Growth Analysis

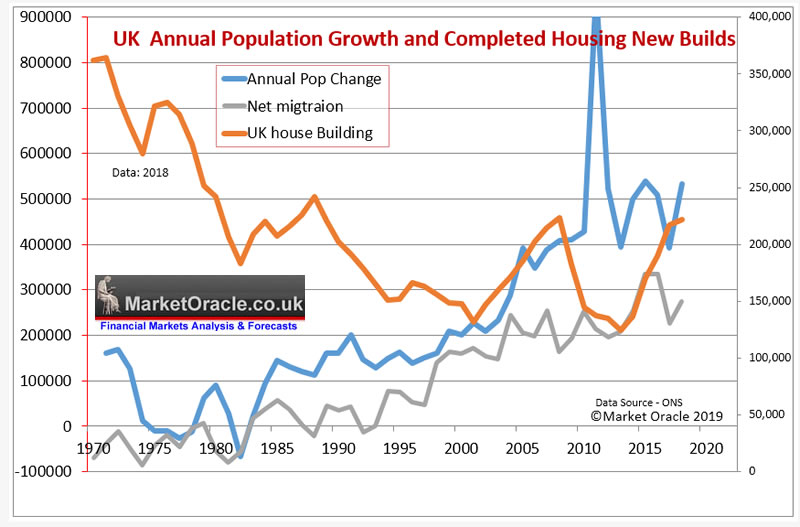

The below graph shows the UK annual population change against annual new housing build completions accompanied by annual net migration.

The graph illustrates a major long-term shift took place in UK housing market dynamics by the year 2000 as the annual change in UK population started to surge higher well beyond the normal dynamics of the system that had typically seen average population growth of about 100k per annum, capped at 200k per annum. Instead population growth soared far beyond the number of new house builds that ended the preceding trend for home construction to exceed population growth demands as the rate if house building fell from 364k per annum in 1970 to just 132k by 2000. Whilst at the same time the average size of the UK household had continued to shrink by falling from 3.1 in 1960 to just 2.23 in 2016 (one of the lowest in the world) as a consequence of the increase in single person households and single parent families. This ratio is only trending in one direction i.e. lower which means that even if the UK population suddenly stopped increasing then the falling ratio towards 2.15 by 2030 would imply demand for at least an EXTRA 1 million properties!

So by 2000 Britain was primed for the catastrophic consequences of a. under construction of new homes and b. a population explosion as a consequence of Tony Blair's Labour government opening the flood gates to allow millions of eastern European economic migrants to enter without consequences to the impact on the infrastructure which resulted in net migration soaring from 50k per annum of the 1990's to a peak of 336k just prior to the 2016 EU referendum totaling some 4 million extra people to house.

And thus the twin forces of out of control immigration and under construction of new homes resulted in a worsening housing crisis that prompted the people of Britain to vote to LEAVE the European Union as Britain had gone from building over 200,000 homes per annum with net migration of less than 50k, a population increase of 100k per annum to building as few as 130,000 homes, with net migration of 250k+ with population growth of over 500,000 per annum and this IS why Britain voted to LEAVE the EU, a housing crisis some 16 years in the making for which the primary blame lies with Tony Blair's government.

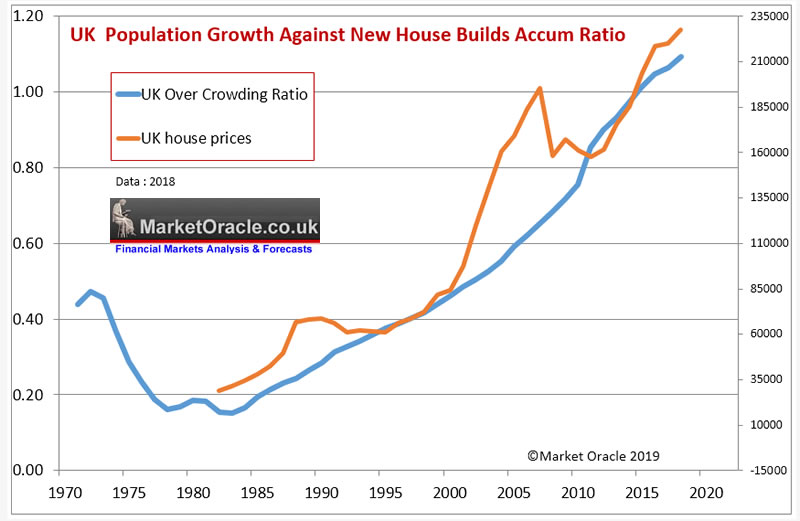

The following is one of my custom UK housing market graphs that more clearly illustrates the degree of housing market crisis that Britain finds itself in as a ratio between the accumulative change in population since 1970 against the accumulative number of new completed house builds also since 1970 which shows the magnitude of the trend towards the over crowding of Britain's housing market that given recent mainstream press headlines based on academic studies clearly remain largely blind to the consequences of, because they still are unable to visualise the magnitude of Britain's housing crisis that has WORSENED since Britain voted to LEAVE the EU which should act as a warning to those who contemplate holding a second EU referendum, as it implies LEAVE could win by an even bigger margin next time!

The ratio illustrates the change in trend that started to take place during the mid 1980's that coincided with the Thatcher governments reversal of the policy for the construction of social housing and implementation of the right to buy scheme that resulted in the sale of millions of socially owned local council housing whilst at the same time putting restrictions on the the construction of new social housing.

