Economist Lays Out the Next Step to Wonderland for the Fed

Interest-Rates / US Interest Rates Aug 22, 2019 - 03:17 PM GMTBy: Gary_Tanashian

Mr. Steven Ricchiuto, he of a Masters in Economics from Columbia, has laid out the proper plan for the Federal Reserve in this oh so noisy environment in which an unassuming and fairly quiet man is trying to tune out a personal bully on Twitter, tune out the stock market’s daily whipsaw and do what he perceives to be the right thing.

Mr. Steven Ricchiuto, he of a Masters in Economics from Columbia, has laid out the proper plan for the Federal Reserve in this oh so noisy environment in which an unassuming and fairly quiet man is trying to tune out a personal bully on Twitter, tune out the stock market’s daily whipsaw and do what he perceives to be the right thing.

Today, the academic named above throws in with Trump and politely harangues Chairman Powell thusly in an open letter. You can read it by hitting the graphic…

https://www.marketwatch.com/story/the....

Stagflation this, Volcker that, deflation the other thing… blah blah blah. But then he gets to the interesting parts, the money parts. Of the post-Volcker era he states…

To rein in excess money supply growth, the Fed trimmed bank reserves — high-powered money — which resulted in dramatically higher short-term rates. This shift in policy served to dampen inflationary expectations, and thus inflation, while increasing central bank credibility. The dollar strengthened and elected officials became strong supporters of an independent Fed as a result.

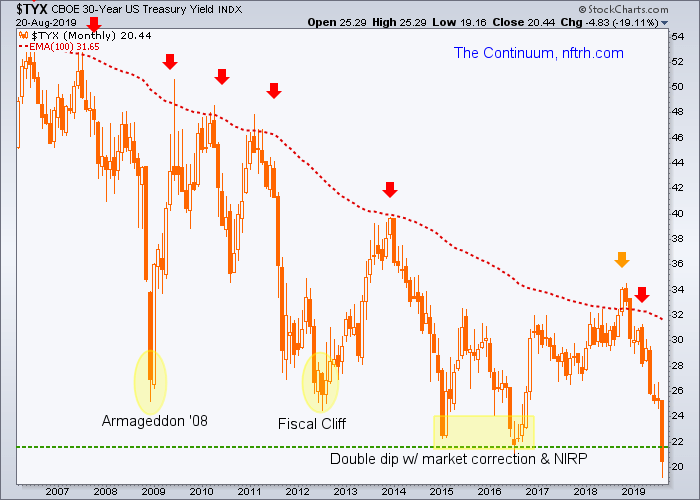

Indeed, in microcosm these periodic drives to the lower rungs of the Continuum are all about Fed credibility. Credibility rebuilt after events like last year’s break of the monthly EMA 100 limiter (red dashed line) on the 30 year Treasury yield.

In H2 2018 while the supposed bond experts were uniformly aligned in a BOND BEAR MARKET!!! posture and market participants were wondering why Jerome Powell was being so stern amid the stock market wipe out NFTRH noted that the Fed was not going to self-immolate in a blaze of inflationary expectations (featuring out of control long-term yields). Credibility would need to be rebuilt and here indeed it has been, and then some.

It should also be apparent from the unintended curve flattening that followed the Fed’s December rate hike, and the equity market selloff that followed the July rate cut, that the status quo is not working. Essentially, policy makers have lost control of the narrative.

We reiterate our call for the Fed to shift policy from targeting interest rates to targeting inflation of 2% or above. This should lead to a rapid decline in short-term rates and a curve steepening which should calm market concerns over the risk of a recession or a persistent deflationary environment.

