Gold, Silver and Stock Market Big Picture: Seat Belts Tightened

Stock-Markets / Financial Markets 2019 Dec 04, 2019 - 10:17 AM GMTBy: The_Gold_Report

Sector expert Michael Ballanger offers his latest insights into the markets and his investment strategy as 2019 winds down.

Sector expert Michael Ballanger offers his latest insights into the markets and his investment strategy as 2019 winds down.

"Gold is money; everything else is credit." —J.P. Morgan

Dating back to the mid-80s, and usually around the end of November, I begin to formulate strategies and portfolios looking out to the upcoming New Year, taking into account technical, fundamental and geopolitical factors in an effort to avoid career-ending draw-downs while posting a respectable degree of performance.

Being a player in both the commodity and equity arenas, it is no surprise that over the past forty years of covering precious metals and stocks, the landscape has changed in a manner that defies the term "evolution." A better term to describe the metamorphosis in the credit and equity markets, particularly since 2009, would be the use of the term "deformation," as government-sponsored intervention has thrown a toxic curve ball at the analytical batter's box. The days where charts of the Dow Jones and five-year gross domestic product (GDP) growth could be coupled with few bank-generated reports on the economy to arrive at a bullish/bearish stance are gone forever, joining the dodo bird and human traders on the list of extinct species. Whereas the two primary drivers of market volatility used to be fear and greed, the only driver left today is policy, as in central bank usage of financial markets to govern final demand.

Years ago, I first learned of the term "full, true, and plain disclosure" while studying to obtain my securities license. This term was in every offering prospectus issued by the underwriting departments of the major brokerage firms during a period where, in Canada, no banks were permitted to dabble. (After June 30, 1987, Canadian banks began absorbing all of the privately held investment firms.) As we move rapidly from 2019 to 2020, that term has to be altered slightly to reflect the more pressing issues facing investors, such that the word "disclosure" is to be replaced by the word "discovery." All commodities and or securities, whether debt or equity, that are publicly traded must be done so under the proviso of "full, true, and plain discovery."

I offer this suggestion in the interest of addressing the issue of market integrity because since 2009, and with rapidly accelerating frequency, these blatant interventions and constant interference have combined with diabolical ferocity in removing the "full, true, and plain" descriptives from the term "price discovery," and without those three words, all markets devolve into chaotic cesspools of randomness.

You see, absent the rule of law, all societies become feral; absent proper price discovery, all markets become unpredictable. Stated another way, driving at night demands that roads have markings. Absent those markings, roads become hazardous.

As an analyst, I have been forced to drive always at night, headlights off, moon behind dark clouds and with no road markings whatsoever. This is because the markets of yore, in which I was trained, were anchored in "true, full, and plain price discovery." I went through the 1981–1982 bear market, where the inflation-fighting Fed under Paul Volcker withheld the supply of credit to the banks, allowing true price discovery (large demand versus limited supply) to raise the cost of credit to 15% while crushing inflationary expectations, which modified consumer behavior.

What followed was the biggest equity boom in history, as the 1982–2000 bull market rode a wave of animal spirits to record highs. During this bull run, stock market addicts could barely come up with the name of the Federal Reserve chairman and were hard-pressed to tell you what the Fed funds rate was.

However, all through this period, prices were allowed to free rein, without the management or direction of the central bankers and/or treasury departments. Since analysts were able to clearly see the center lines and shoulders, the road to equity market riches was navigable regardless of the skies and time of day. Markets were far simpler and infinitely healthier than they are today, and it is all because participants are no longer governed by true, full, and plain price discovery. Investment decisions are made today based upon "policy," and as long as the global central banks are "dove-ish," the green light for excessive speculation remains in the "on" position. with nary a blink at economic signals such as weakening PMIs or soft retail sales numbers. And this, I submit, is a recipe for disaster.

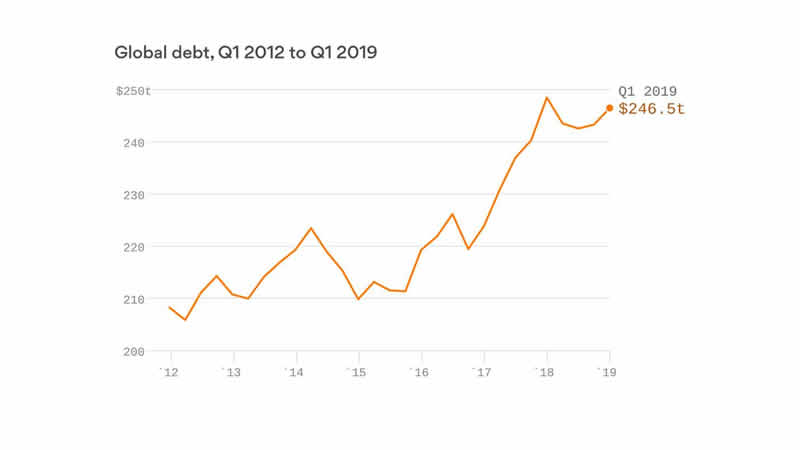

To the extent that past is prologue, the actions of the G7 central banks from 2009 to 2020 are massively inflationary, as over $14 trillion in new credit was issued by the U.S. Fed alone. Add the other nations, and the number approaches $250 trillion, as the Bank of Japan alone had been on a reflation campaign for over thirty years.

