Gold Above $1,600 As Iran Retaliates

Commodities / Gold & Silver 2020 Jan 10, 2020 - 03:52 PM GMTBy: Arkadiusz_Sieron

We didn’t have to wait long for Iran’s response. After the missile attack on U.S. bases in Iraq, gold briefly soared above $1,600. What should we expect next?

Iran Retaliates, Gold Rallies

On Tuesday, I wrote that “given that Soleimani was widely seen as the second most powerful figure in Iran, we should expect a response.” And, indeed, it arrived before too long. On Wednesday, just hours after the funeral of the Iranian general, Iran launched a missile attack on two military bases in Iraq housing U.S. troops.

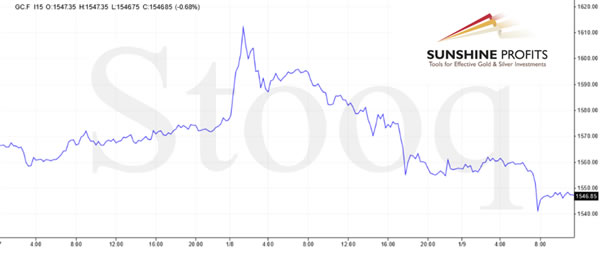

In the last edition of the Fundamental Gold Report, I also wrote “the elevated geopolitical risks may support the gold prices, at least in the short-term.” Indeed, gold got support – and what a strong one! Please take a look at the chart below. As one can see, the price of gold spiked to above $1,610, the highest level since February 2013.

Chart 1: Gold prices from January 7 to January 9, 2020.

However, the rally was not sustainable. When the dust settled, it turned out that there were no casualties, and gold returned below $1,600. Moreover, both countries sent signals that they did not go to war. Iran’s foreign minister said that Iran had taken “proportional measures in self-defense” and didn’t seek further escalation of the conflict. Some analysts speculate that the said Iranian officials even warned the U.S. the strikes were coming, as they did not want to kill Americans, but rather to appease Iranian citizens calling for revenge. Meanwhile, President Trump tweeted that “all is well” in the immediate aftermath of the attack. Later, he suggested that the U.S. is not planning to retaliate:

No Americans were harmed in last night’s attack by the Iranian regime. We suffered no casualties. All of our soldiers are safe, and only minimal damage was sustained at our military bases (…) Iran appears to be standing down, which is a good thing for all parties concerned and a very good thing for the world (…) The fact that we have this great military and equipment, however, does not mean we have to use it. We do not want to use it. American strength, both military and economic, is the best deterrent.

The whole statement indicated an important de-escalation in the conflict, which created downward pressure for gold prices. The price of the yellow metal has already decreased below $1,550.

Implications for Gold

What does it all imply for the U.S.-Iran conflict and the future of gold? Well, although the tensions have been put on the back burner somewhat, it would be naïve to think that Iran is done retaliating. The recent attacks were just a first strike, or a symbolic response necessary to save face after Soleimani’s death. But confrontation will almost certainly explode again at some point this year. So, gold could receive support then.

However, while not minimizing the importance of geopolitical risks for investing in precious metals, I am of the optinion that macroeconomic factors are far more impactful when investing long-term. The recent developments in Iraq do not change the fundamental outlook for gold. And it has deteriorated somewhat, at least when compared to 2019. Thus, while not being a bear, I expect that after a solid beginning of the year, gold may struggle somewhat.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.