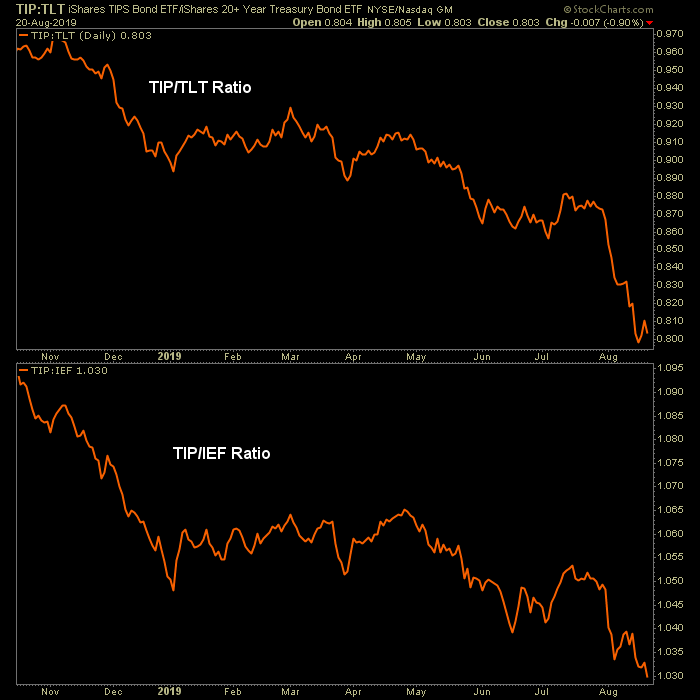

In other words something must be done about these charts, which are going the wrong way.

Inflation expectations have been tanking right along with the 30 year yield above.

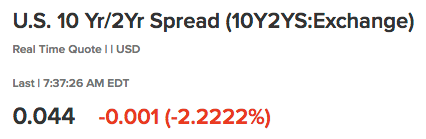

And the Yield Curve resumed its flattener after the FOMC was widely seen to be too tight (which, when taking macro signals and factors at face value, they are).

With the obsession about conjuring inflation that now occupies most global central bankers (with the exception of one rather important one) and market participants a flat yield curve means that inflation is not taking hold; as a yield curve steepener can be driven by inflation or deflation. It’s just a matter of opposite forms of a lack of confidence in the economy and/or the policy that props it.

The Fed’s new intermediate target should be its balance sheet, which we believe should be expanded and restructured to achieve a 2% inflation target. Initially the balance sheet target should be set at the $4.5 trillion peak reached back in 2015. To support this shift and lift in inflation expectations, we also suggest a reverse “Operation Twist” and the elimination of paying interest on excess reserves. With the fed-funds rate completely decoupled from policy and allowed to find the level the market dictates, the tools put in place to control the funds rate with a large balance sheet are no longer necessary.

These radical changes are necessary in our view, if this economy is to avoid the deflation trap that appears to have already caught Japan and Europe in its viselike grip.

Yours truly,

Steven Ricchiuto

U.S. economist, Mizuho Securities USA LLC

It is interesting that Ben Bernanke launched full frontal Goldilocks when he set the Operation Twist macro manipulation upon the world. But now she is hungry again and there is no more porridge, hot, cold or just right. There is no more meat either. She’s biting into bone. Goldilocks is not the play anymore because the yield curve flattener is so long in the tooth. The only play is the other play, the inflationary play, which would probably be seen as benign and even beneficial in its early stages.

In 2011 the inflationary play was not so benign. At that time Bond expert (he ain’t no King) Bill Gross famously shorted the long bond in an unwitting bet that our Continuum above would break out above the limiter. It didn’t, the Continuum continued and all we are doing now is simply extrapolating the process 8 years later. If the macro is to stay on the course it’s been on for decades (and termination is always possible) then the next play will be as our academic noted above implores; inflationary.

Let’s put aside that a flat or inverted yield curve is not something to worry about. At worst, inversion is probably around a year early in forecasting recession. Enough with the media muck-raking already about the dreaded yield curve inversion (98% of the people the media are blaring this concerning news to have no clue about what the hell a yield curve even is).

A curve flattener is a Goldilocks condition when viewed as a stand-alone. Today, with tanking inflation expectations it is a concern because after all what does the country – like most other developed economies run on? Bueller? Anyone? Yes, debt… and more of it!

To quote my late friend Jonathan Auerbach “It’s inflation all the way, baby!”

Stop hand wringing, tune down the noise and realize that the next inflation (or at least inflation attempt) will come. But it’s not going to come in real time with the president haranguing the Fed chief on Twitter and MBA economists writing open letters.

The next inflation will come or the coming steepening of the yield curve will be deflationary and then that’s all she wrote (and ate).

Also see this companion piece posted shortly after… Enter, the Vampire

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2019 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.