Now these Thatcherite measures were not just adopted out of spite for socialism, but instead was clearly as a result of academic government advisors looking in the rear view mirror at what had happened during the 1970's, namely the mass exodus of millions of Brit's who become economic migrants populating mainly North America and Australia and thus the over supply of UK housing.

This lack of insight of what was going to happen next laid the seeds for the property boom of the nineties as house prices responded to the lack of supply to meet new demand that has persisted since the mid 1980's. With Tony Blair's Labour government exacerbating the trend for the inability of supply to keep pace with population growth which ensured continuously persistent upward pressure on UK house prices that despite the great recession o 2008-2009 still showed an accelerating trend as new build supply that currently stands at 220k per year is set against government estimates for a requirement of at 300k per year, with 350k being a more realistic estimate to meet demand given the trend for falling household size, which thus ensures that the UK's over crowding crisis just keeps worsening with each passing year just as it has done or the past 20 years!

Remember the graph is a ratio of how over crowded Britain is, having gone from a ratio of 0.46 in 2000, when perhaps housing was largely affordable for Britain's hard working families with average house prices at £80k. To today's ratio of 1.09 (2018) that is worse than the previous years (1.06) and thus average house prices are now £227k!

So I hope you now fully understand the true nature of Britains housing crisis and what the journalists and academics fail to see, hence their doom and gloom housing market crash is always coming headline stories in the mainstream press.

And this analysis does not even consider the fact that each year the total number of properties remaining empty continues to rise either as a consequence of being up for sale, let, legal issues or falling derelict. This total is now more than 1 million empty properties at any one time, a number which despite demand looks set to continue to rise as many of the derelict buildings will only come back on the market when they have been demolished and rebuilt, so erroneously counted as new builds when they should be classed as rebuilds.

Implications for UK House Prices

New build supply plays an important role in the housing market as it tends to average at approx 10% of the total number of annual transactions, which is more than enough to have a significant impact on the UK housing market especially as supply over recent decades has been consistently below that which is deemed necessary to meet the demands of an relentlessly increasing population which means that the UK housing market was never destined to replicate the housing busts of countries such as the United States or even closer to home of countries such as Spain, where that housing bust prompted many hundreds of thousands of British ex-pats to cut their losses and return to the UK, closely followed by unemployed Spanish and other PIIGS citizens seeking employment in a far more liberal and robust UK jobs market and thus introduce even greater new demands on Britain's stressed housing market.

This suggests that the often put forward academic standards in terms of valuing housing market affordability ratios such as X3.5 salary towards the likely path for the UK house prices does not take into account that of relentless new demand against lack of new supply to meet this new demand that implies affordability ratios look set to continue to be pushed ever higher to new trend extremes, and therefore supports a long-term trend for rising UK house prices in real terms, i.e. expensive UK house prices look set to be here to stay for as long as the lack of new supply exists, especially as the UK population is expected to grow by at least another 5 million over the next 10 years and probably nearer 6 million which demands at least an extra 2.75 million homes to be built which is set against a realistic estimated construction of just 1.9 million new homes, near 1 million short! Which means Britain's over crowding housing crisis is going to get even worse and thus WILL act to drive house prices higher, despite the mainstream press mantra that house prices must fall because they are unaffordable!

The bottom line is Britain's over crowding ratio insures that no matter what arguments are put forward by academics that most people cannot afford to buy anymore so unsustainable house price rises must fall, instead the population growth fundamentals are such that their arguments just do not matter, the only thing that can effect this fundamental trend is if the UK literally doubles the number of houses built each year towards 400k, and even then it would probably not result in falling UK house prices but tend to index house prices to inflation. But of course that is not going to happen, the UK is not going to build anywhere near 300,000 homes per year let alone 400k, as the reality is that for most years UK house building will be short by as much as 100,000 completed new builds which will act to compound housing market demand vs supply pressures and thus exert further upward pressure on house prices with each passing year.

So this analysis continues to confirm that UK house prices on average will continue to rise for many more years. Until we start to see the over crowding ratio decline. Otherwise it acts like a coiled spring primed to yank house prices into their next strong bull market which I am sure will leave the clueless mainstream media journalists scratching their heads as to why house prices are rising when the academics say they 'should' be falling. Where negative volatility in house prices in any given year is just going to prove to be temporary as the underlying fundamentals reassert themselves as we witnessed in the aftermath of the 2008-2011 bear market as house prices proceeded to rise a wall of worry of why they would not rise due to a decade of stagnating wages when my housing crisis ratio clearly illustrates why they would rise as my above graph at the time warned to expect.

Perhaps when Britain actually does manage to LEAVE the EU and gets a grip on net migration then we will start to see a fundamental change in a trend that has been in motion for some 30 years, until then Britain's house building fundamentals are firmly for rising house prices.

The rest of this analysis has first been made available to Patrons who support my work: UK House Building and House Prices Trend Forecast

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Scheduled Analysis

- NASDAQ

- GBP/USD

- EuroDollar Futures

- Bitcoin Update

- UK Housing market series

- Machine Intelligence Investing stocks sub sector analysis

- EUR/RUB

Recent Analysis includes:

- How to Invest in AI Stocks with Buying Levels

- China SSEC Stock Market Fundamentals and Trend Analysis Forecast

- Silver Investing Trend Analysis and Price Forecasts 2019 Update

- Gold Price Breakout - Trend Forecast 2019 July Update

- Dow Stock Market Trend Forecast July 2019 Update

- Investing to Profit and Benefit from Human Life Extension AI Stocks and Technologies

Your mega-trends investing analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.