NASDAQ Set to Fall 1000pts Early 2020, and What it Means for Gold Price

Stock-Markets / Financial Markets 2020 Jan 08, 2020 - 12:44 PM GMTBy: Chris_Vermeulen

One of our most interesting predictive modeling system is the Adaptive Dynamic Learning (ADL) price modeling system. It is capable of learning from past price data, building price DNA chains and attempting to predict future price activity with a fairly high degree of accuracy. The one thing we’ve learned about the ADL system is that when price mirrors the ADL predictive modeling over a period of time, then there is often a high probability that price will continue to mirror the ADL price predictions.

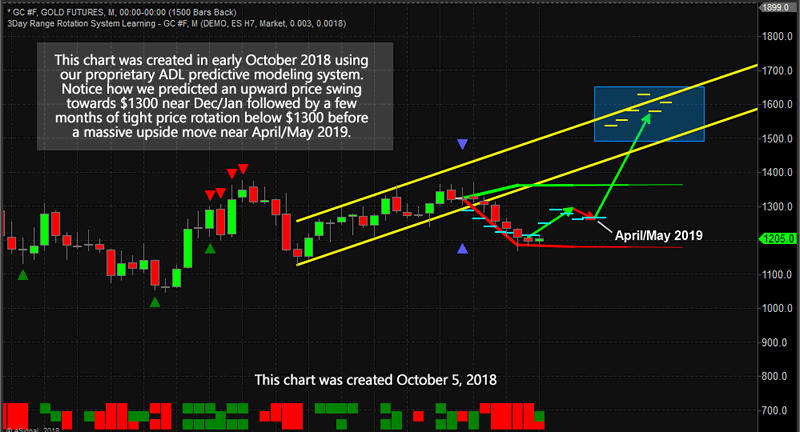

One of our more infamous ADL predictions was our October 2018 Gold ADL prediction chart (below). This chart launched a number of very interesting discussions with industry professionals about predictive modeling and our capabilities regarding Adaptive Learning. Eric Sprott, of Sprott Money, highlighted some of our analyses related to the ADL predictive modeling system in June and July 2019. Our ADL predictive modeling system suggested a bottom would form in Gold near April/May 2019 and then Gold would rally up toward $1600 by September 2019, then rotate a bit lower near $1550 levels.

Listen to What Eric Sprott Said About Our Analysis

October 2018 Gold Forecast

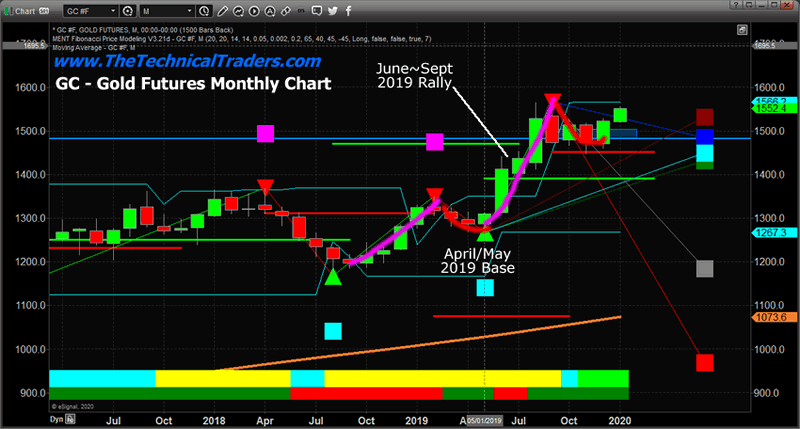

Current 2020 Gold Forecast

This next chart shows what really happened with Gold prices compared to the ADL predictions above. It is really hard to argue that the ADL predictions from October 2018 were not DEAD ON accurate in terms of calling and predicting the future price move in Gold. Will the ADL predictions for the NQ play out equally as accurate in predicting a downward price rotation of 1000pts or more?

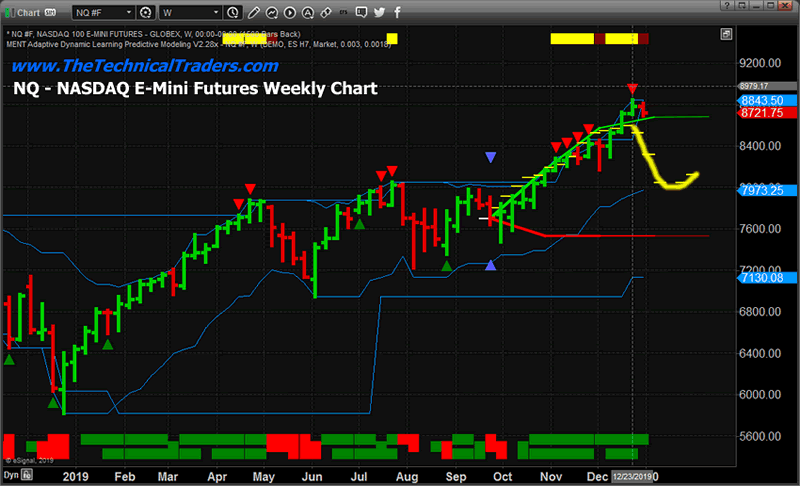

Current 2020 NASDAQ Forecast

This NQ Weekly chart shares out ADL Predictive Modeling systems results originating on September 23, 2019. The Price DNA markers for this analysis consist of 15 unique price bars suggesting the future resulting price expectations are highly probable outcomes (95% to 99.95%). This analysis suggests the end of 2019 resulting in a broad market push higher in early 2020 may come to an immediate end with a downward price move of 800 to 1000+ pts before January 20~27, 2020. The ADL predictive modeling system is suggesting price will be trading near 8000 by January 20th or so.

Only time will tell in regards to the future outcome of these ADL predictions, but given the current news of the US missile attack in Iraq and the uncertainty this presents, it would not surprise us to see the NQ fall below the 8000 level as this euphoric price rally rotates to find support before moving forward in developing a new price trend.

Pay attention to what happens early next week with regards to price and understand the 8000 level will likely be strong support unless something breaks the support in the markets over the next 30+ days. Ultimate support near 7200 is also a possibility if a deeper downside move persists.

As we’ve been warning for many months, 2020 is going to be a fantastic year for skilled technical traders. You won’t want to miss these opportunities in precious metals, stocks, ETFs and others.

We have a good pulse on the major markets and can profit during times when most others can’t which is why you should join my Wealth Trading Newsletter for index, metals, and energy trade alerts. Visit our website to learn how you can see what this research is telling us.

I am going to give away and ship out silver and gold rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. You can upgrade to this longer-term subscription or if you are new, join one of these two plans listed below, and you will receive:

1oz Silver Round FREE 1-Year Subscription

1/2 Gram Gold Bar FREE 2-Year Subscription

SUBSCRIBE TO MY TRADE ALERTS AND

Free Shipping!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.