So again, anyone with any hair left, gray or otherwise, would construct an investment strategy designed to insulate one's wealth from the ravages of currency debasement. That would include ample allocations to resources, including gold and silver, while being underweight on bonds. Every era of Fed stimuli prior to 2009 ushered in weak credit markets and strong commodity markets because participants were following the road markings that helped them to avoid crashes due to poor conditions.

However, after the 2007–2008 financial crisis, interventions designed to protect the banks at taxpayer expense accelerated, and as if with the stroke of a brush, the road markings were suddenly altered. As unemployment declined and economies recovered, interest rates for the first time ever did not rise; they declined. In fact, until a few months back, over 60% of sovereign debt was yielding negative returns. This abhorrent behavior is a deformation of the highest order, and one that has moral hazard readings well beyond the red line.

With the preceding paragraphs as a disclaimer of sorts, I ask that you all use the term "caveat emptor" as a precursor in consideration of my forecasts. I am investing today and in 2020 on the assumption that these cretins in government and in central banking are going to be neutered in their dominance over pricing. If, as and when that happens, the reversion of hard assets to the mean is going to result in a new paradigm, whereby the maximum of market participants are gored with a miniscule number enriched. As the ancient axiom explains, markets tend to inflict the maximum amount of damage and pain upon the vast majority while the hard-to-find contrarians sail off into the sunset. As such, gold and silver remain my primary holdings because they have been the primary victims of intervention and interference since 2009.

A few weeks ago, I proposed that if you were able to sequester H.G. Wells' "Time Machine" and set the dial for 1977, you would arrive at the floor of the Chicago Mercantile Exchange to interview a trader, operating with only a pencil and an order book, receiving oral instructions from one of his "runners." No computers, no algorithms and no pattern-recognition technology spitting out high-frequency orders 500,000 times the speed of the 1977 order flow. Had you informed the trader (with long hair, deep sideburns, platform shoes and smoking a Marlboro) that in 2019, the federal debt would be $23 trillion, he would immediately look at the 1977 debt level at $700 billion; race over to the precious metals pits; sell all his stocks and bonds; and buy gold and silver.

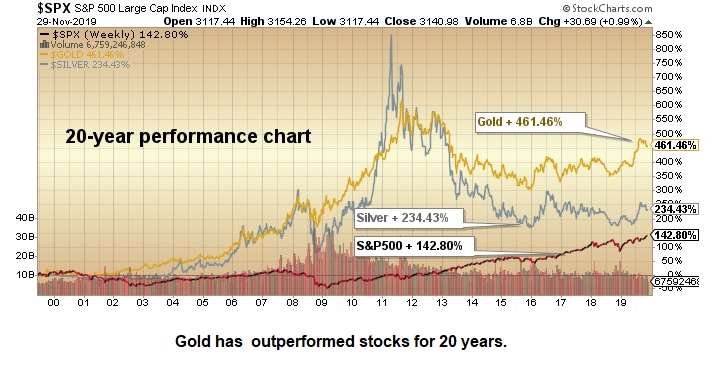

U.S. federal debt has increased 34.28 times in 42 years, and since gold was $135/ounce in 1977, our trader would surmise that since gold has been correlated to federal debt since the Dawn of Creation, a price tag of US$4,628/ounce was not unrealistic. A 1977 Dodge Ram was US$5,200 back then; it is over US$80,000 today, a 15-fold increase. The average cost of a detached house in Toronto was CA$41,500 in 1977, it is CA$810,000, a 19.5-fold increase. Gold, despite being the best performer since 2001, is still only ahead 10x in forty-two years. The 5,000-year-old role as the anti-inflation "wealth preserver" has been largely absent due to what I call "central bank hostilities."

Nevertheless, the case for a return to normalcy in the area of price discovery is one borne out of optimism for the integrity of markets. The GGMA portfolio constructed last January is ahead 163% year to date (YTD), and really hasn't budged since my sell signal for the metals on Sept. 4. I have since bought back all of the gold miner ETFs below where they reside today, so the $6 haircut in GDXJ and $4 clip in GDX were completely avoided, and today I am 100% long once again.

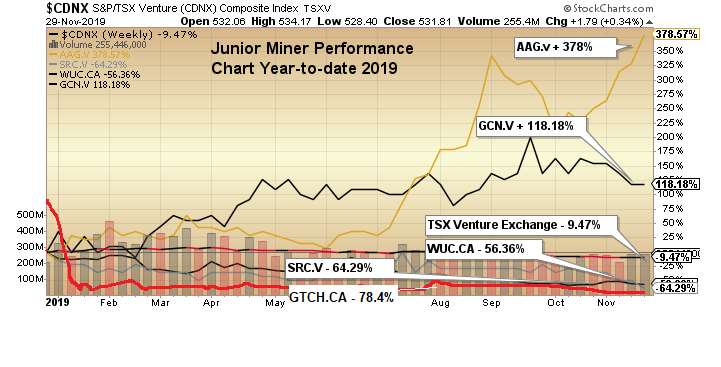

I have not yet replaced the Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTCQX) (bought in January at CA$2.33/share), which was jettisoned along with the ETFs in September above CA$9, and I am still holding Aftermath Silver Ltd. (AAG:TSX.V), bought at CA$0.08 in July and sitting nicely in the mid-$0.30s.

