When the Crude Oil Price Collapses Below $40 What Happens? PART III

Commodities / Crude Oil Nov 17, 2019 - 02:54 PM GMTBy: Chris_Vermeulen

This, the final section of this multi-part research article, will continue our exploration of the consequences that may result from our ADL predictive modeling system’s suggestion that Oil may continue to fall to levels below $40 over the next few months.

This, the final section of this multi-part research article, will continue our exploration of the consequences that may result from our ADL predictive modeling system’s suggestion that Oil may continue to fall to levels below $40 over the next few months.

In Part I and Part II, we’ve highlighted what we believe to be very compelling evidence that any continue oil price decline from current levels may be setting up the global markets for a massively volatile price reversion – similar to what happened in 1929.

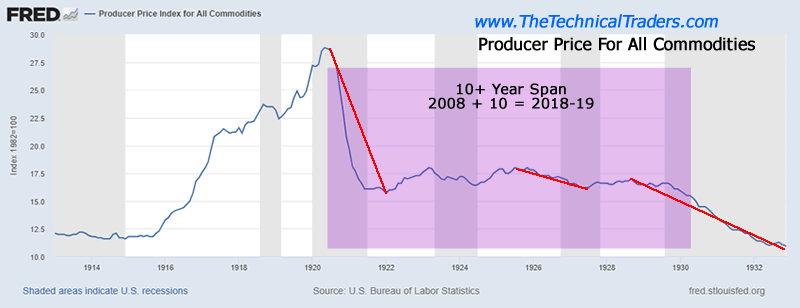

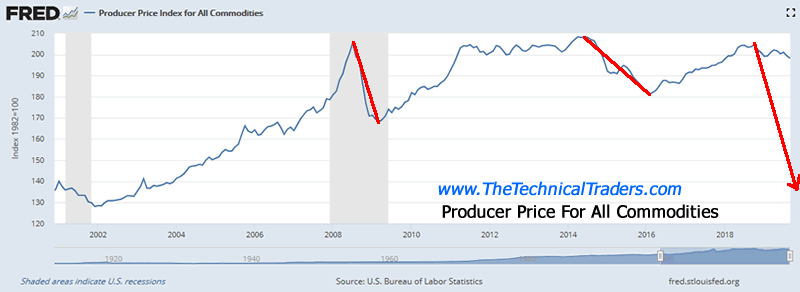

Prior to the stock market collapse in 1929 and the start of the Great Depression, commodity prices collapsed in 1921 and again in 1930. This commodity price collapse was the result of over-supply and a dramatic change in investor mentality. The shift away from tangible items and real successful investing/manufacturing and towards speculation in the housing markets and stock market.

Today, we want to focus on some of the core elements of our current global economic structure to attempt to present any more compelling evidence of a commodity collapse event that may happen after the past 7+ years of a massive credit market expansion event. Allow us to briefly cover the events of the past 20 years.

You can get my daily market analysis articles and trade ideas by opting into my free market trend signals newsletter.

1999: the DOT COM bubble burst after a mild recession in 1993-94 and a stock market rally from 1996 to 1999

September 11, 2001: Terrorist Attack on US soil. Shocked the world and global stock markets. Sent the world’s economy into severe contraction. US Fed lowered interest rates from 6.25% to 1.0% from 2001 to 2003.

2004-06: US Fed begins raising rates from 1.0% and gradually increased rates to 5.25% in August 2006: +525%. Pushing the US credit market, and housing market, over the edge and starting the 2008 Credit Crisis.

2007-2008: US Fed lowered interest rates to near ZERO over a very short 16-month span of time as the US Credit Crisis event unfolded.

2009-15: US Fed continued to keep interest rates near zero throughout this time-frame and continued to pump capital in the global capital markets with multiple QE and debt buying events. Other global central banks followed the US lead providing additional capital throughout the global markets. This massive expansion of credit/debt over a 7+ year span of time allowed foreign nations to “binge” on cheap US and Euro credit/debt while an Emerging Market and Foreign Market recovery were taking place.

2016-2019: US Fed raised interest rates from 0.08% to 2.42% over this span of time. Pushing US Fed rates up by the highest percentage levels EVER: +3025%

This continued global cycle of “boom and bust” has wreaked havoc on global consumers and business enterprises. Over the past 20+ years, various cycles of economic appreciation and depreciation have left some people considerably better suited to deal with these cycles while others have been completely destroyed by these events. Now, it appears we are entering another period of “early warning” as global manufacturing activity, growth and economic output appears to be waning. Are we entering another period like the 1929 to 1940 period of the US where a global economic contraction resulted in a deeper economic recession/depression and took 15+ years to recover from?

