Global Markets Chaos means Precious Metals will Continue to Rise

Commodities / Gold & Silver 2019 Sep 03, 2019 - 11:06 AM GMTBy: Chris_Vermeulen

Reading the new today of the riots and protests in Hong Kong as well as the military action between Iran and Israel suggests to us that the metals markets are poised for a very big run this week and possibly much further into the future.

Reading the new today of the riots and protests in Hong Kong as well as the military action between Iran and Israel suggests to us that the metals markets are poised for a very big run this week and possibly much further into the future.

This type of Chaos creates a level of uncertainty in the global markets that will prompt a massive surge in the precious metals markets as traders and investors continue to pour into precious metals as a means to hedge against fear and weakness in the global markets. At this point, we believe a move in Gold could easily target $1640 or higher and Silver could target just under $21 over the next 5 to 10 days. This type of move would represent a +7 to 10% rally in Gold and a +10 to 20% rally in Silver.

Pay attention to how the ES, NQ, and YM react to trading as markets open on Sunday and Monday evening as well as the news events related to these issues. Any escalation of tensions and fighting between parties throughout the world will likely shed shock waves throughout the global economy as well as prompt a contraction in price levels.

We attempted to warn all of our followers that the August 19th breakdown super-cycle event would likely present a massive potential for a price correction to the downside. These super-cycle events operate on a much broader scale and scope than most people realize. A delay of 20 to 30 days for an event to begin is equal to a span of 10 seconds in the larger scope and perspective of these bigger events. Pay attention as this move really begins to play out over the next 25+ days.

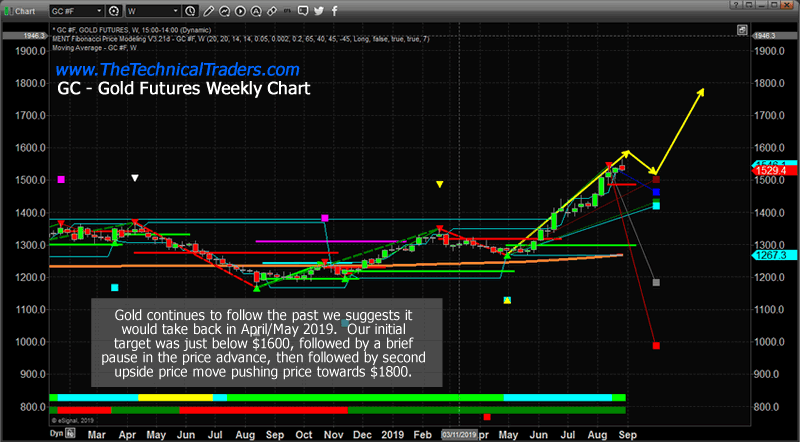

Weekly Gold Chart

This weekly gold chart has followed our expectations from April/May 2019 almost perfectly. Our original target of just below $1600 has almost been reached. Now, with the global chaos playing out in China, Hong Kong, and other locations, we believe Gold could rally well past the $1600 and possibly move as high as $1640 to $1675 before attempting to stall and rotate.

What is interesting is that the price of gold is hitting new highs is most other currencies. This is something we will talk about in another article here shortly, so be sure to opt-in to our Free Market Forecast and Trade Ideas Newsletter

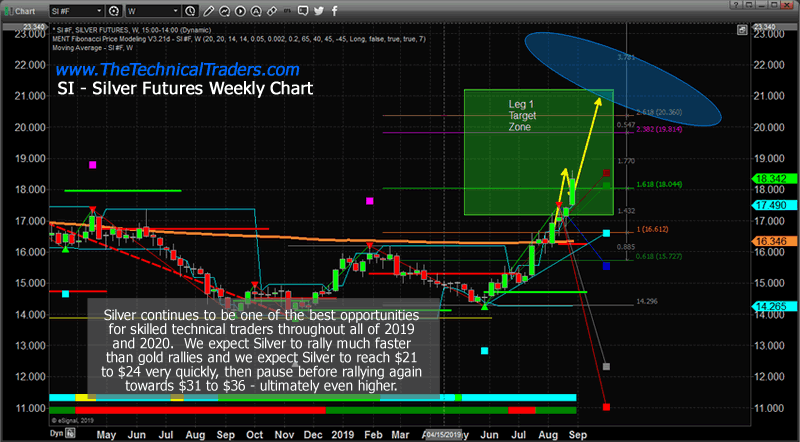

Weekly Silver Chart

Silver, which has continued to impress even the most passive traders. It has continued to outperform Gold over the past 30+ days. Overall, our original target range of $18.75 – $21 is still valid, but we believe the true upside potential in silver is well past $34. Right now, we believe Silver could rally well past $24 as the chaos in the foreign markets rattles global investors.

CONCLUDING THOUGHTS:

If you followed our research over the past few months, you would have already known about these setups and trades. If not, now is the time to pay attention. The markets are going to react to this foreign market chaos by attempting to find true price valuation levels related to the fear and future economic expectations of the entire market. Get ready for some really big moves over the next 8+ weeks.

As we’ve been suggesting for more than 12 months, 2019 and 2020 are going to be fantastic years for skilled technical traders or subscribers of our Weal Building Newsletter. The potential for big trades (20% or more), like our recent UGLD 24% trade, will continue to set up in different sectors and global markets. All we need to do is stay on top of the opportunities to find ways to profit from these moves.

We believe our super-cycle research and other proprietary modeling systems are suggesting that price weakness will dominate the markets for the next few months. Ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis and recession.

In short, you should be starting to get a feel of where commodities and asset class is headed for the next 8+ months. The next step is knowing when and what to buy and sell as these turning points take place, and this is the hard part. If you want someone to guide you through the next 12-24 months complete with detailed market analysis and trade alerts (entry, targets and exit price levels) join my ETF Trading Newsletter.

FREE GOLD OR SILVER WITH SUBSCRIPTION!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.