Lifting the Entitlement Burden Through Increased Infrastructure Spending

Economics / Infrastructure Nov 03, 2019 - 06:20 PM GMTBy: Richard_Mills

On Wednesday the US Federal Reserve cut interest rates for the third time this year, amid continued weak growth both domestically and globally.

On Wednesday the US Federal Reserve cut interest rates for the third time this year, amid continued weak growth both domestically and globally.

The federal funds rate, the baseline for credit card and mortgage borrowing, dropped 25 basis points and is now between 1.5 and 1.75%.

Fed Chair Jerome Powell says the current interest rate levels are “likely to remain appropriate” (ie. on hold for the time being) to meet the Fed’s goal of 2% inflation.

Chairman Powell has been pressured for months by President Trump to continue slashing interest rates to help goose the American economy and keep North American stock markets on the boil.

On Friday the Dow and Nasdaq indices both hit new intra-day highs, on the back of an October jobs report that beat expectations. US employers added 128,000 jobs in October, better than the 89,000 forecast by economists, despite the strike at GM which represented 36,000 less positions.

The unemployment rate edged up slightly to 3.6%, but that was due to 325,000 Americans that started looking for work, according to the Bureau of Labor Statistics. September’s 3.5% figure was the lowest since 1969.

While the jobs report is strong, it doesn’t highlight the fact that October’s 128,000 jobs gain is down significantly from 2018’s average monthly increase of 223,000 positions.

The US economy needs 150,000 jobs a month just to keep up with population growth. It’s actually not a great year to be unemployed in the United States.

Take payroll employment and household employment. The former is the figure usually given but it does not include the agricultural sector ie. farmers hard-hit by Chinese import tariffs - nor the self-employed. Third-quarter payrolls of production and non-supervisory workers gained 70,000, but that is well below the average monthly payroll gain of 98,000 during the second quarter. It’s the smallest quarterly gain since 2010.

Payrolls of production and non-supervisory workers in mining, manufacturing, retail trade, utilities, leisure and hospitality declined in Q3.

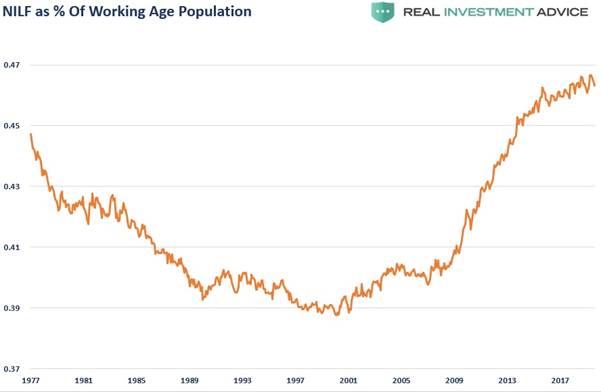

There’s something else that mainstream news is leaving out. A column in ‘Real Investment Advice’ piqued my attention for a very interesting graph of the percentage of the population that has given up looking for work (as opposed to the participation rate which measures people either working or looking for a job)

Those folks ‘not in labor force’ for whatever reason, have skyrocketed as a percentage of the working-age population - from 0.41% during the recession to the current 0.47%.

That may not seem a lot, but when this “swelling mass of uncounted individuals” to quote columnist Lance Roberts, are thrown in with the “working poor” who are living paycheck to paycheck, it puts a whole different twist on the jobs report.

Roberts’ research finds that, contrary to Canadians’ perception of America being a much worse place to find oneself without a job, broke, homeless or without health insurance, compared to Canada’s larger, and softer safety net, is actually false.

