Why History’s Longest Stocks Bull Market Is Just Getting Started

Stock-Markets / Stock Markets 2020 Jan 02, 2020 - 11:11 AM GMTBy: Robert_Ross

Doom and gloom predictions about the stock market drive click. I get it.

But those predictions have fallen flat for 10 years straight.

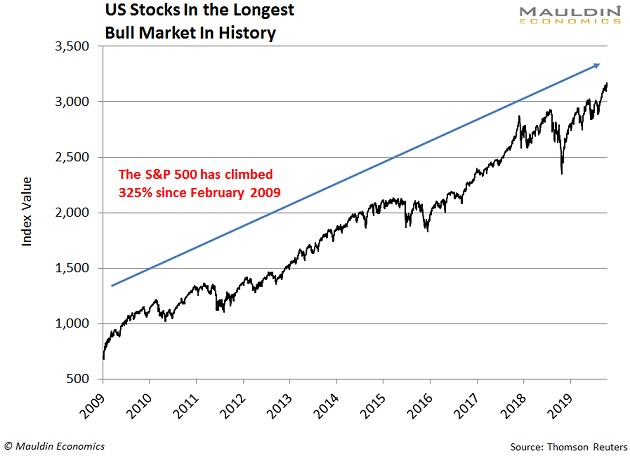

US stocks keep marching higher, and history’s longest bull market keeps getting longer. Here’s a chart of the S&P 500 since February 2009. It’s climbed 325%:

I’ve said before that the stock market will continue to rise until at least September 2020. Since I first made that prediction, the S&P 500 has climbed 10%.

Frankly, I don’t expect the market’s trajectory to change anytime soon. So, if you can tune out the noise and choose the right stocks, you can still make big profits.

Bull Markets Don’t Have an Expiration Date

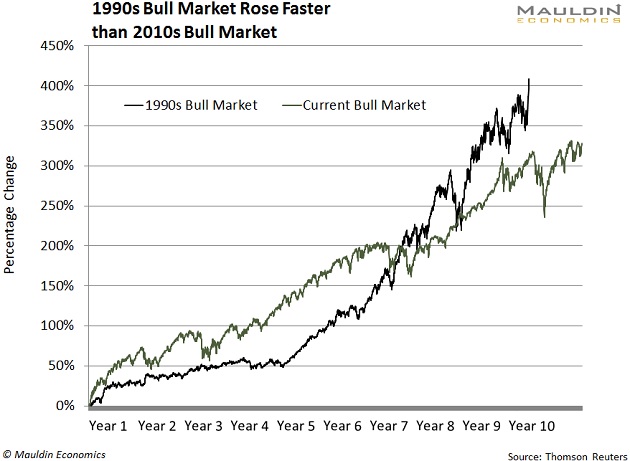

This bull market is unique. Stocks have climbed much slower than they did during previous bull markets.

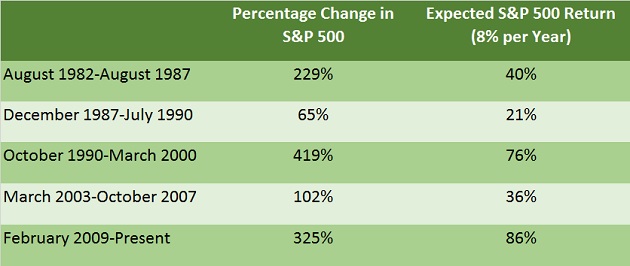

Take a look at the S&P 500’s last five bull markets, and you’ll see what I mean:

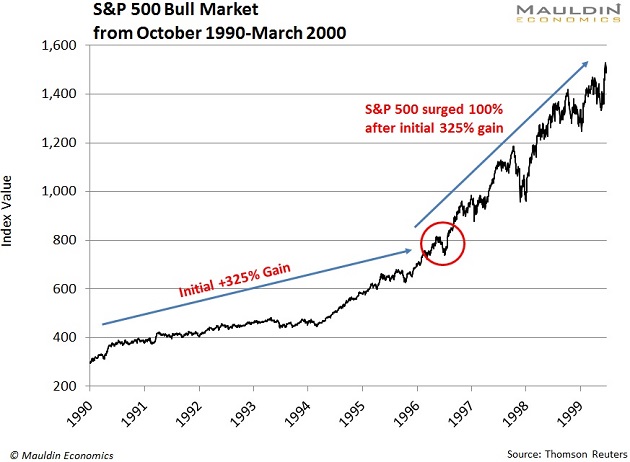

Note that stocks soared 419% from October 1990 to March 2000. That’s significantly more than the current bull run (325% to date). And they rose a lot faster, too: 43% per year vs. 33% per year.

Let’s look at this from a different angle…

The current bull market started in February 2009, or 130 months ago. Since then, the S&P 500 has climbed 325%, or 2.5% per month.

Again, this is the market’s longest period of growth in US history. But consider this for perspective: During the ’90s bull market, it only took the S&P 500 110 months to rise 325%. In other words, it reached this marker nearly two years faster.

This put the monthly return for the ’90’s bull market at nearly 3%. Meaning stocks rose 20% faster back then.

And then they kept going. After the initial 325% gain, stocks rose another 100% over the next 36 months:

That’s huge. It equals the S&P 500’s return since March 2013.

So, if someone tells you this bull market’s returns are unprecedented, remind them of what happened in the ’90s.

How to Ride This Bull Market Even Higher

The S&P 500 has climbed steadily over the past decade. And it still has a wide-open runway. But you still want to pick and choose the stocks you hold.

Longtime readers know I prefer safe and reliable dividend-paying stocks, and for good reason. Dividend-paying stocks outperform during bull markets.

From 1972 to 2013, a period that included seven bull markets, dividend-paying stocks returned 9.3% annually, according to research firm Ned Davis Research. At the same time, non-dividend-paying stocks only returned 2.3%.

This makes sense. High-quality businesses are more likely to have cash left over to pay out dividends.

Three Ways to Profit

Walmart Inc. (WMT) is one of my top dividend-paying stocks right now.

I’ve been shouting Walmart's praises for the last year. The company has made serious inroads into e-commerce. It’s even grown its online sales twice as fast as Amazon.com, Inc. (AMZN) over the last 12 months.

Walmart’s share price has climbed 22% since I first recommended it, but it still has room to run. The company has also raised its dividend for 31 years in a row—and I expect that trend to continue. So it’s the perfect addition to any income investor’s portfolio.

Trailer park kingpin Sun Communities, Inc. (SUI) is also high on my list. Sun Communities is a special type of company called a real estate investment trust, or REIT. So it’s required to pay out 90% of its profits as dividends.

Sun directly benefits from the growing wave of retiring Baby Boomers. This is a long-term trend that should help the company continue to churn out regular profits—and dividends—for the next 10–20 years.

Even better, Sun Communities has a very resilient stock.

I expect the stock market to keep marching higher, but SUI should hold up regardless. (It only dipped 2.7% when the S&P 500 sank 20% over three months late last year.)

Finally, we have Cisco Systems, Inc. (CSCO), the world’s largest supplier of hardware and software for large computer networks.

Cisco is a leading maker of “backhaul chips.” These chips are essential to the 5G buildout, which will pull in hundreds of billions in investment over the next five years.

Cisco pays a 3.1% dividend yield and a consistently low payout ratio. So it fits nicely in any income investor’s portfolio.

The current bull market should keep rolling into 2020. But the truth is, no one can predict the future with absolute certainty. That’s why savvy income investors hold safe and reliable dividend-paying stocks… stocks that will hold up no matter what the future brings.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

By Robert Ross

© 2019 Copyright Robert Ross. - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.