Bailout Plan Bullish for Stock Market? What Happens Next?

Stock-Markets / Credit Crisis Bailouts Oct 03, 2008 - 10:57 AM GMT One major international bank after the other is collapsing and is either being nationalized or sold off in sections. Although passed by the US Senate, the House of Representatives has yet to approve a bail-out plan for beleaguered banks.

One major international bank after the other is collapsing and is either being nationalized or sold off in sections. Although passed by the US Senate, the House of Representatives has yet to approve a bail-out plan for beleaguered banks.

Globally there is a sudden shortage of US dollars in money markets. Central banks of major powers are injecting enormous amounts of money into money-market systems worldwide.

Japan and the US are already in economic recession, while Europe is on the brink. The economy of China, which has been the major driving force behind global economic growth, is slowing down, resulting in commodity prices declining.

Understandably, equity markets world-wide are finding themselves in sharp bear markets.

The causes of the above are legion, but can be summarized as money-hungry financial institutions that lent too much money too readily to eager individuals and institutions for the purchase of overvalued assets. If the one who bought last cannot find a buyer, he, as well as the one that financed him, will be in trouble. This has a domino effect, as no one wants to buy or take over the debt.

The critical positions in which the banks find themselves have led to virtually frenzied activity in all financial markets as they tried to reduce their risks and neutralize market positions at all costs, and take out cover on other assets. This is similar to the 1920s in the US when banks allowed investors to use equities as collateral. When equity prices dropped, the investors could not repay their debt, resulting in the banks holding collateral that had no value. Many of the banks subsequently went bankrupt.

The question is: what now?

There is no doubt that everything possible will be done to resolve the crisis as quickly as possible to rescue the world from the financial chaos and thus avoid a global recession. The US Congress has no other option but to accept the bail-out plan in its current or amended form, as without it banks will be forced to call in companies' credit lines in order to survive, with the resultant downward spiral of unprecedented unemployment and poverty worldwide. Although the fiscal bail-out plan would contribute to ensuring greater stability in the banking sector and financial markets, all might not be over yet.

There are doubts about whether the bail-out plan, or New Deal as it was called in the 1930s, will be sufficient to stop the wave of deteriorating financial statements of banks and give them the courage to start lending money again. The main concern is whether it will result in a turnaround in consumer sentiment, especially in view of the fact that consumer spending is key to economic growth.

In order to ensure the New Deal lends enough impetus to the economy and largely prevents disinflation or deflation, the Fed and other central banks will have to relax their monetary policies considerably and reduce their bank rates aggressively. This will be necessary in especially the coming months, as inflation rates in First World economies in particular will decline sharply owing to lower oil and other commodity prices.

If a bail-out plan is not accepted, the Fed and other central banks will have no option but to lower their lending rates to banks and increase their current support of banks substantially. Although such monetary action would underpin the global financial system, banks would still be reluctant to pass the lower interest rates on to consumers and would rather improve their balance sheets.

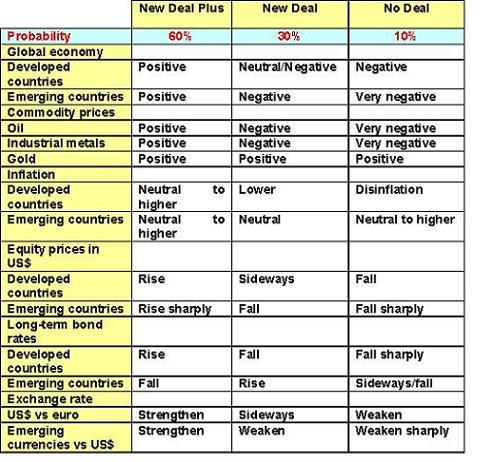

Therefore, from an economic and investment perspective, there are three scenarios that should be considered. Firstly, a completely New Deal (”New Deal Plus”), which entails the bail-out and lower bank rates, secondly, a New Deal that entails only the bail-out, and thirdly, no bail-out and only lower interest rates.

Outlook for asset classes

Equities : At present it is extremely difficult to project profit, earnings and dividend growth and therefore to value equities and stock markets. However, what is clear is that in the current bear market prices worldwide have declined to such an extent that the Standard & Poor 500 Index is currently trading at a price-to-book value ratio of around 1.85 compared with an average ratio of 2.4 over the past 30 years. This is equal to the lows in 1987 and 1990.

Should the bail-out plan be approved, it would be positive for global equity markets, but it would have to be followed up with lower interest rates in order to pull the markets out of the current bear phase. Emerging markets such as China would once again come to the fore as favourites.

Long-term government bonds : The decline in long-term interest rates in recent months is largely the result of fears of a worst-case scenario, namely that the bail-out plan would be rejected. Should it be approved, long-term interest rates could start bottoming and rise slightly, whereas a bail-out followed by lower interest rates would cause long-term interest rates to rise more markedly as stronger economic growth is anticipated.

Commodities : Commodity prices (oil, industrial metals and platinum) could recover somewhat if the bail-out plan is approved, but would probably start falling again in the absence of monetary stimulus. On the other hand, commodity prices could strengthen if the accepted bail-out is followed by lower interest rates.

The following table summarizes my view on the likelihood of the three possible outcomes of the bail-out plan and its effect on the global economy, financial markets and currencies.

As is evident in this table, the New Deal Plus should be the most beneficial for the entire global community and gets my vote. Let's hope common sense prevails in the next few days.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.