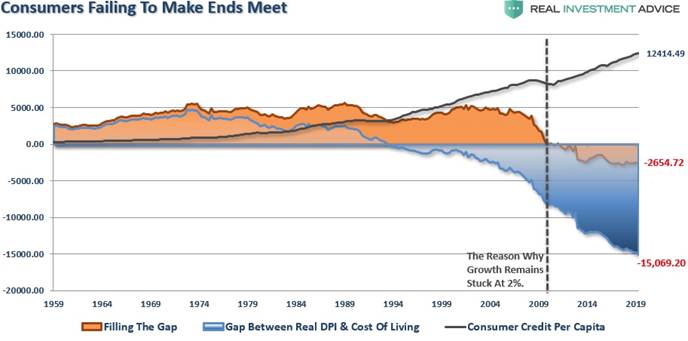

In fact social benefits now comprise 22% of real disposable incomes - a record high. Forty million Americans are on food stamps, an estimated 63 million get Social Security 59.9 million receive Medicare, 79 million get Medicaid, 5 million receive housing subsidies and 4 million get Veterans’ benefits.

Half of 330 million Americans receive at least one federal benefit, according to the Census Bureau.

Another shocker of a stat: “U.S. households are now getting more in cash handouts from the government than they are paying in taxes for the first time since the Great Depression,” Roberts states. “In 2018, households received $2.2 trillion in some form of government transfer payments, which was more than the $1.7 trillion paid in personal income taxes.”

It’s no wonder the US government is running up a trillion-dollar annual deficit. Every year the Treasury spends more than it earns, much of which is going towards upholding the welfare state. Social Security is the largest item in the US budget.

According to the World Bank, countries whose debt-to-GDP ratios are above 77% for long periods experience significant slowdowns in economic growth. Every percentage point above 77% knocks 1.7% off GDP, according to the study, via Investopedia. The United States’ current debt-to-GDP ratio is 106.5%.

The Congressional Budget Office says debt-to-GDP will reach 150% by 2047.

If what Roberts is saying is true, the US economy has a serious problem. How can it grow when half of Americans are earning their income from government largesse rather than their own labor? It’s like trying to motor a vessel whose hull is caked with barnacles.

Staying with that metaphor, how to strip the hull of barnacles, without killing the little suckers, thus enabling the economic ship to cruise unencumbered?

To us here at AOTH, we see a combination of options being a possible answer: pursue a Roosevelt “New Deal”-type of program that drives the economy further into electrification and clean-tech; get Americans off the government teat by making a massive investment in infrastructure.

Green deal

We’re not talking here about the Democratic Party’s New Green Deal, which has been widely discredited for failing to back its lofty ambitions up with a costed budget. However, we like some elements of the green manifesto; these could be introduced and expanded upon.

For instance, the goal to “Shift 100% of national power generation to renewable sources” will never happen in our lifetime but we do believe in transitioning from coal and greenhouse-gas belching natural gas power plants to thorium-based nuclear power. Molten-salt reactors fed by thorium offer an extremely good bang for the buck and are fully portable - one thorium reactor would produce as much power as the entire Site C Dam being built in northeastern British Columbia.

A push to “Decarbonize, repair and upgrade the nation’s infrastructure, especially transportation” is also do-able. The shift towards electrification of the global transportation system is already happening. The US has the second-largest electric vehicle market in the world, behind China. The country could use a workable plan to cut its dependence on imports of lithium, cobalt and other EV raw materials, but it’s on the right track. Fully electric car and battery plants are coming. In 10 years EVs and hybrids will represent a much higher percentage of the total US vehicle fleet.

Electricity generation is also in the midst of a major sea-change.

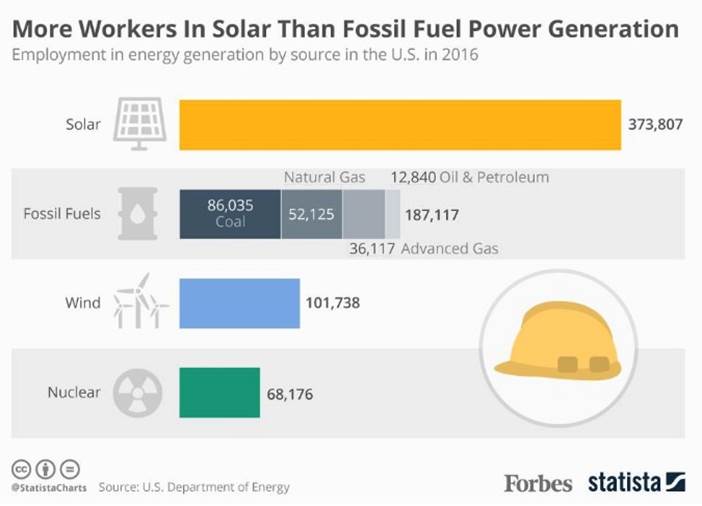

More people now are employed in solar power than generating electricity from coal, gas and oil combined, states a 2016 report from the US Department of Energy, via Forbes. - 374,000 versus 187,000.

