Gold & Silver Stocks Belie CoT Caution

Commodities / Gold & Silver 2019 Dec 08, 2019 - 10:13 AM GMTBy: Gary_Tanashian

We all know that the gold and silver Commitments of Traders are very extended and at levels of commercial net shorts and large spec net longs that tend to be in place at tops in the metals. Well, the metals topped in the summer, so what does that tell us?

For one thing it tells us that bull market rules are different from bear market rules as per this post from August as gold was topping.

Gold and Silver Commitments of Traders for This Week

Listen sports fans, I just call ’em as I see ’em. The Commitments of Traders for gold is as extended as it has been lately and open interest is significant. Speculators are all-in here and while we note that bull market rules are different than bear market rules, extended is extended. Gold is vulnerable to pullback by this measure, especially since the gold price is in the target zone we laid out months ago.

Gold dropped about 100 bucks an ounce from the time of that post and yet the CoT are not cured. Talk about bull market rules! CoT was and still is a reason for a level of caution, but as noted last weekend in NFTRH 579 the charts of several miners we track (and I own) belied a cautious stance.

From #579…

The way things appear to be setting up is that the miners are preparing to be a ‘go to’ play when the stock market party burns out. Despite the caution begged by the gold and silver Commitments of Traders, the chart of HUI, the Gold/SPX ratio on page 30 and the fact that Friday was a holiday shortened affair, the overall look of our charts this week is constructive to bullish…

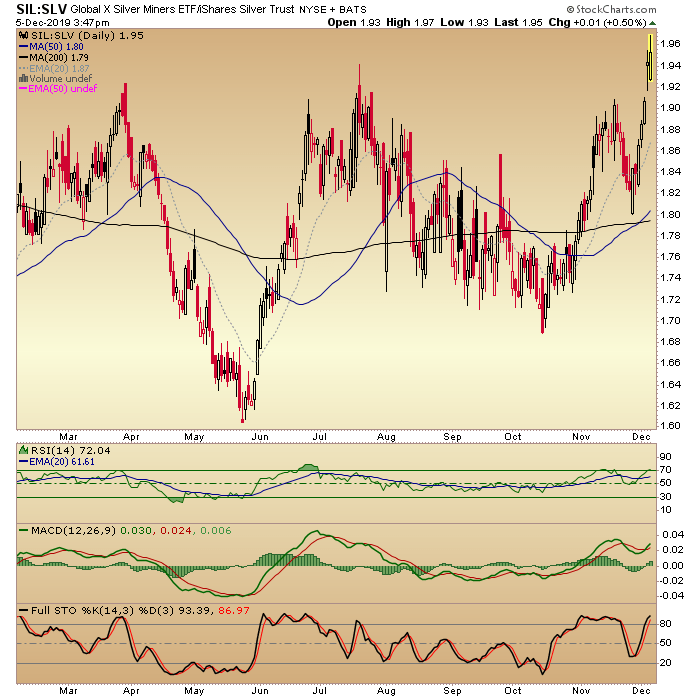

HUI has gone on to have a thus far bullish week this week with a move to break the post-summer consolidation and as we’ve noted in NFTRH, the HUI/Gold ratio has remained intact and is also now in a bullish stance. It’s a leader, as is the Silver ETF vs. silver. Get a load of this.

As for the stock charts, NFTRH 579 included 30 of them, many of which are smaller exploration plays and need to be kept for subscriber review only. But a few notable leaders in the sector that have belied the ongoing correction view that are included each week in NFTRH can be reviewed so that we may more viscerally get the view of a bullish sector at odds with caution signals as gold and silver continue in their post-summer corrections.

I am not doing TA here and so I am not marking up the charts. I am simply giving a view of some trains leaving stations, while other items in the sector lag or remain bearish. Something’s up and a lot more somethings are likely to be up in 2020.

Let’s go with a few producers and a royalty, each of which I own.

