Why Shale Oil Not Viable at $45WTI Anymore, OPEC Can Dictate Price Again

Commodities / Shale Oil and Gas Dec 03, 2019 - 10:56 AM GMTBy: Andrew_Butter

Why Shale was once Viable at $45WTI but it’s not anymore. That’s why OPEC can dictate the price again.

- Some shale operators now say they can’t make money at $55; so they are cutting-back. But in 2017 when WTI averaged $50; output-growth was 60% higher than today. How come?

- In 2015, five-hundred frac-spreads, bought and paid for; some from profits, many at fire-sale; were idle; so day-rates plunged; and so, helped by multi-pads and cheap sand, shale re-booted.

- In June 2019 all those spreads were working. But now, for shale to continue to grow, more are needed. Except at $55 operators can’t pay the pumpers the day-rates they need to buy new.

- CAT is crying and Halliburton is stacking; holding-out for better rates. Rig count has plunged; there’s no point drilling if you can’t find a cheap frac-spread to complete.

- Now OPEC & Co can push the price up to $75 WTI without fear of sparking a third boom. But they may make the mistake they made in 2015; trying to kill-off shale. If they do, they will fail.

Over the past year the penny that shale-oil output growth was going down, not up, finally dropped for most commentators (1-to-7). Although EIA, IEA, OPEC and Rystad Energy are all sticking with their predictions for a 900,000 bpd or so build in shale production in 2020 (8-to-10). They say the slump in growth which started in June 2018, was because of pipeline constraints in Permian (11). But those were fixed in December 2018, yet output-growth kept going down.

Today oil is still priced on the assumption that the 900,000 number will come in for 2020, so logically to maintain the so-called balance; OPEC will need to cut at least 400,000 more on top of the 1.2 million they are supposedly holding-back, to keep the price where it is.

There are signs OPEC’s solidarity is crumbling. The shorts are betting it will fall-apart; they are encouraged by inventory builds and the US-China trade war. But those builds are mostly caused by the switch from importing oil, to exporting; and the trade war is just politics. When traders start to doubt the 900,000 number, the price could spike.

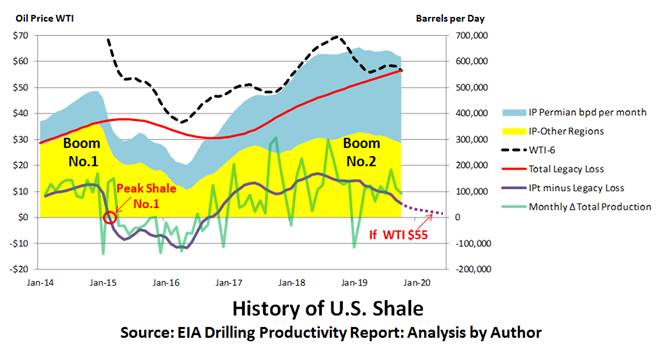

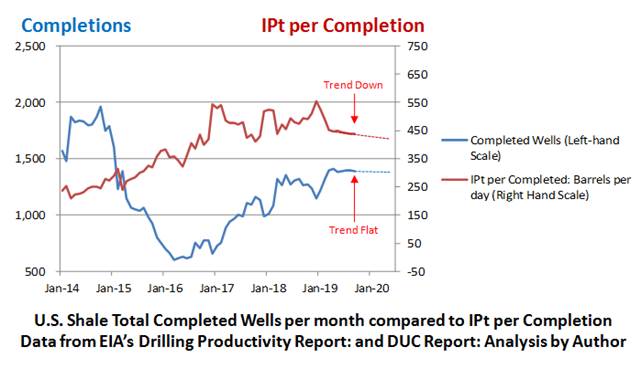

Trend-line growth in shale production fell from the peak of 168,000 bpd per month in June 2018, down to 53,000 last month, which is less than it was three years ago. Then WTI was $47, last month it averaged $57. So oil prices went-up 27% over 18-months and growth was flat; that’s not logical.

EIA recently predicted that this December, growth will be 49,000 bpd per month, and cup-half-full, production of U.S. shale-oil will hit an all-time-record. America is Great Again.Halleluiah!!

Cup half-empty, to hit 900,000 for 2020, monthly growth will need to go up 50% to 75,000.

EIA offered no explanation for how-come a trend-line that has been going steadily down over the past eighteen-months; might magically start going up; particularly in the light of the evident financial woes of operators; plummeting rig-count; and since June, plummeting frac-spread utilization.

Cup nearly-empty, to grow total production by 900,000 bpd in 2020, total initial production (how much new oil is brought on line from new wells (IPt)), will need to jump by 12%.

