Saudi Oil Shock: Who Wins, Who Loses

Commodities / Crude Oil Sep 29, 2019 - 04:37 PM GMTBy: Steve_H_Hanke

On September 14th, drones targeted Saudi Arabia's Abqaiq oil refinery and Khurais oil field. The strikes reportedly knocked out more than half of Saudi Arabia's total output. That amounts to a whopping 6-7% of the global daily oil supply. Not surprisingly, before the dust had settled, the press sounded an alarm and spread fear. Then, President Trump jumped in, claiming the attack “won't affect us and ultimately I don't think it will affect the world either.” Well, let’s take a look at the data.

On September 14th, drones targeted Saudi Arabia's Abqaiq oil refinery and Khurais oil field. The strikes reportedly knocked out more than half of Saudi Arabia's total output. That amounts to a whopping 6-7% of the global daily oil supply. Not surprisingly, before the dust had settled, the press sounded an alarm and spread fear. Then, President Trump jumped in, claiming the attack “won't affect us and ultimately I don't think it will affect the world either.” Well, let’s take a look at the data.

Brent crude prices surged by 15%, from $60/bbl on September 13th to $69/bbl on the 16th, the first trading day after last weekend’s drone attacks. Brent crude is now trading at $65/bbl. While a significant increase, the response to this incident has kept oil in what Arend Kapteyn of the Union Bank of Switzerland (UBS) deems to be in a safe zone ($50-$75/bbl). When prices are in this sweet spot, the “gains” and “losses” from oil price changes are roughly balanced, so the global economy can hum along without missing a beat.

But, even though we might still be operating in the oil-price sweet spot, crude oil prices are—as a result of a big chunk of the Saudi’s capacity being temporarily knocked out—higher than they would have been absent the drone attacks. Furthermore, the repairs on the Saudi facilities will most likely not be as straightforward as many seem to think. The Abqaid facility is highly complex and specialized. Indeed, even planned maintenance at Abqaid can take up to three months. In consequence, there aren’t off-the-shelf replacement parts. Repairs, therefore, will take an extended period of time And, if that’s not bad enough, there could be further attacks on Saudi facilities, which appear to be vulnerable. Indeed, the markets have already priced in higher future prices, as reflected in the forward curves that contain prices for future crude delivery.

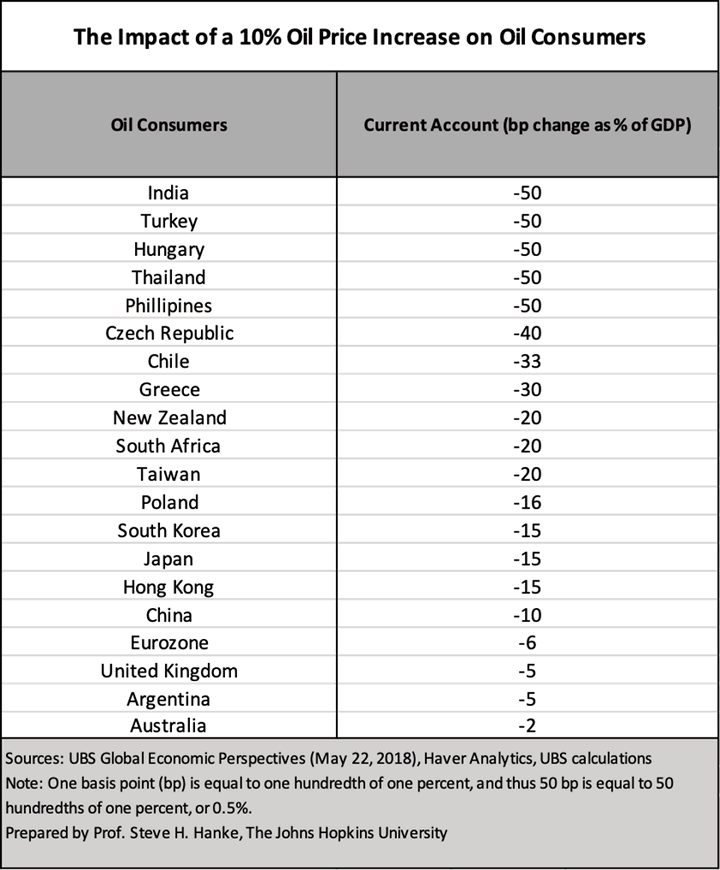

The specter of elevated crude prices raises the obvious question: what countries are the biggest winners and losers? To answer that, I use results from a UBS modeling exercise. The table below shows the negative effect that 10% price increases (starting at $50/bbl and moving up to $100/bbl) would have on the current account balances of oil consuming countries. The numbers are given in changes in basis points as a percent of GDP. So, for India, a 10% price increase would result in an increase in the Indian current account deficit of one half a percent (50 basis points) of GDP.

Prof. Steve H. Hanke

Let’s take a look at the two big losers: India and Turkey.

India imports over 80% of the oil it consumes, making it one of the largest importers of oil in the world. While the world’s economies have, on average, become significantly more energy efficient over time, India’s use of oil per unit of GDP has hardly changed in over 50 years and is well above the global average. So, when crude prices spike, India’s external balance (read: current account) takes a hit, and the rupee slumps.

Turkey imports almost 85% of its oil. Like India, each 10% increase in the price of crude oil would result in a half a percent increase in its current account deficit as a percent of GDP.

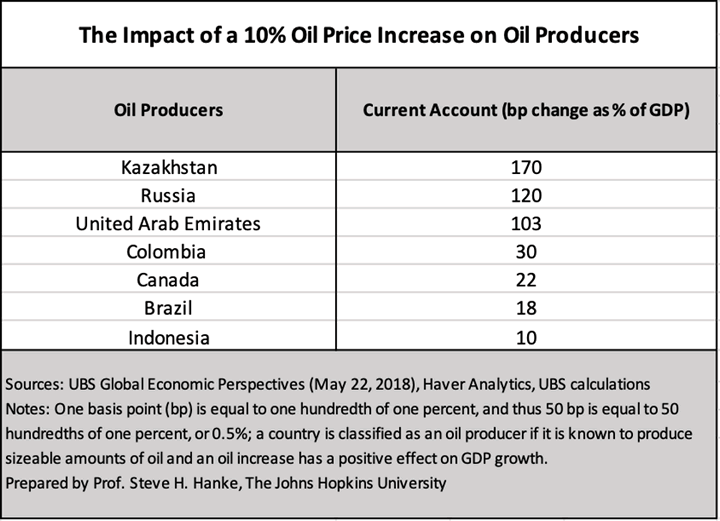

Turning to a few countries that benefit from price increases, it turns out that Russia will be a big winner. As indicated in the table below, Russia’s external balance improves by 1.2% of GDP for each 10% increase in the price of oil.

So, the recent attacks on the Saudi’s oil facilities promise to elevate oil prices, but leave them, for the time being, in the so-called sweet spot, with no particular world disruptions. I wonder if President Trump had studied the UBS oil-price model? We will never know. But, we do know that India and Turkey will take hits and that Russia will be a big winner. This promises to throw storm clouds over the Indian rupee and Turkish lira and sunshine over the Russian ruble.

Follow me on Twitter. Check out my website.

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2019 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.