Manipulation of Gold and Commodity Prices to Prevent Inflation and Higher Interest Rates

Commodities / Market Manipulation Oct 03, 2008 - 05:00 PM GMTBy: Rob_Kirby

The Invisible Hand and

the Pox Known as Usury - First, from Wikipedia, a little background on usury :

The Invisible Hand and

the Pox Known as Usury - First, from Wikipedia, a little background on usury :

Usury (pronounced /ˈjuːʒəri/ , comes from the Medieval Latin usuria , "interest" or "excessive interest", from the Latin usura "interest") originally meant the charging of interest on loans. After countries legislated to limit the rate of interest on loans, usury came to mean the interest above the lawful rate. In common usage today, the word means the charging of unreasonable or relatively high rates of interest…..

….But one must always consider that usury, in historical context, has always been inextricably linked to economic abuses , mostly of the masses and of the poor; but sometimes of the financier and royalty, as bankrupt royalty has led to many a demise, thus frowning upon lending at interest or for a euphemistic "just profit". The main moral argument is that usury creates excessive profit and gain without "labor" which is deemed "work" in the Biblical context.

Profits from usury do not arise from any substantial labor or work but from mere avarice, greed, trickery and manipulation. In addition, usury creates a divide between people due to obsession for monetary gain. Most importantly, usury commodifies biological time for profit, which is linked to life, considered sacred, God-given and divine, leading to excessive worrying about money instead of God, thus subjugating a God-given sanctity of life to man-made artificial notions of material wealth…..

I began this paper with a broad definition of usury to explicitly point out, in an historical context; it has always been inextricably linked to ECONOMIC ABUSE .

Today is no different.

Interest Rates and Gold Joined at the Hip

Before delving into the nuts-and-bolts of how usury has been utilized in deceitful and harmful ways to perpetrate economic abuses upon mankind we should also grasp the historic relationship between GOLD and INTEREST RATES :

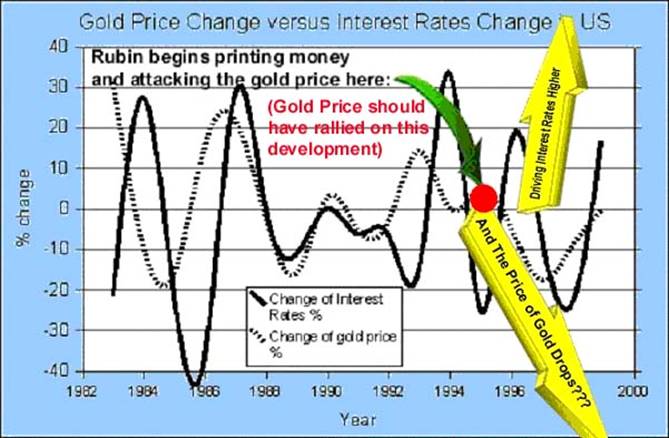

Historically, the gold price is a leading indicator as it tends to predict interest rates. When the gold price is high, interest rates tend to rise in the near future.

Gold as a leading indicator to interest rates is more obvious when gold price changes are plotted. Except for the last major upswing in interest rates in 1999, the gold price trend led interest rate levels by about a year.

Also, it's important to remember that from an historical standpoint, money creation [absent productivity increases] IS inflationary. Inflation historically drives interest rates higher. The question then becomes, what happened to break-down the gold price, yet, send interest rates higher around the 1995 time period [above]?

Economic Laws state that this cannot have happened without good reason.

Refresher As to What Happened In 1995?

We need to wind our clocks and calendars all the way back to 1995, in the twilight of the first Clinton Administration. Sir Robert of Rubin was then Treasury Secretary and the U.S. government was facing default on its financial obligations due to a bitter, partisan debate causing delay on raising the debt ceiling. In the words of Robert Rubin himself in his book, In An Uncertain World, on page 170 he states,

“Without an increase, the federal government would hit the debt ceiling before the end of 1995, possibly as early as October. Default and the President being forced to sign an unacceptable budget were both untenable. We needed to find a way out, rather than simply hoping that at the last minute the opposition would blink and increase the debt limit.”

The ultimate response to this dilemma is chronicled by Rubin, on page 172, where he reveals,

“It was Ed Knight, our savvy chief Treasury counsel, who suggested borrowing from the federal trust funds on an unprecedented scale to postpone default.”

You see folks; as Mr. Rubin was well aware, the federal trust funds DO NOT AND NEVER DID CONTAIN ANY MONEY . These accounts exist in the minds of accountants and lawyers [ledgerdom] only. So here's what was going on:

Beginning Nov. 12, 1995, the Treasury started issuing government bonds, IOU's, and putting them in the Social Security Trust Fund “cookie jar” – with the Fed then PRINTING the corresponding amount of money they needed and called this a ‘legitimate loan'. By accounting for their finances in this manner, the government got to understate their annual budget deficits by the same amount that they were burdening the cookie jar with IOU's – all the while dramatically increasing the unfunded [off balance sheet] liabilities of the government by the same amount. Where I come from, this is neither savvy nor a loan. It is better described as treasonous, fraudulent and larcenous.

At the same time, the methodology for measuring inflation was undergoing rigorous fraudulent changes – which made a mockery of ‘then' Fed Chairman, Alan Greenspan's claims of a productivity miracle and, through the yeoman's work of John Williams [www.Shadowstats.com] was exposed for what they really were: deceitful obfuscations to mask profligate monetary policy being pursued by government. This deception was reinforced by the jaw-boning-ruse we know as the Clinton/Rubin/Summers “strong dollar policy”.

