Stock Market Stalls: Caution Ahead

Stock-Markets / Stock Markets 2019 Oct 21, 2019 - 12:45 PM GMTBy: QUANTO

Equity markets have once again moved to all time highs esp in the US but action at the top is dicey and looks suspicious.

Equity markets have once again moved to all time highs esp in the US but action at the top is dicey and looks suspicious.

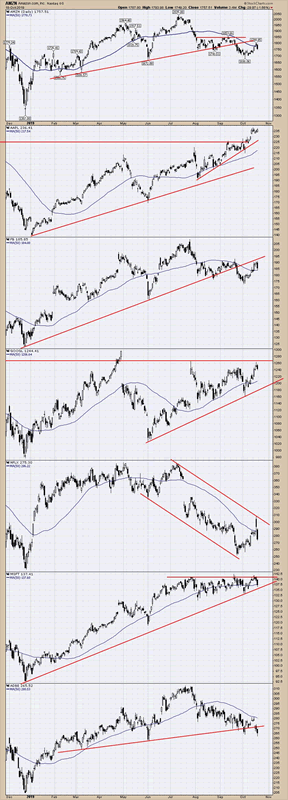

Key stocks are analysed below and we can see the stall in momentum which is often a harbinger of things to come.

AMZN- Stalling under the 50-day moving average after back testing the up trend line. AAPL - Stalled out all week, flat to Friday's close. FB - Stalling at last months high, trying to bounce off the 50-day moving average but below the trend line. GOOGL - Stalling at resistance NFLX - Stalled and reversed at the channel line. Falling below the 50-day moving average. MSFT - Stalling at resistance, falling below the 50-day moving average today. ADBE - Stalled at the 50-day moving average, falling below the topping pattern neck line.

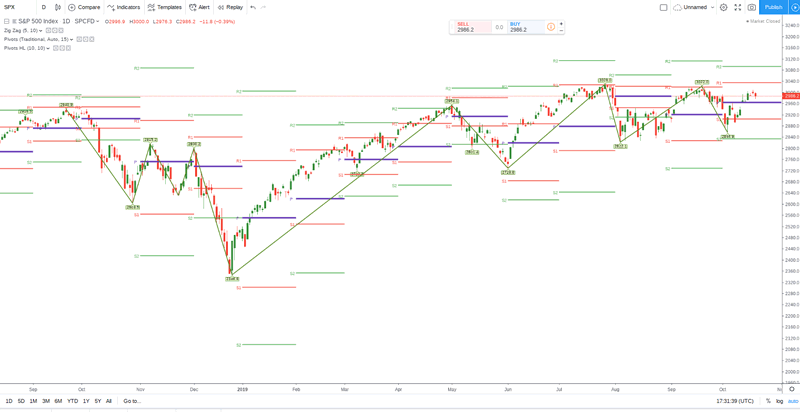

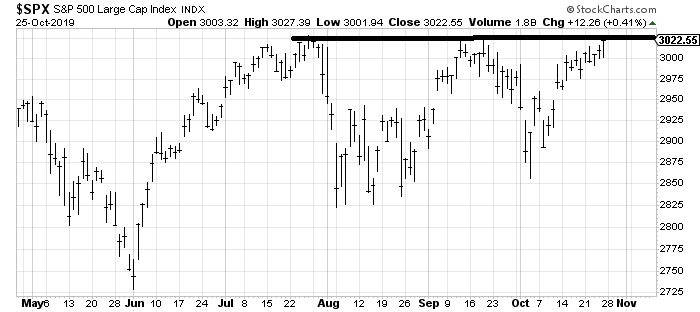

SPX is just above its daily pivot level.

The lack of buyers at the top is puzzling and thus we are forced to be on the sidelines and watch the action. Our sneaky suspicion is that markets could push higher but will be faced with fierce resistance.