In October 2019 IPt was down 6% on the peak in February 2018.

Perhaps Santa will wave a magic-wand this Christmas?

Why did the growth-rate of Shale output go down 70% over the past 18-months?

That’s a slightly complicated story. To be clear, I’m not talking volume (still going up); I’m talking growth (going down).

Only two numbers matter if you are interested in where U.S. shale is going, not that many of the commentators who splash the headlines with predictions, hardly ever mention them.

1: Legacy Loss

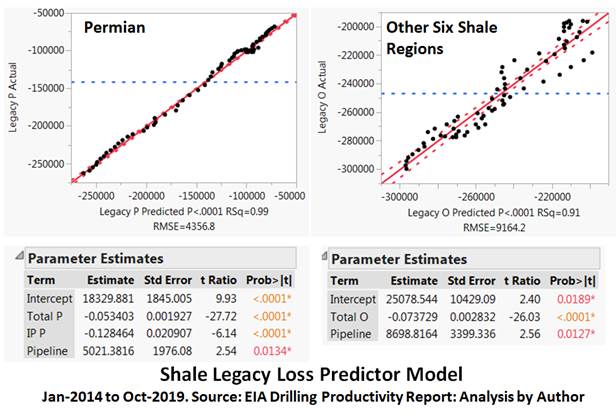

Legacy Loss is reported by EIA on the third Monday of the month for each of the seven shale-oil regions. It is highly predictable.

Looking at the best-fit formulas (the boxes under the charts):

- The main driver of Legacy Loss is Total Production, which is logical.

- In Permian, higher Initial Production (IPt) increased legacy loss, probably because new wells deplete faster than old wells; that was not a viable (statistically significant) explanatory variable outside of Permian, probably because those regions are more mature and IPt as a proportion of total production is less.

- Pipeline woes in Permian were tested as a dummy-variable; (1=Problems (between April 2018 and December 2018); 0=No problems). The model says legacy-loss was down by 5,021 bpd in Permian and 8,699 elsewhere, corresponding to a drop in production of about 100,000 bpd in Permian and 120,000 bpd elsewhere, caused by pipeline constraints (3% of total production).

- So the pipeline-woes in Permian seem to have affected other regions more, possibly because Permian operators could afford to pay more for alternatives (rail and road), than the others, so the other regions got priced-out.

- Pipelines are now just academic history. But at 900,000 bpd growth per year in-total (say half in Permian), it will take three years for that capacity to fill; at 300,000 it will take ten.

- Guess what? The pipeline operators are now discounting like crazy, rather than holding out for the mirage of a new boom in shale; which was likely the key-assumption they made when they decided to build (11). Perhaps they saw now which was the wind is blowing?

2: Total Initial Production by Region (IPt)

Hardly anyone talks about IPt because EIA only reports IP/rig, so to figure IPt by region you need to multiply Rigs x IP/rig.

Sounds odd that EIA do not directly report the most important number in the shale industry, but that’s how to calculate it. You can check by adding up calculated IPt-minus-Legacy loss, for a year, which pretty-much equals the reported annual increase in production, the small difference is because year-on-year production-change is a lagging indicator, IPt is a leading indicator.

IPt-minus-Legacy Loss is a smooth line, so it’s easy to spot the trend. Monthly change in total production is a jaggedly line, so the trend is hard to spot (see chart on “The History of Shale” below). That might explain why it took so long for many commentators to twig that the direction was decidedly down.

WTI-6 is a measure of the enthusiasm of operators to call-in the pumpers for the frac, which these days can cost 70% of the CAPEX for a new well if you count the cost of the sand and the liquids, now that the cost of drilling per foot is down, thanks to multi-pads and re-designed horizontal drill bits.

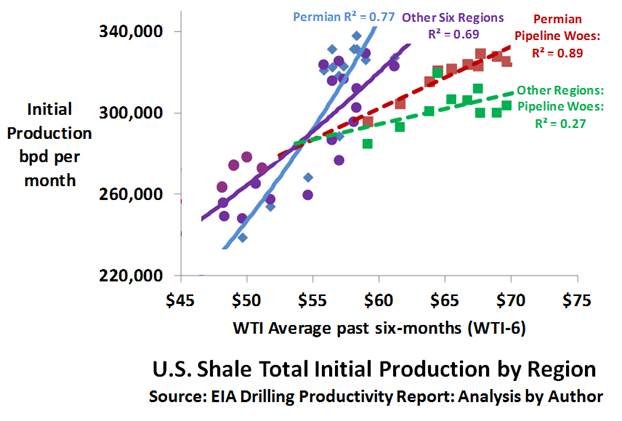

Logically IPt ought to depend on expectations about the price of oil over the next year. One would suppose that might depend on the direction oil-prices took over the recent past. It does, pretty-much. The best explanatory variable I found was the average of the past six months WTI:

Those are not bad correlations; they say IPt is likely driven by “expectations for the likely direction of oil prices as measured by WTI-6”, although the relationship is different depending on region and pipeline woes.