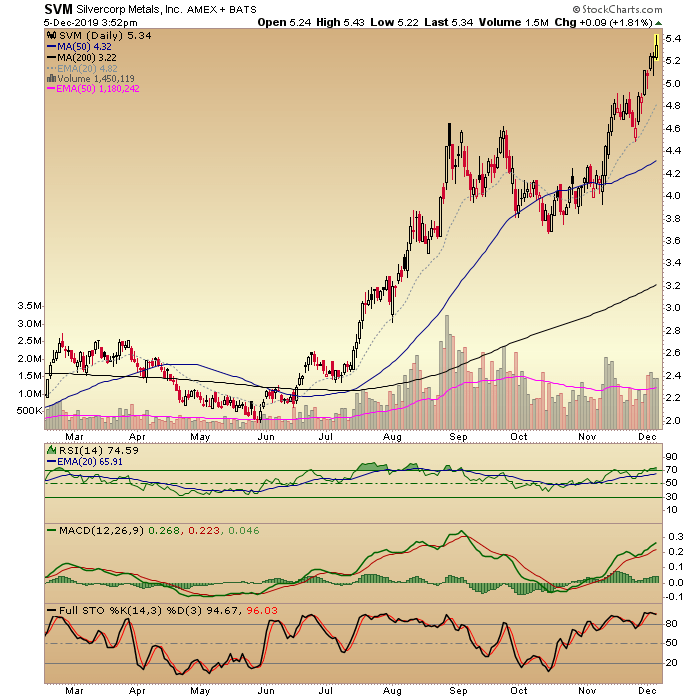

SVM is at new highs for the cycle. Yeah, tough correction wasn’t it? Daily chart trends by the SMA 50 and SMA 200 are up.

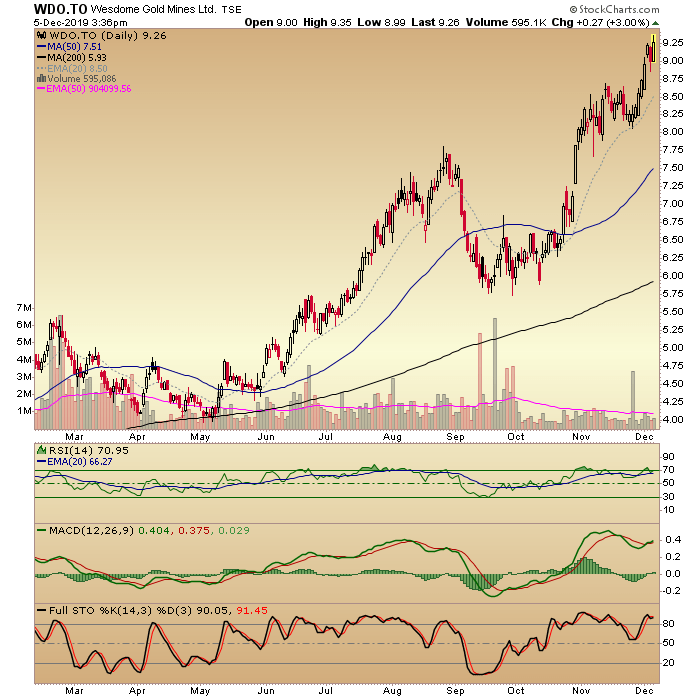

WDO.TO is at new highs for the cycle, not to mention all-time. Trends up.

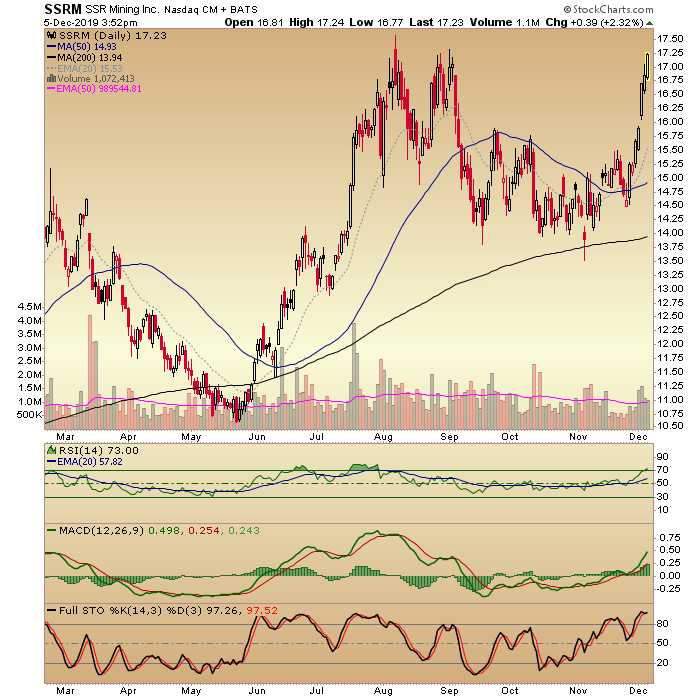

SSRM appears to be on its next leg toward a new cycle high. Trends up.

