Will Miami be the First U.S. Real Estate Bubble to Burst?

Housing-Market / US Housing Oct 11, 2019 - 07:36 AM GMTBy: Harry_Dent

Earlier this week I read a great article by Kuppy at Adventures In Capitalism. It brought back memories of the last condo and real estate bubble in Miami… I was there. I was moving to Tampa and sold before the crash that I was nearly alone in forecasting in late 2005 .

Earlier this week I read a great article by Kuppy at Adventures In Capitalism. It brought back memories of the last condo and real estate bubble in Miami… I was there. I was moving to Tampa and sold before the crash that I was nearly alone in forecasting in late 2005 .

Kuppy noted that prices had plateaued for a few years and had begun to drop 20% to 35% in South Beach – and worse in the downtown Brickell area. He talks to a friend who makes non-traditional loans against these condos, and he says “it’s about to blow… just give it six to nine months.”

Miami is Bubble City

It’s a part-time vacation town for many, a show-off place that’s big on laundering money into real estate from drug dealers in South America and so on. At night most are empty with no lights on, even in season.

Builders get on a roll at $300 per sq. ft. costs, selling for $700,000+. So, they keep building until it blows. I was there a year ago and saw more than twice as many cranes as at the last top in 2005-6.

Most buyers put 20% or less down and don’t even have to come up with the rest until completion. They borrow, and borrow more if needed as the prices rise. But when they stagnate or fall, they quickly get into trouble… It’s the carrying costs that average 4% to 7% before financing. The property taxes are 2% alone – I know because I paid that.

When people start to default, the non-traditional lenders add penalty interest and the banks refuse to lend further after prices start to drop. Builders just keep adding inventory to a glut as it pays them short term to complete.

Finally, the lenders start to panic and force fire sales. Miami was the biggest bubble crash in the last real estate bust, averaging 52%. It will be higher this time. The market is dominated by even higher “faker luxury” condos. Larger with more flamboyant features. Those are the hardest to unload when prices drop, says Kuppy’s lending friend.

Is this the First Major Market to Blow?

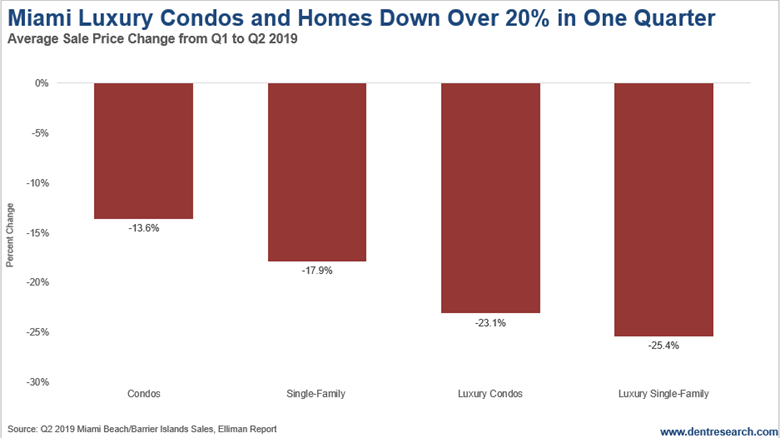

This chart shows how much prices dropped between Q1 and Q2 this year… what?

The broader market for condos fell 13.6%, homes 17.9%. But as is happening around the world from Sydney to London to Manhattan, the high-end market is leading. Luxury condos are down 23.1% and homes 25.4%.

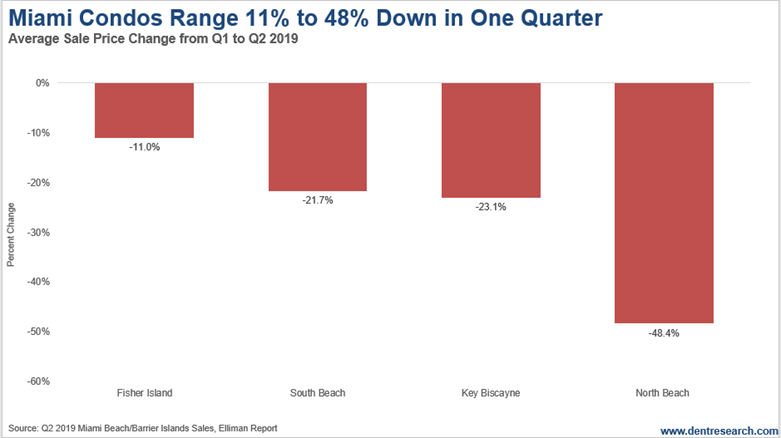

The next chart shows the range for condos in the Miami area. The worst drop was North Beach at a whopping 48.4%. Fisher Island dropped the least at 11.0%. But it was already down starting in Q2 2018 and is down 24% cumulatively from the top. South Beach came in the middle at 21.7%. Going back to Q2 2018, Key Biscayne condos are down 37.2%.

All it takes is one prominent market to have a crash to get investors spooked and lenders downright paranoid.

Based on the “crane indicator” alone, Miami does look like the first major market to blow… and many more will follow.

Do you want to wait and see… and hope you get lucky? Real estate and lending get tight fast!

And to my Australia subscribers: Don’t follow the crowd there that thinks your sharp correction is over and it’s time to buy. You are the “lead dog” in this global crash, like the U.S. was last time.

Harry

Follow me on Twitter @HarryDentjr

P.S. Another way to stay ahead is by reading the 27 simple stock secrets that our Seven-Figure Trader says are worth $588,221. You’ll find the details here.

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2019 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.