The pipeline-woes lines are for the period April 2018 to December 2018. Outside of the eight months when Permian pipelines were flowing at full capacity, and spot surcharges were as much as $10 per barrel; 70% of changes in Initial Production (IPt) could be explained by changes in WTI-6 (that’s what RSquare=0.7 means).

I re-analyzed the data iteratively calculating “Effective WTI-6” for the pipeline-woes period, the best fit explanatory variable for that was for WTI-6 minus $6 outside of Permian (Other), and minus $5 inside Permian, reflecting the average increased cost of takeaway then.

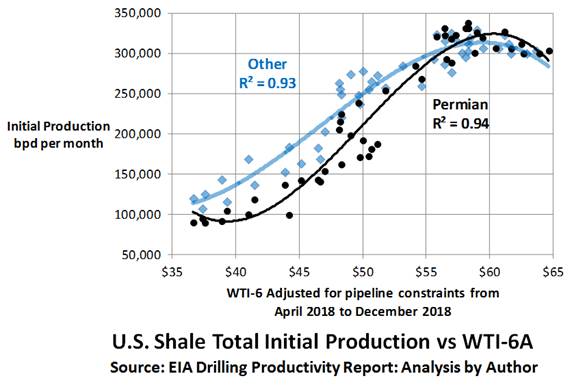

The best-fit for both regions was a third-order polynomial which is an approximation for an S-curve, the correlations (RSquare), were very high.

It’s easy to buy the idea that under $40 IPt was flat, until a threshold was reached at about $45, after which it accelerated.

But one would expect that logically, IPt would accelerate exponentially at higher prices, as margins improved, but that didn’t happen, instead it started to flat-line after WTI-6A hit $55.

Looking at the data another way:

When the red line gets up above IPt, that’s Peak Shale No.2; notice in January 2019 when the pipeline issues had been sorted, there was no bounce in IPt, even though WTI-6 grew for six months after.

That’s weird.

A year-ago, the CEO of Schlumberger was warning of a slowdown in shale because of child-plays interfering with each other. He put up pretty charts to explain his ideas, except I never quite understood how that related to the big picture.

Yes the productivity gains from longer laterals and pumping more sand have been drying-up, but there is little evidence of an increase in legacy loss as a function of total production over the past year, although IPt per completion was sharply down since January 2019, after having almost doubled since January 2014, but that’s hardly a trend, yet.

So, looking at the charts, I’m scratching my head; wondering what’s going on?

Then I remembered a conversation I had with a gentleman from Houston-Texas. You could tell he was from there because he was wearing $500 cowboy boots, presumably because in Texas everyone rides to work on horseback?

He didn’t seem to know much about horses, but he knew a lot about oil, much more than me.

That was in mid 2016; when WTI was settling at over $45, we were talking about rack, he cuts the best rack in the world.

- Changing the subject, I asked, “When do you think shale will re-boot?”

- He told me, “It’s re-booting now; I’m building six multi-pads for Permian”.

- My jaw dropped, “But how can that be, they could hardly make money at $100 before?”

- He replied, in the laconic style that only Texans can do, “Frac-spreads are paid for”.

My penny dropped.

This is the story on the frac-spreads:

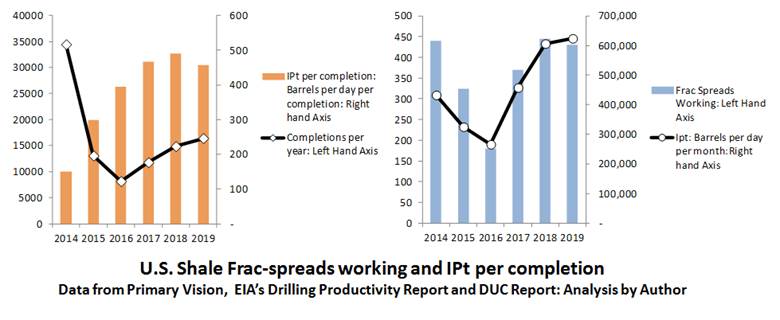

What changed from 2014 was laterals got longer, so IP per completion went up from 150 to 500 bpd per completion; completions per year went down from 35,000 to 15,000, and average IPt (annually) went up from a little over 400,000 bpd/month to a little over 600,000 bpd/month, likely not so much because of a technological marvel in the frac, more likely because on the multi-pads, with longer laterals, you don’t need to dismantle and re-build the frac-spreads so often.