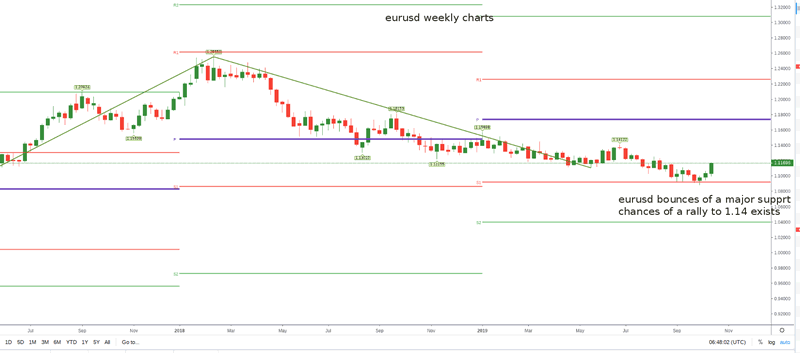

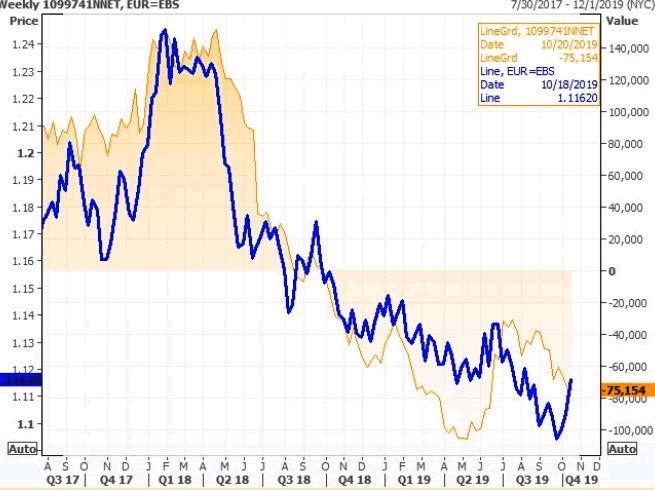

THE eurusd rally on back of brexit resolution means that EU is set to gain nearly 40 billion euros as brexit cost from UK. The fundamental reason could be any but technically the price took support at S1 area of weekly charts at 1.0880. Weekly charts show the bounce area of EURUSD.

However the price action while showed the bounce, the CFTC shorts are still building at least till last tuesday.

Looks as if speculators caught on the wrong foot. Hedge Funds slightly extends their bearish Euro.

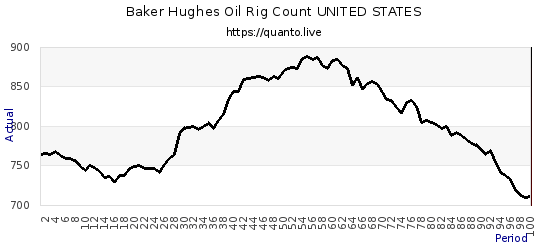

US Bakercount

New rig count is falling fast. The sluggish Oil prices have discouraged new investment and is often considered a bad omen for the future economic job creation.