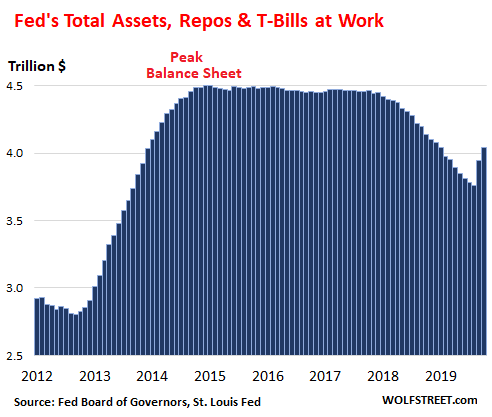

The US Fed has recently started acquiring assets again – at a far greater rate than at any time since 2012. It is very likely that the US Fed is “front-running” a crisis event that is already starting to unravel again – possibly aligned with institutional banking entities and global credit/debt risks.

Chinese factory orders have continued to fall recently and the news is starting to trickle out of China that the US trade tariffs have done far greater damage than currently expected. This suggests that manufacturing, exports, and GDP for China have entered a massive decline. What happens next is that commodity prices collapse because of the lack of demand from manufacturers and consumers. (Source: https://www.yahoo.com/finance/)

Chinese new loan origination rates have fallen to a 22 month “new low” – which suggests corporate and consumer borrowers are simply not willing to take on any new debt/credit at the moment. This happens when a population decides they want to “disconnect” from any economic risks and shift towards a “protectionist” process. (Source: https://finance.yahoo.com)

Recent news suggests that Chinese demand for European consumer and luxury goods has also contracted dramatically. Germany will release GDP estimates on November 14th. It is our opinion that the Chinese have already shifted into a more protectionist consumer stance and that would mean that demand for non-essential items (call them high-risk purchases) are very low at this time. If this is the case, the lack of true demand origination out of China/Asia could push much of Europe into a recession. (Source: https://www.yahoo.com/)

The last thing China would want right now is to blow the potential for any type of US/China trade deal – even if it means giving up more than they may have considered many months ago. More tariffs or any type of tit-for-tat retaliatory trade war would not be in the best interest of either party at this stage of the game. Who flinches first? The US, or China, or the rest of the world?

So, the question, again, becomes.. “will a commodity collapse lead the global stock market into a prolonged period of price decline and/or a global recession over the next 10+ years?”

If so, can we expect commodities to collapse as they did after the 1929 stock market peak?

You may remember this chart from the earlier sections of this multi-part article. It highlights what happened leading up to the 1929 stock market crash and how early warning signs of manufacturing and agriculture weakness continued to plague the markets while speculation in housing and the stock market pushed certain asset values much higher near the end of the “Roaring 20s”.

Are we setting up for the same type of event right now where global trade, manufacturing, and agriculture are weakening after the 2008 Credit Crisis and we are meandering towards a repetition of the events that led to the “Great Depression”? Will commodities prices collapse to 2002 or 2003 levels for most items? Will Oil collapse to levels below $30 ppb over the next 6 to 12+ months? And what will happen to Gold and Silver throughout this time?

Can we navigate through these troubling events without risking some type of new collapse event or reversion event? Are the central banks prepared for this? Are traders/investors prepared for this? Just how close are we to the start of this type of event?

The answers lie in what we do now and how the commodities react over the next 12+ months. The one major difference between now and 1929 is that the world is far more inter-connected economically and there are more people throughout the world that have moved into the “economic class”. Thus, it is our opinion that any event that is likely to happen will be followed by a moderately strong recovery event – no matter how severe the outcome. The world is in a different place right now compared to 1929. Overall, only time will tell if our research and ADL predictive modeling system is accurate with respect to future oil prices.

We believe it is critical for all traders to understand what lies ahead and the risks involved in “playing dumb” about the current market environment. We recently authored an article titled “Welcome to the Zombie-land for investors” and highly suggest you read it. Our researchers will share this one component that should help to ease some of the stress you may be feeling right now – the most capable, secure, mature and best-funded (reserves) economies on the planet will likely lead any recovery process should an event as this happen. Therefore, look for strengths in the most mature and capable economies on the planet if some new crisis event begins.

Even if a trade deal between the US and China were to happen today and eliminate all trade tariffs, would this change anything or would this simply pour fuel onto the “capital shift” fire that is already taking place with speculation reaching frothy levels?

If you want to earn 34%-50% a year return on your trading account with very few ETF trades then join me at the Wealth Building Newsletter today!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.