The "Everything Bubble" Just Burst. Here's Why

Stock-Markets / Financial Markets 2020 Jan 29, 2020 - 02:46 PM GMTBy: The_Gold_Report

Bob Moriarty of 321gold reflects on how government actions in the financial and public health spheres will pop market bubbles.

I was in Vietnam from July 1968 until March 1970. From November 1968 until July 1969 I was flying the O-1 Birddog as a forward air controller (FAC). Back then I used to believe all the bull our government puts out. Now, when Trump says the Iranians fired missiles at a US base in Iraq and none of our troops were injured, I know at once he was lying. And sure enough, two weeks later we find that 34 soldiers were injured.

Governments lie about everything and as a result we are about to pay a terrible price. All of them lie.

As a FAC I controlled hundreds of air strikes and artillery missions in the belief I was helping protect the lives of the Marines and soldiers below. Compared with weapons systems of today what we did was primitive. We had to have the fixed-wing ordinance-carrying aircraft find us. We had to identify them and they had to identify us. Then we had to talk them into where they were to attack. It was vital to use exactly the correct terminology. It was easy to confuse the high-speed fixed-wing aircraft if you didn't use words as they should be used.

Does the word "right" mean direction or does it mean "correct?" In the fog of battle you might tell an aircraft to attack on a heading of 355 and to pull off left to avoid high terrain covered in cloud.

If he responded, "Pull off left?" because he didn't fully understand your instructions, and you respond, "Right," don't be real surprised if he makes a right hand pullout and hits the mountain because you used the wrong word. If you had said "correct," he would not have been confused.

All of last year I was calling for a major correction. My belief that the bubble would burst in October was based on everything I saw. October came and went without a correction and certainly not a crash. I may have been "left," but for certain I wasn't "wrong." Wrong and left both being the opposite of right.

I've called market turns in the past correctly. In January of 2008 I forecast a market crash in the fall. It happened just as I forecast. I called the top in silver to the day in 2011 and just a year ago called a stock market rally to the day at Christmas. Lots of other writers would love to throw rocks at me who have never managed to call anything correctly. I've made a lot of accurate calls. But actions of the Fed postponed the October crash.

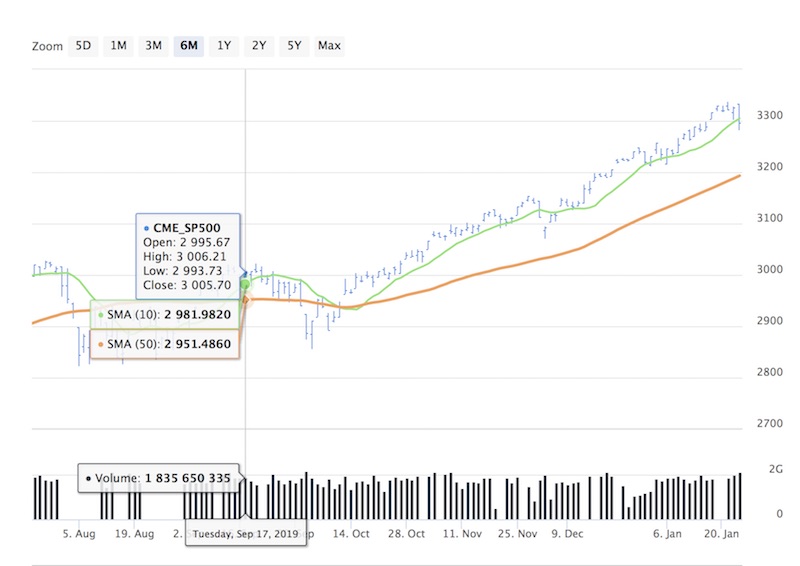

On the 17th of September the Fed panicked and began Not-QE, pumping billions of dollars into the Repo market. Clearly the money had to go somewhere. It found a home in the major markets just as the Fed wanted. If you look at the chart above, the market started a massive climb without a correction about the first of October, continuing until a few days ago.

That pile of cash postponed the "Everything Bubble Crash," but for certain did not eliminate it.

The Fed began its journey down the rabbit hole in 2008. That was the last opportunity to allow the system to heal itself. Banks that caused the problem should have been allowed to die a merciful death, as they so justly deserved. But due to political pressures, losses were socialized and profits privatized. We have been in something right out of Kafka and Lewis Carroll ever since.

You see, the world has over $12 trillion in negative interest rate bonds. Should short-term interest rates rise as they began to in September, the bond market would collapse as trillions of dollars of price disappeared into bond heaven.

A simple concept exists in physics that everyone who wants to understand how the world works needs to understand. That concept is of entropy. Everything in the universe moves from order to disorder. Including financial systems.

Since 2008 the world's financial system has been pushed, prodded and manipulated by all of the central banks to the point it is simply out of control. The system is so unstable that even a tiny straw would be sufficient to break the back of the system. That's what I saw a year ago and predicted would burst the "Everything Bubble" at last. I may have been left but I wasn't wrong. The Fed managed to push the system into even more disorder, which is now visible to everyone and anyone with a room temperature IQ or a lick of financial sense.

The coronavirus coming out of Wuhan is going to pop the "Everything Bubble." It would be wrong to think of it as a minor pinprick. With somewhere between 35 and 50 million people in China already under quarantine in a dozen cities, it would be a lot more like a thermonuclear blast that will flatten every bubble in sight. In all of recorded history no nation has ever managed an effective quarantine on so many people. With transportation screeching to a halt, the lives of millions of those people are at risk due to a simple lack of food or warm shelter.

Every form of sickness that can be passed on has a reproductive number. If a cold or flu in one person is passed on to only one other person, it has an R0 of 1. Below 1 the flu or cold will eventually disappear. Above 1 the sickness will be passed on to more and more people. A typical seasonal flu comes in at an R0 of 1.28; the 2009 flu pandemic came in at 1.48 and the deadly Spanish flu of 1918 measured 1.80. Lancet believes this coronavirus is between 3.6 and 4.0. And it's deadly.

This has the potential for being the biggest mass casualty event in world history. At the very least it will take down the financial system as the world economy grinds to a halt with efforts to contain the virus.

Now would be a great time to be prepared for a disaster bigger than any in history. On Jan. 1, 2020, I posted a piece warning of a stock market crash. It's here and it's now.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Disclosure: 1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned are billboard sponsors of Streetwise Reports: Wheaton Precious Metals. Click here for important disclosures about sponsor fees. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Newmont Goldcorp, Franco-Nevada and Royal Gold, companies mentioned in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.