Price Of Gold Is A Reflection of US Dollar; Not US Dollar Index

Commodities / Gold & Silver 2019 Aug 30, 2019 - 08:24 AM GMTBy: Kelsey_Williams

Several articles by others recently have pointed out the apparent inconsistency of the US dollar’s action relative to the price of gold. For example, over the past year the US dollar Index has continued to strengthen, while gold has also risen in price.

Several articles by others recently have pointed out the apparent inconsistency of the US dollar’s action relative to the price of gold. For example, over the past year the US dollar Index has continued to strengthen, while gold has also risen in price.

That would seem to indicate that the US dollar’s value is not a primary factor in determining the price of gold. As we have said, though, the US dollar Index is not the same thing as the US dollar. The two are not interchangeable.

The US dollar Index (see Gold – US Dollar Vs. US Dollar Index) is a comparison of the US dollar versus a basket of other currencies (Euro, Yen, etc.) on an exchange rate basis . As such, it does not tell us anything about gold, positive or negative.

The rising US dollar Index over the past year, or any other time, tells us that the US dollar has strengthened relative to some other paper currencies. That’s all it tells us.

There can be extended times when declines in the US dollar Index parallel absolute weakness in the US dollar. That happened in the 1970s and again from 2000-2011.

What is happening right now is indicative of a US dollar that is weakening on an absolute basis re: higher gold price in dollars, but is stable or stronger relative to other currencies.

Also, there can be periods when relative dollar strength on an absolute basis, i.e. lower gold prices, might also parallel a weaker US dollar versus its trading partners, resulting in a a lower US dollar Index.

If you are a marathon runner, you may pass certain other runners during the race, only to be passed by those same runners later. That information does not tell us anything about how well you are doing against the eventual winner.

The inflationary policies and actions of the Fed and the US government have resulted in a decline in purchasing power of the US dollar of more than 98 percent over the last century. In other words, it takes sixty or seventy times as many dollars today to buy what one dollar would purchase a hundred years ago. Whereas one ounce of gold will still buy today what it would a hundred years ago, and in some cases, even more. See A Loaf Of Bread, A Gallon Of Gas, An Ounce Of Gold.

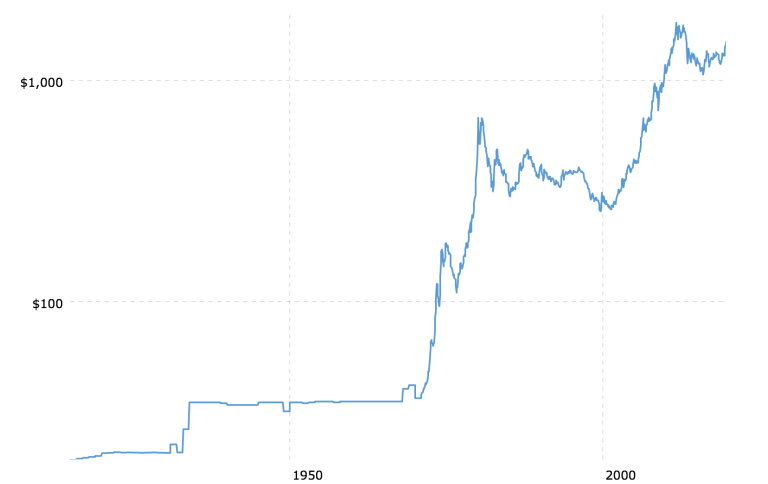

Below is a one hundred year history of gold prices…

(source: macrotrends.net)

The higher gold price over time is a reflection of the cumulative effects of US dollar depreciation – over time.

Seems simple enough, but the effects of inflation are volatile and unpredictable. Remember how investors and others expected huge increases in the cost of living after the Fed’s hugely inflationary QE efforts? They didn’t get what they were expecting, at least not in the way they expected it, or to the extent that it was anticipated. There are specific reasons for that. See Fed Inflation Is Losing Its Intended Effect.

There is a great deal of subjectivity involved in assessing the value of the US dollar at any given time. Changes in the price of gold reflect changes in the value of the US dollar, both real and perceived. And there are periods of relative dollar strength and stability when gold prices remain relatively stable or decline.

When you own gold, you own real money. Real money, i.e. gold, is a store of value. Nothing else is.

If you want to hold real money, you own gold. Owning gold is like holding cash. How much cash do you want to hold?

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2019 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.