The report notes that between 2006 and 2016, electricity generated by natural gas increased 33%, versus solar’s 5,000%!

Updated figures from researchers at University College London have the US employing 10 times as many workers in renewable energy as fossil fuels. They found the “green economy” is worth $1.3 trillion, about 7% of GDP, and accounts for 9.5 million jobs, versus 900,000 working in coal or natural gas. That sounds a tad high.

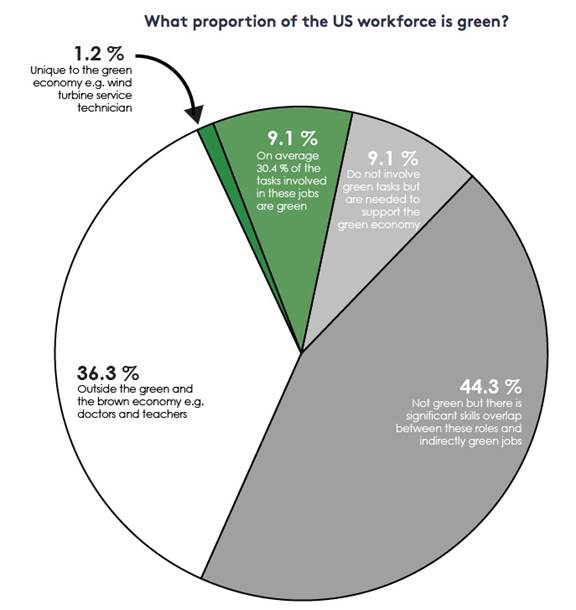

More credible is a 2017 report from the International Energy Agency, quoted by the London School of Economics, showing the US solar workforce increasing by 25% and the number of personnel employed in wind energy 32% higher. The report found just 1.2% of US jobs are unique to the green economy, with 9.1% of the workforce doing some green tasks in their jobs.

How much does would it cost to go all green? 2014 study by a team of economists at the University of Massachusetts calculated what it would take to cut US carbon emissions by 40% in 20 years. Referenced by Pacific Standard,

The study found that the American government and private companies would have to invest a collective $200 billion a year, the government should collect about $200 billion a year in carbon taxes, about 1.5 million jobs would be destroyed, and 4.2 million new jobs would be created.

That leaves a net gain of 2.7 million jobs. Depending on where one lives, a government-led green-deal transition would have winners and losers, Pacific Standard quotes a University of Iowa economist:

Thus, we might expect the sunny South and Southwest, windswept Great Plains, and states that are amenable to offshore wind turbines to benefit. Top fossil fuel-producing states, such as Wyoming, West Virginia, Texas, and Pennsylvania, might be in for a rough transition.

Oddly enough, some abandoned coal-workers back the plan, especially if it means hitting up their un-caring Big Coal employers. In a feature article, The Guardian interviewed coal miners in Appalachia, including a Kentucky miner who worked the underground coal seams for 41 years:

“What you’re doing with the Green New Deal is you’re opening the door to infringe on the Republicans’ money and that’s what they’re afraid of. Republicans laugh and say you can’t pay for it. But if you tax everybody what they should be taxed, and I’m talking about the wealthy, there wouldn’t be a problem.”

[He] cited the coal companies that receive billions of dollars in annual government subsidies and tax breaks, while hiring expensive lawyers to fight paying black lung benefits to coalminers. “I fought seven years before I got my black lung benefits, and they were hoping I died before getting paid.”

Infrastructure spend

President Trump and Democratic congressional leaders plan to spend $2 trillion on US roads, bridges, power grids, water and broadband infrastructure - bricks and mortar priorities that are sorely underfunded in both the United States and Canada.

