Precious Metals & Stock Market VIX Are Set To Launch Dramatically Higher

Stock-Markets / Financial Markets 2019 Oct 13, 2019 - 02:07 PM GMTBy: Chris_Vermeulen

The recent rotation in the US stock market and US major indexes have set up a very interesting pattern in the Metals and VIX charts. Our researchers believe precious metals, Gold and Silver, are setting up a new momentum base/bottom and are beginning an early stage bullish price rally that may surprise many traders. If you have not been following our research, please take a minute to read these past research posts:

The recent rotation in the US stock market and US major indexes have set up a very interesting pattern in the Metals and VIX charts. Our researchers believe precious metals, Gold and Silver, are setting up a new momentum base/bottom and are beginning an early stage bullish price rally that may surprise many traders. If you have not been following our research, please take a minute to read these past research posts:

September 24, 2019: IS SILVER ABOUT TO BECOME THE SUPER-HERO OF PRECIOUS METALS?

September 19, 2019: PRECIOUS METALS SETTING UP ANOTHER MOMENTUM BASE/BOTTOM

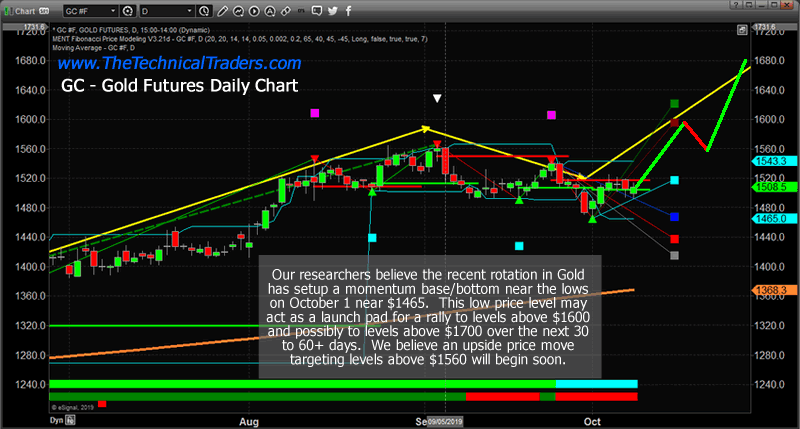

Our researchers believe the bottom in Metals has already set up on October 1, 2019. This setup aligns with our earlier analysis that a new bullish price leg is setting up that will propel Gold to levels above $1600 before the end of November – possibly resulting in a rally that attempts to breach the $1700 price level.

Daily Gold Chart

Of course, for Gold to rally in this manner, some type of extended fear must enter the global markets. We believe this fear could become known to traders within 3 to 10+ days based on our understanding of the schedules and calendars available within the news cycle. The US/China trade talks appear to be breaking down again. News that one of India’s largest banks is in the process of collapsing hit last weekend. And news that the US political parties are about to ramp up nearly all levels of activity ahead of the 2020 US Presidential election cycle is sure to throw the markets a few curve-balls.

As skilled technical traders, there are times when we must understand how the news cycles and external events can have dramatic impact on prices and trends in the financial markets. These are times when we must protect our assets by deploying very skilled trades, proper position sizing and become even more skilled at understanding the global stock market dynamics.

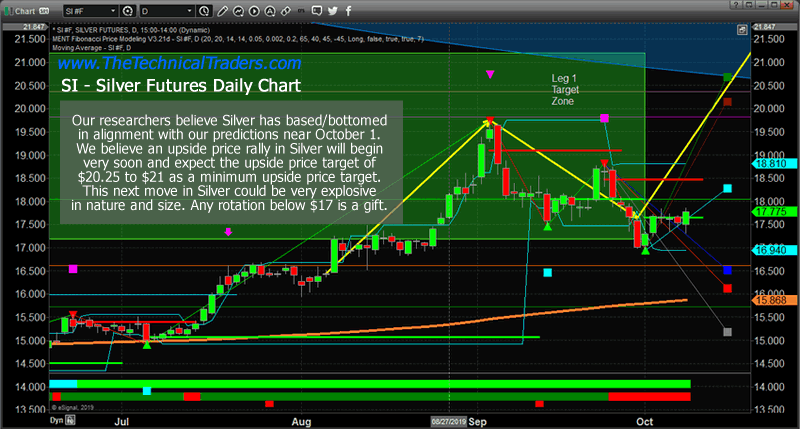

Daily Silver Chart

Silver, or as we have termed it “The Super-HERO of Metals”, will likely move much higher, even faster than Gold. If our research is correct, the next upside price leg in Metals will see Silver rally to levels well above $20, then stall briefly, then begin a move to levels above $26 (or higher). The Gold to Silver ratio will likely fall to levels near 65 throughout this move. That would mean that Silver would appreciate about 11% to 15% faster than Gold will appreciate over the next 60 to 90+ days.

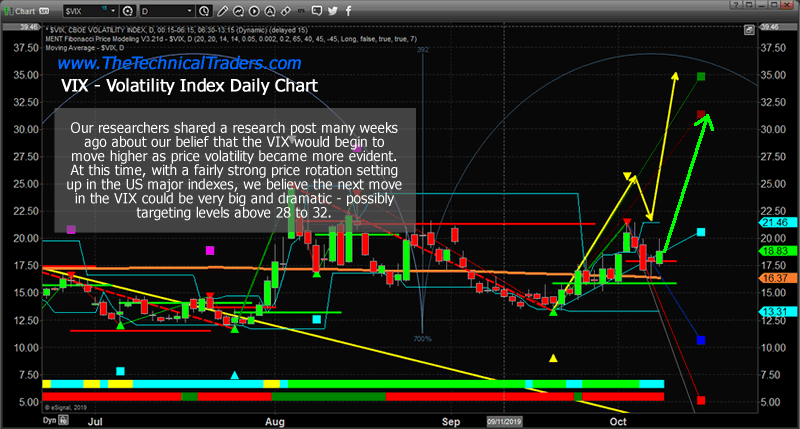

VIX – Daily Volatility Index Chart

And finally, the VIX. At this point, our research team believes a broader downside price rotation has already begun to set up in the US stock market (with Technology and “unicorn” sectors at severe risk) which may prompt a move in prices to retest the December 2018 lows. This is why we believe the VIX is very likely to begin an upside price move over the next 30 to 60+ days and attempt to break above the 26 to 27 level as the US stock market reacts to increased fear and uncertainty. This is, obviously, also why we believe Gold and Silver will begin to move dramatically higher very quickly.

September 17, 2019: VIX TO BEGIN A NEW UPTREND AND WHAT IT MEANS

Concluding Thoughts:

Our researchers are attempting to follow all the news and price activity we can handle over the past 4+ weeks or longer. At this point, it seems all the global markets are unstable in terms of price trends, extended volatility, and uncertainty. We believe our expectations within the metals markets, us stock market and the VIX predictions are relatively saved expectations given the research we’ve completed.

It would be wise for skilled traders to prepare for a moderate to deep price correction at this point. Price has failed to move higher above historic all-time high price levels and has begun to move lower. Unless some extremely positive news, event or outcome is reached within the next 90+ days, it is very likely that price will continue to rotate within established ranges attempting to identify true support levels. This ride could become very volatile – very quickly.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

Be sure to ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

I can tell you that huge moves are about to start unfolding not only in metals, or stocks but globally and some of these supercycles are going to last years. My simple technical trading strategy using ETFs will allow you to follow the markets closely and trade with it so you never get caught on the wrong side of the market with big losses.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.