What didn’t change was that in 2014 the fleet of frac-spreads was 500; in 2019 the same fleet was working, flat-out.

Looks like the fleet cannot bring in more than 650,000 bpd per month. Shale is very simple, IPt is a function of how much sand you pump, and if sand is plentiful and cheap, which it is now, that’s a function of how many frac-spreads you got, which is why (right-hand chart), since 2016, IPt correlated almost perfectly with the numbers of frac-spreads deployed.

In order for IPt to grow faster than legacy loss is growing, there will need to be additions to the fleet, with the proviso, looking at the chart; that WTI-6 settles at more than $55.

But there’s a problem, a new diesel frac-spread costs $30 Million, the e-fleets that have gas-turbines powering generators that drive the pumps, which are more environmentally friendly, much quieter, and don’t cover everything in soot, cost $60 Million (12).

Operators like the e-frac spreads because the gas is free; and you can spend $350,000 on diesel for a frac (new wells cost $6 to $8 million these-days, all-in).

But pumpers don’t want to invest in new spreads, particularly because the way the industry is going, if you buy-new, you need to buy the latest technology; e-frac.

I couldn’t find good numbers on what frac-spreads make as a day-rate, the latest analysis I found was by EIA in 2016 (13), but rule of thumb from other types of oil-field equipment, I guess about $500,000 per frac just for the spread.

For the sake of argument, and I may have these numbers completely wrong; say 20 fracs per year that’s $10 million per year, just renting-out the frac-spread without the cost of the crew. The spreads take a beating on the frac, so after wear-and-tear and the cost of refurbishment, net might be $5 million per year.

So if you bought a hardly-used frac-spread from a liquidator in the bust in 2015, for $10 million, you would pay-back in two years. Good business, could explain why everyone jumped back-in with such enthusiasm.

But if you buy a new diesel-spread for $30 million, today, and the rates are the same, your payback will be six-years; that’s no good on a speculative investment in equipment that could be obsolete in ten years.

For the pumpers to start to get greedy again, the cost of the spread for a frac will need to go up by $1 million, that’s a big chunk when currently new wells cost $6 million to $8 million each.

If you buy a new electric spread for $60 million, even after getting an extra $350,000 per frac from free gas, the cost of the spread for the frac will need to go up by $1.75 million, before the pumpers start to have dollar-signs in their eyes.

What’s happening now is that the spread you bought for $10 million in 2016; is likely worth $20 million, because depreciated replacement cost is a function of the useful life left, and how much a new one costs using latest technology.

That’s of course the value to you, but you might even be able to sell it for that, because of upward pressure on day-rates, because utilization is so high.

So the best thing for you, would be to stack 25% to 50% of your fleet (it costs almost nothing to stack now the units are paid for), and wait until oil prices go up, so your customer can afford to pay the higher rate, so you can afford to start to buy new.

Or if that doesn’t happen, wait until your customer goes broke and his assets get sold fire-sale, and the proud new owner can afford to pay your price.

That’s what Halliburton just did (14).

I may have got the numbers completely wrong, but one thing is for sure; what no-one is doing is rushing-out to buy new e-frac spreads at $60 million a pop, which is why CAT is crying (15). The gas-turbines for those have a nine-month delivery, (that’s what I was quoted for a unit last week), so until the orders start to pile in, day-rates for frac-spreads will be going up, regardless of what happens to oil-prices.

That doesn’t mean Peak Shale will happen any time soon, so long as:

- WTI stays up above $55, which looks increasingly likely, particularly since the prospects of competition with conventional oil from increased shale will be less.

- If so IPt will flat-line at above 600,000 bpd/month, which will be enough to keep IPt-minus-legacy loss above zero (Peak Shale) for at least a year.

- More likely WTI will settle at $75 because that’s what it will likely take for operators to have the extra cash to be able to persuade Halliburton and others to un-stack their spreads, and then start to invest in new. But until that happens, growth of shale output will be close to zero.

Running the numbers for the algorithms for legacy-loss (above), assuming IPt flat-lines at 600,000 bpd/month, in other words, no one starts to rush out and buy new frac spreads, and even if they do, those don’t get delivered in 2020; says growth in shale oil output in total in 2020 will be less than 450,000 bpd, i.e. half of what EIA, IEA and Rystad are predicting.