For more on this, read The global infrastructure deficit: the road not yet taken

According to the American Society of Civil Engineers (ASCE), the US needs to spend $4.6 trillion by 2024 in order to upgrade all its infrastructure to an acceptable standard. Only $2.6T has been earmarked, leaving a funding gap of $2 trillion. About half of that is for surface transportation including transit, roads, bridges and rail.

Leaving aside the thorny issue of whether an infrastructure bill will get passed having failed so far (2020 is an election year after all), we want to know how many jobs a big infrastructure push would create.

The Boston Consulting Group conducted such an analysis when Trump’s initial infrastructure offering was $1 trillion, back in 2017. The study, based on an evaluation of +60 projects, found an investment of that magnitude would create at least 3 million jobs over five years, if projects were prioritized based on their job creation potential, as well as criticality. If their ability to create employment is disregarded, however, the program may create as few as 1.6 million jobs.

Also of interest - facts on current infrastructure spending and employment. According to Boston Consulting Group, infrastructure spending is responsible for about 15.5 million direct and indirect US jobs paying an average $68,000 per year, considerably higher than the US median income of $53,000.

Direct-spend, temporary jobs include positions in design, engineering and construction. Permanent jobs pertain to ongoing revenue-producing assets such as airports and seaports.

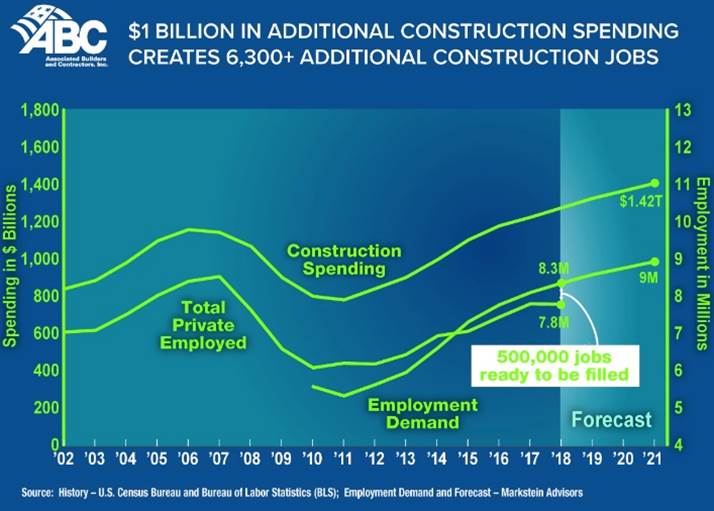

Infrastructure spending has a significant multiplier effect in terms of the number of indirect jobs it creates, such as those in manufacturing (steel, glass, concrete), and transportation logistics. The Associated Builders and Contractors estimates that $1 billion in additional construction spending creates over 6,500 jobs.

Conclusion

This brief analysis discussed what it might take to kick-start the US economy through combining a very large infrastructure spending bill - over twice President Obama’s $787 billion economic recovery package; and a widespread clean-energy program that would accelerate the shift from fossil fuels to green power and fuels.

The infrastructure spend would seem to have the bigger bang for the buck, and have a more immediate effect. On the upside, these jobs are well-recognized and trained for, they pay well, and personnel can be deployed quickly. The downside is they offer temporary employment and only a select few will become permanent.

Clean and green jobs are great but the sector needs to be better defined. What exactly is a “green” job? A wind turbine mechanic obviously fits the category but how about someone who drives a natural-gas powered delivery van? Or an administrator in charge of the company’s recycling program, among other tasks?

Many green jobs need to be transitioned to, say from oil and gas operations. Some will pay less, a lot less. They may be hard to fill. Others might offer better compensation but will require specialized training. Re-training is complicated and time-consuming. In short the economic impact of these new jobs isn’t clear.

Why not a combination of the two plans? A green deal as the long road, infrastructure as the short path to filling new jobs in the US, especially for the “chronically” unemployed or under-employed. Just a couple of ideas for reducing the unacceptably large entitlement spending burden that weighs so heavily on economic growth.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.