What Global Stock Markets Drop After US Iran Missile Strike Mean?

Stock-Markets / Stock Markets 2020 Jan 05, 2020 - 03:09 PM GMTBy: Chris_Vermeulen

The US Stock Market contracted in early morning trading on Friday, January 3, by more than 1% after news of the missile attack in Baghdad targeting a top-level Iranian military General and others. After the attack on the US Embassy in Iraq last week, President Trump issued a strong warning that the US would act to protect its people throughout the world and Iran scoffed at this message. It would certainly appear President Trump means business and won’t hesitate to stop terrorists from acting against the US – no matter where they are in the world.

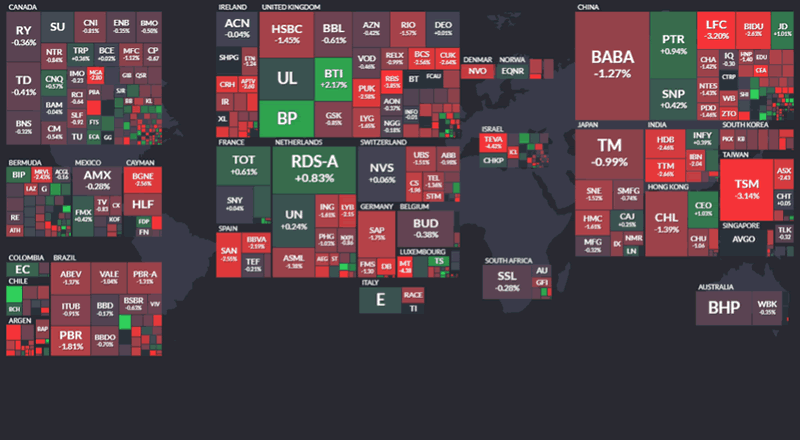

This news, overnight, pushed Oil, Gold, Silver and most precious metals higher. The fear factor associated with the unknowns of what may come from these actions shot through the roof over the past 24 hours. The global stock markets contracted by a fairly strong amount in Friday’s trading. Most global markets were off by 0.75% to levels well over 1%.

Global Market Selloff After Missle Strike – Canada, Brazil, China, UK…

The real question skilled technical traders must ask themselves is this “will this turn of events prompt a change in investor expectations/thinking over the next 12+ months”?

I can remember what happened in the markets and the US economy in 1991 when Desert Storm happened. Because this was one of the first US military efforts that were televised almost 24/7, almost immediately people were suddenly distracted by these war images and videos. They were entranced by the actions taking place half-way around the world. Local economies slowed because of this change in consumer sentiment and certain businesses struggled as their customers stayed home and watched TV.

A similar type of event happened after 9/11. The United States was in shock. People still attempted to conduct life as normal, yet our objectives changed. We lost a bit of that care-free American attitude that we had in place before the 9/11 event. We were more solemn, more conservative, more reserved in our daily lives. Could something like this happen if Iran (and neighbors) attempt to retaliate against the US for this missile attack? Could this change the thinking of consumers and investors as concerns about re-engaging in a Middle East conflict arise?

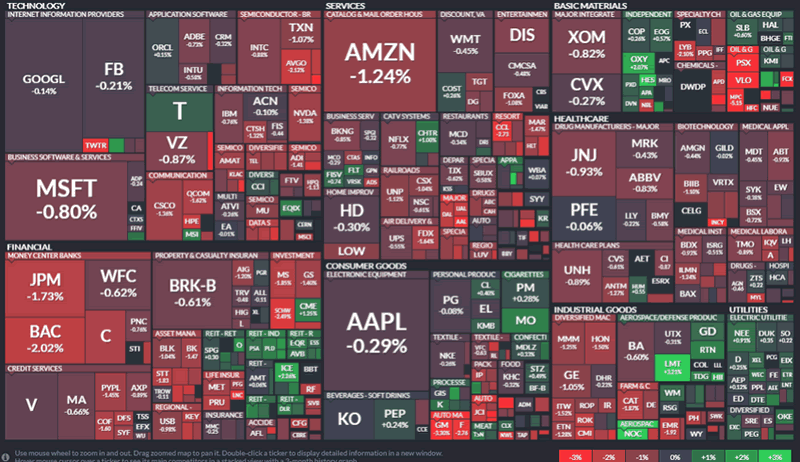

US Market Sold Off on Missile Attack

The US stock market contracted fairly strongly in early trading on Friday, January 3, 2020. Yet, by afternoon trading, support had pushed most prices off the lows. We authored a research article recently that suggested traders were very emotional near the end of 2019. We believe these emotions could continue to haunt the markets in various ways over the next 10 to 25+ trading days. One thing we are concerned with is a change in price trend sometime between January 13 and January 25. We believe these dates could prompt a major change in price trend and direction in the near future.

December 20, 2019: WHO SAID TRADERS AND INVESTOR ARE EMOTIONAL RIGHT NOW?

We don’t have a confirmation, as of yet, that any major trend change is taking place – but we feel it would be unprofessional to not warn traders that an event like this could dramatically change the way traders view future expectations. We really have to understand one key factor about investing and trading – trends are the results of investors/traders believing the future revenues and results of a company, stock or economy will product greater or weaker returns. If investors believe the returns will be greater, then the trend tends to move higher. If investors believe the returns will be weaker, then the trend tends to move lower.

Event Could Change Equities Market Outlook – Dow Jones Index

Could this new event change future expectations for traders and investors? How will extended uncertainty or military engagement alter trader’s expectations over the next 12+ months?

![]()

Righ![]() t now, we want to urge our followers to protect their open long positions and watch carefully as this event unfolds. We don’t have any confirmation that a trend change is taking place. If the YM price fell to levels below $28,000, then we would consider recent support near $28,350 breached and begin to take a look at other price modeling systems.

t now, we want to urge our followers to protect their open long positions and watch carefully as this event unfolds. We don’t have any confirmation that a trend change is taking place. If the YM price fell to levels below $28,000, then we would consider recent support near $28,350 breached and begin to take a look at other price modeling systems.

We suggest our followers read the following research post from the end of 2019. This will give you a better understanding of what is really happening right now and what would be needed to push the markets into a new bearish trend in early 2020.

December 31, 2019: WHAT TO EXPECT IN EARLY 2020

As we warned throughout most of 2019, we believe 2020 will be an incredible year for traders with extended volatility and returns. You really don’t want to miss these bigger price moves when they happen. Our precious metals calls throughout all of 2019 were nearly perfect and our recent Gold calls have nailed this big move. Get ready – 2020 is going to be a great year for skilled technical traders.

With over 55 years of technical trading experience, we have been through a few bull/bear market cycles, I have a good pulse on the market, timing key turning points and what to buy and sell for both short-term swing trading and long-term investment capital. The opportunities are financially life-changing if handled properly.

I urge you visit my Wealth Building Newsletter and if you like what I offer, join me with the 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.