Now, for the gunslingers, I am short the gold-to-silver-ratio (GSR) at 92.40, and look for 70 by mid-2020. I am also long March silver from US$17.05, and recently added a whack of the SLV January $16 calls at US$0.34. These highly speculative positions are outside of the GGMA portfolio and are for the risk-tolerant only. Stop-loss for March silver is at US$16.70.

Stocks, as represented by the S&P500, are currently in "melt-up mode," where portfolios managers are scrambling to recapture the alpha they lost by being underweight stocks/overweight cash/hedged going into Q4. When stocks failed to repeat last year's Q4 swoon as predicted here in early October, it set the stage for a buying panic.

I wrote this in early October: "Maniacal rants set aside, history would show that purchases of common stocks during the last two weeks of October have proven to be the timeliest of purchases for the investor class." The S&P was 2,986 when I wrote that, and last week it closed out at 3,140. A 5.1% move from early October to late November has been largely orchestrated by underinvested managers desperate to exceed their benchmarks going into year-end. Amazing how the threat of lost bonuses serves to motivate the hedgies. . .

As for the miners, the chart below covers the names I currently own, and while it is certainly a mixed showing, what is not in this chart is the trade from the Jan. 3–Sept. 4 in Great Bear Resources, bought at CA$2.33 and sold at $9.03 (within a week of the top). I have been adding to AAG, Goldcliff Resource Corp. (GCN:TSX.V; GCFFF:OTCBB ), Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX), and more recently, bought the Getchell Gold Corp. (GTCH:CSE) funding unit at CA$0.10. Stakeholder Gold Corp. (SRC:TSX.V) is a hold until I get some clarity on forward guidance.

Speaking of forward guidance, I continue to follow with great interest the charts of uranium and vanadium, one an energy metal and the other a battery (and industrial) metal. With some fifty new reactors under construction around the world, one would expect a pickup in uranium prices at some point.

As for V2O5, China's construction slowdown is an offset to the new rebar rules regarding steel hardness, which is an obvious boon for vanadium demand. Yet prices are still in retreat after peaking in the mid-$30s two years ago. Section 232, favoring domestic producer/developer names (like Western Uranium & Vanadium), could get a substantial tailwind when we finally see what the Working Group has in store for them in terms of credits and/or subsidies. I am adding to WUC as we approach the tax-loss selling period (mid-December) at or around the 52-week low of CA$0.65.

It is crucial to recognize that when the uranium sector turns, companies with domestic resources and tight market caps can quintuple in a New York minute, as even the slightest jump in investor interest can have a sizable impact on price, as we saw in 2018 with WUC's run from CA$0.50 to CA$3.37 in under six months.

I head into 2019 with the distinctly mixed emotions, as silver continues to struggle to regain its mojo after peaking in September at US$19.75. Blind optimism, on the basis of strong fundamentals, is faced with the historic, paper-market stranglehold around the throats of silver investors worldwide. It is not very much fun when price action defies the fundamentals. Just as the S&P500 has, in my view, no business being above 2,500 on the basis of valuation (elevated P/E), my friendly margin clerk could care less about my opinion when I am locked in a short squeeze and cash call. In the end, only price matters, which underpins and reinforces the need for stop losses when trading the metals.

There is one last point for today's missive. If I am correct in my bullish outlook for gold and silver, those tiny, little micro-cap junior exploration companies, many of which were touching 52-week lows last week, are going to come back into favor. To be sure, they are certainly out of favor today, but give me a US$1,650 gold price and US$23 silver, and I'll show you ten, twenty, thirty-baggers in many of these beat-up names.

There is a plethora of companies with decent projects that are trading at fire-sale prices, and as cheap as they are, they could be even cheaper by mid-month. I'll be e-mailing a list of my personal tax-loss purchase candidates next weekend, so if you wish to be included in the mailing, e-mail me at miningjunkie216@aol.com with your request. (NB: It will be the last freebie before the subscription service is launched in January 2020).

Follow Michael Ballanger on Twitter ;@MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver, Western Uranium & Vanadium, Getchell, Stakeholder, Goldcliff Resource. My company has a financial relationship with the following companies referred to in this article: Aftermath, Getchell Gold and Western Uranium and Vanadium. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources, Goldcliff Resource. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Aftermath Silver, Western Uranium and Vanadium. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aftermath Silver, Western Uranium and Vanadium, Getchell and Stakeholder, companies mentioned in this article.

Charts provided by the author.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.