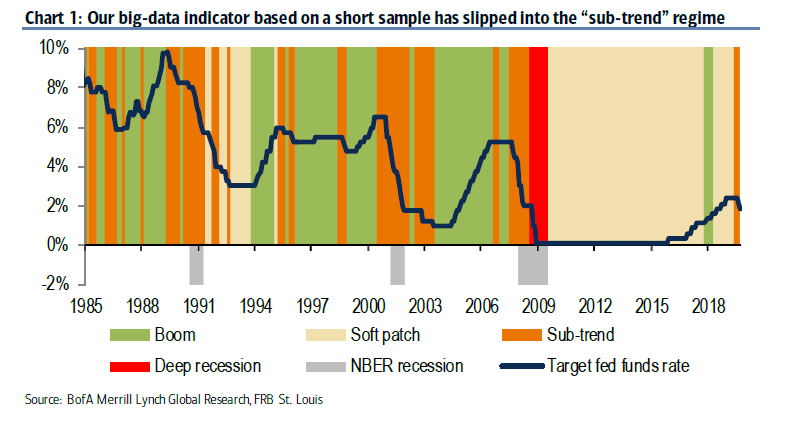

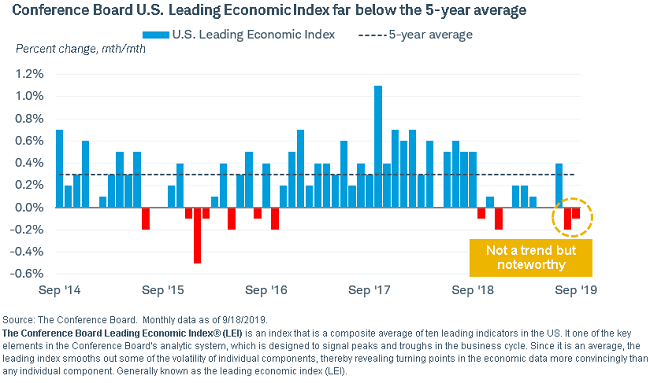

BAML's big data indicator of the U.S. business cycle (recessions & expansions) has moved into 'sub-trend' for the first time in a decade, after having been in 'boom' territory less than a year ago.

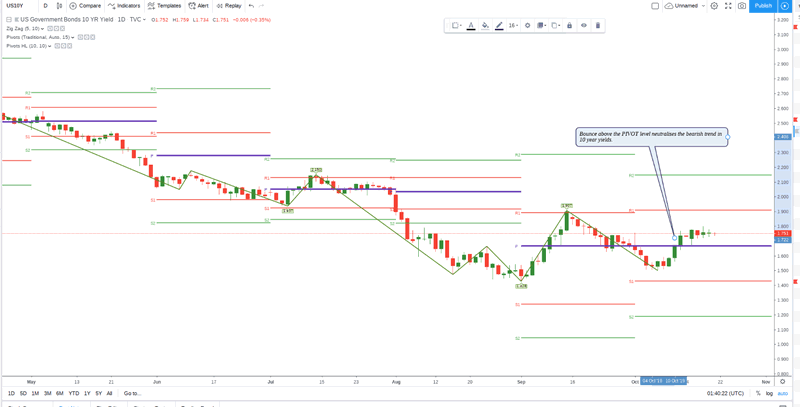

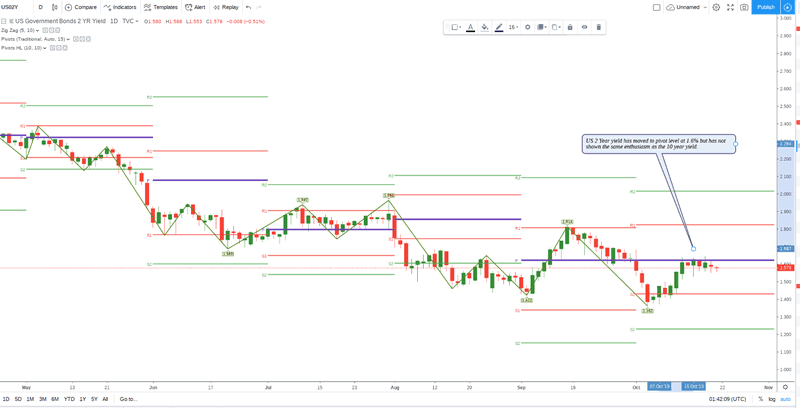

Yield story

US 10 Year yield has moved above its near term resistance and neutralised the bearish pressure seen in 2019. However any news shock will ignite a new wave of downtrend and thus forcing FED to cut rates.

US 2 Year yield has moved to pivot level at 1.6% but has not shown the same enthusiasm as the 10 year yield.

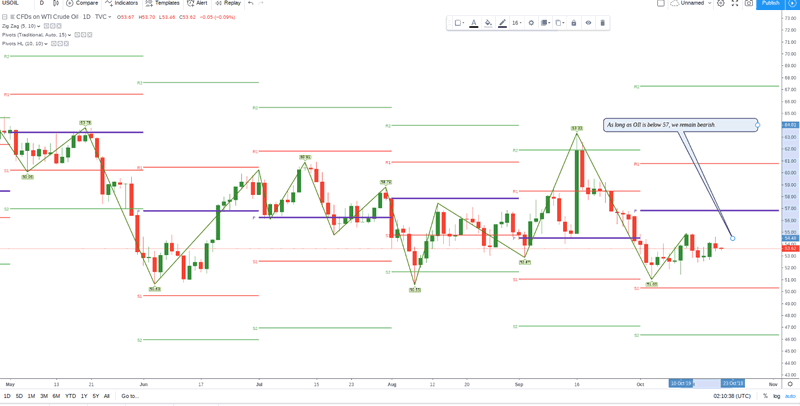

Oil Trends

As long as Oil remains 57 pivot level, we remain bearish. A sustained push above 57 is required to neutralise the current bearish trend. The US pull out from Syria is Oil negative because there will be more Oil underpriced transactions by non-opec parties, more smuggling. It will further cut into already falling demand world wide.