That’s not Peak Shale, but it’s not a boom, in 2018 growth was 1.7 million bpd per year.

Meanwhile, some folks over at OPEC & Co have started to notice the writing on shale-oil’s wall, notably the Russian Oil Minister (16).

If this analysis is right, they can cut a little more in December, and then stand back, and watch WTI go to $75, without risking igniting a third Shale-Boom.

Looks like there may be light at the end of the tunnel for conventional oil-service and E&P companies, for example like Transocean (RIG), up 20% since it’s bottom in October.

But will they?

Russia is cheating and the Saudi’s are signaling they are not willing to go on taking on the lion’s share of the pain.

On reflection, OPEC made a big blunder in 2015 when they decided not to cut, so as to “protect market share”, which translated into English meant, “Kill Shale”.

If they had cut, Brent would likely have bottomed at $67, as predicted by the one commentator who saw that a massive bust was on the cards, three years before it happened.

In which case, many operators who went bust; would not have gone bust.

- So their almost-new frac-spreads would not have been sold at auction for pennies

- So the investors who had financed those, would have insisted that they get a decent return on the $30 million.

- So they would have held out for higher day-rates

- So the breakeven cost would have stayed high.

But when Brent hit $35, the investors got wiped-out, assets were sold by banks for pennies, and the survivors could offer spreads priced one-third of the price in 2014.

So combined with the new multi-pads, cheaper sand, and faster horizontal drill-bits; shale became viable at $45 when only two years before it had hardly been viable at $100.

That’s the beauty of U.S. bankruptcy laws.

Whether OPEC will stand-hard on the present cuts, and even cut a little more; is hard to predict, but we shall learn soon what they decide.

One thing is sure; they can take back control now, if they want.

Wouldn’t it be ironic if this time OPEC lent a helping hand to the U.S. shale industry, so it could be a little more profitable, so the wave of bankruptcies is slowed and there is no repeat of the carnage in 2015 that drove down costs.

Whilst of course keeping an eye on CAT’s order book for turbines for new frac-spreads, and when (not if) that starts to fill, aim to do a bit of market-share-protection after nine months, just in time for deliveries to start. The threat of that might keep the pumpers holding tightly onto their wallets until Brent hits $100.

References:

1. https://www.bloomberg.com/news/articles/2019-10-14/peak-shale-how-u-s-oil-output-went-from-explosive-to-sluggish

2. https://www.washingtonpost.com/business/energy/americas-great-shale-oil-boom-is-nearly-over/2019/10/13/31650cde-ed87-11e9-a329-7378fbfa1b63_story.html

3. https://www.worldoil.com/news/2019/11/6/shale-oil-pioneers-say-the-boom-times-are-over

4. https://www.dallasnews.com/business/energy/2019/07/12/is-the-red-hot-permian-basin-beginning-to-flame-out/

5. https://www.worldoil.com/news/2019/11/7/us-oil-production-growth-in-for-a-major-slowdown-says-ihs-markit

6. https://oilprice.com/Energy/Crude-Oil/The-EIA-Is-Grossly-Overestimating-US-Shale.html

7. https://www.forbes.com/sites/daneberhart/2019/11/01/the-great-shale-slowdown-has-arrived/#6d03eb943755

8. https://www.eia.gov/todayinenergy/detail.php?id=38832

9. https://www.rystadenergy.com/newsevents/news/press-releases/us-shale-to-grow-to-14.5-million-bpd-by-2030/

10. https://www.forbes.com/sites/gauravsharma/2019/11/05/opec-sees-flood-of-us-shale-barrels-hurting-demand-for-its-crude-oil/#6646d11074b7

11. https://www.reuters.com/article/us-usa-permian-pipeline/new-us-pipelines-poised-to-start-price-war-for-shale-shippers-idUSKCN1UY2EG

12. https://www.reuters.com/article/us-usa-oil-electric-fracturing-focus/low-cost-fracking-offers-boon-to-oil-producers-headaches-for-suppliers-idUSKCN1VX112

13. https://www.jwnenergy.com/article/2016/7/here-are-five-main-costs-frac-job-us/

14. https://oilprice.com/Energy/Energy-General/Oil-Giant-Slashes-Jobs-Amid-Shale-Slowdown.html

15. https://www.bloomberg.com/news/articles/2019-10-23/fracking-slowdown-weighs-on-caterpillar-as-sales-of-pumps-drop

16. https://oilprice.com/Energy/Oil-Prices/Russia-Predicts-The-Death-Of-US-Shale.html

By Andrew Butter

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe. Ex-Toxic-Asset assembly-line worker; lives in Dubai.

© 2019 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.