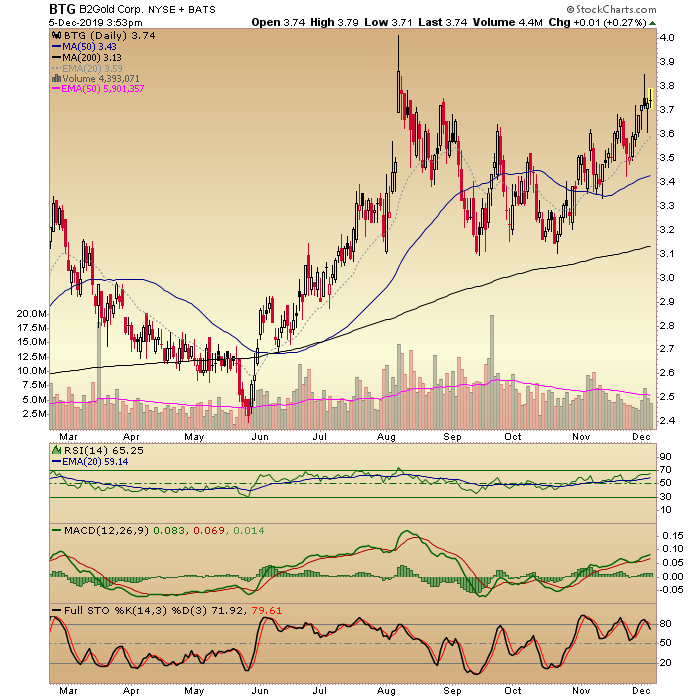

BTG has looked constructive and I committed to hold it as long as it held the SMA 50, which it has thus far done. Trends are… yup, up.

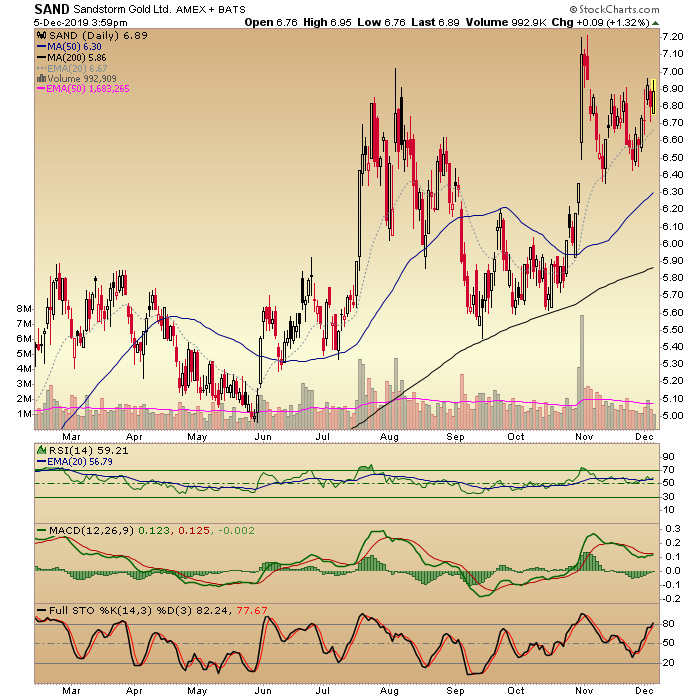

Royalty company SAND is in a bullish Cup & Handle and well, there’s that uptrend again with the SMA 50 and SMA 200 sloping nicely upward.

So there you have it, four producers and one royalty all trending up and saying the same thing; quality is getting a head start and leading the whole raft of items higher in 2020 as the metals work through much needed corrections.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2019 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.