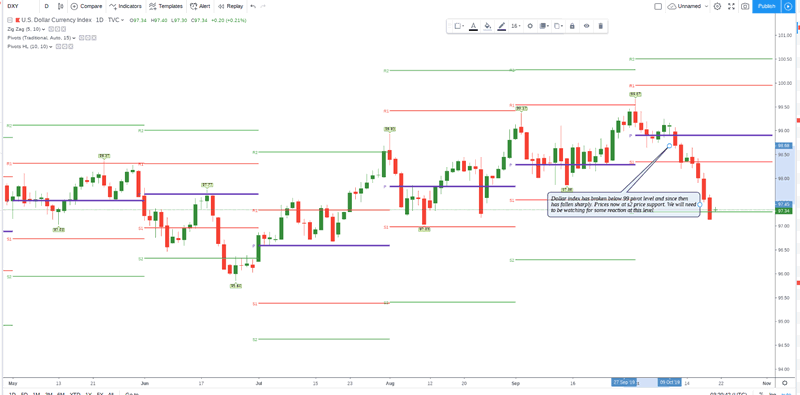

Dollar index has broken below 99 pivot level and since then has fallen sharply. Prices now at s2 price support. We will need to be watching for some reaction at this level

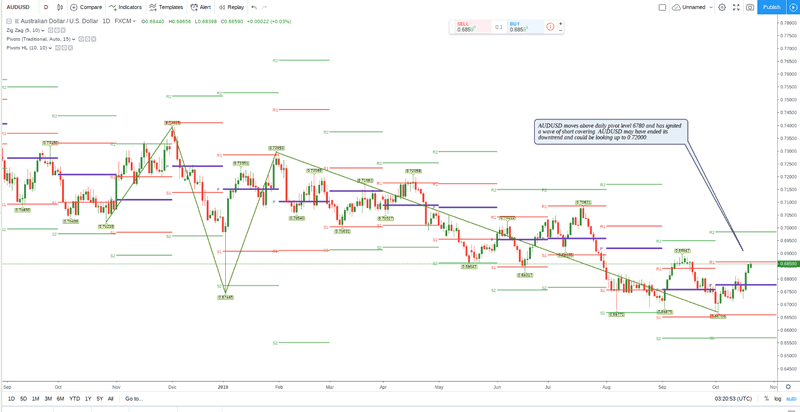

AUDUSD moves above daily pivot level 6780 and has ignited a wave of short covering. AUDUSD may have ended its downtrend and could be looking up to 0.72000.

QUANTO Tradecopier Even as the markets grapple with uncertainty and direction, the QUANTO system is on cruise mode as returns rise to +23.8% in October. Very stable returns as now into 7 months, we have not had a negative month of returns. Recent History

Last one month trading history...

Very high degree of winners as returns pile up.

Summary

Monthly The QUANTO system is making money from May and has not had a negative month of trading. Very solid returns and continuous returns.

To get started on QUANTO system, please send us a request here Contact Us

QUANTO is free on select brokers so it costs nothing to the client to run for a limited period of time.

QUANTO tradecopier can be started FREE on your MT4 BY REGISTERING FOR FX MT4 account at Vantagefx here: CLICK FOR QUANTO ACCOUNT

Source: https://quanto.live/dailysetups/market-stall-caution-ahead/

By Quanto

Quanto.live is a Investment Management firm with active Trading for clients including Forex, Crypto. We send our trades via trade copiers which are copied to clients trading terminals. Top notch fundamental analysis and trading analysis help our clients to generate superior returns. Reach out to us: http://quanto.live/reach-us/

© 2019 Copyright Quanto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.