Market rates of interest are historically set at the real rate of inflation plus 250 basis points. The real rate is determined by backing out “inflation” from nominal rates of interest. By understating inflation, interest rates look higher [or more positive] than they otherwise would be.

The budding fraud depicted in the graph above shows that interest rates were behaving as they should but the gold price reacted counter-intuitively?

Why the Gold Price Dropped

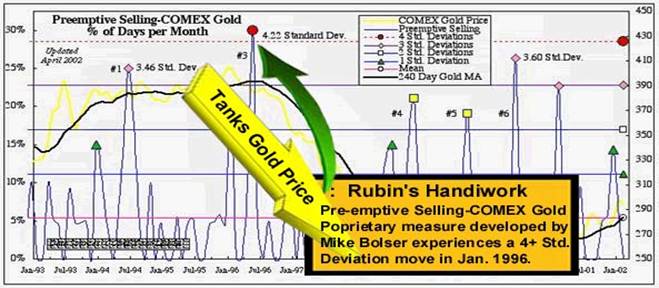

In late 1995, Rubin knew that the course being charted, Government profligacy, would naturally lead to a much higher gold price and higher rates; so, the Fed / Treasury [Plunge Protection Team] unleashed their “stealth” gold price suppression scheme, a direct hit from a golden-torpedo, in Jan. 1996:

In the chart above, mathematician Mike Bolser employs ‘ statistical regression analysis' to depict what amounts to forensic statistical accounts of how an ‘invisible participant' involved in the trade whose actions dictate they are not motivated by “profit maximization”.

“Preemptive selling, which is a fraud detection algorithm , measures very aggressive COMEX gold market selling when compared to the London gold market (LBMA). Table 1 displays the percentage of days per month in which the COMEX gold price falls 300% more than the London gold price. The probability of changing macroeconomics being the cause for such extreme New York price drops is highly diminished because the two markets trade the same commodity on the same day. Preemptive selling should not be confused with price volatility or rate of change, which are measures of rapid price fluctuation. In addition, preemptive selling is a measure of relative activity between two markets. Recall also that it does not measure the volume of comparative selling, only its effect as measured by gold market prices.”

With the gold price effectively “dead and buried”, there was still a problem that needed to be tended to – to prevent or stem the “Bond Vigilantes” from selling bonds in sufficient quantities to “ FORCE ” interest rates higher.

The solution to this part of the problem [rising rates] is where J.P. Morgan's [now] 93 Trillion Derivatives Book swung into action.

Embedded in every interest rate swap is a bond trade. In simple terms, the greater the volume of interest rate swaps – the greater is demand for bonds to hedge them. Ergo, if enough interest rate swaps are transacted – they serve as a “ VACUUM CLEANER ”, sucking up ALL MEDIUM TERM BONDS [3 – 10 yrs.] in their path.

In this respect, bond trading volume originating from the interest rate swap derivatives complex overwhelmed and supplanted traditional bond market participants. The motivations and risk tolerances between these two classes of “traders” are not necessarily consistent with one another – and in the extreme - manipulatively opposite to one another. We have been witness to the same type of phenomena in the precious metals arena where futures [COMEX and LBMA] prices have served to “trump” or suppress those which would be dictated by physical supply or demand. This is now manifesting itself in bifurcation of our capital markets – banks are now refusing to lend money at Libor [an interest rate futures derived price] because it is not reflective of their costs of funds and owners of physical metal are refusing to part with their precious at COMEX prices, because it costs more in many cases to mine it. This is evidenced by stiff and increasing premiums being paid for physical metal.

What's more, interest rate swaps being “off-balance-sheet items” – an untrained eye [or Bond Vigilante, perhaps?] was none-the-wiser as to why yields were counter-intuitively falling or remaining at low levels despite demonstrable inflationary pressures. According to the Office of the Comptroller of the Currency's [ archived ] Quarterly Derivatives Fact Sheets:

“J.P. Morgan's Interest rate swap book grew from 12.716 Trillion Notional at Q4/1995 to 14.7 Trillion at Q2/1996.”

Back in those days a couple of Trillion used to buy a lot of love, or respect.

Against this backdrop, bond vigilantes quickly joined the ranks of the “extinct” – acquiescing or losing their jobs - while interest rates, the primary efficient arbiter of capital – became fallacious and meaningless.

It was this GROSS mis-pricing of Capital and associated market rigging practices that facilitated ALL THE ASSET BUBBLES - from the contorted Dot Com Boom to the Real Estate debacles that followed.

To mask and obfuscate their ever heightening profligacy [if you consider 850 billion dollar bail-outs for Wall Street profligate], officialdom has increasingly relied on the handiwork of their agents in the derivatives markets of strategic commodities to suppress or cap prices – trying to turn back accelerating runs-on-banks. In this surreal set of circumstances, while fiat currency continues to self destruct before our very eyes, the saying that, “price action makes market commentary” leaves the mainstream financial press and unwitting market commentators babbling about rampant deflation even as these “bank-runs” and counter-intuitive physical shortages intensify.

Not by coincidence, if one reads an Introductory Economics Text Book, one would read that artificially low, negative real interest rates deter savings and encourage consumption and frivolous speculation while creating shortages of basic goods.

Does any of this sound familiar?

Welcome home, folks.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research.

Many of Rob's published articles are archived at http://www.financialsense.com/fsu/editorials/kirby/archive.html , and edited by Mary Puplava of http://www.financialsense.com

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.