Dow Jones Utility index could trade like the FANGs

Stock-Markets / Stock Markets 2020 Feb 03, 2020 - 02:14 PM GMTBy: readtheticker

The world is changing because the US FED is considering capping the US 10 yr interest rate under the US inflation rate, or negative real interest rates forever. Further massive destruction of the US dollar purchasing power. Previous Post: Formula for when the great stock market rally ends In the previous post this blog said:

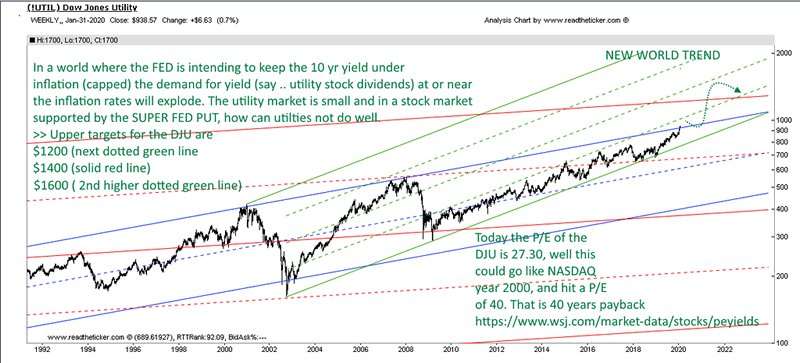

When valuations for the boring water company or the boring electric company is trading like your Facebook, Apple, Amazon or Netflix or Google (ie FANG) you know something is wrong. This is when a seriously over valued market is screaming at you. Of course the reader must understand in a world where money printing goes super nuts (Zimbabwe style) the stock market may go hyper inflationary and picking a time frame for a top is never a good idea, but we are not there yet. There is no Ben Bernanke helicopter money to the masses yet (ie MMT).

We may be there, 'helicopter money lite'. If the intention is to cap interest rates under inflation, this is a form of massive easy money (or easy debt). Of course the effect of negative real interest rates is the US 10 yr is now broken because it does not protect you from inflation, this is interest rates suppression, or fake. The US FED has enacted this policy before, during WW2, are we in WW3? No. Yet the debt levels as a percentage of GDP suggest we are. Crazy. This means investors will hunt for a UST 10 yr alternative, hence utility stocks with their high dividends will attract a lot more investor interest. Yes a water company may go to a P/E of 40. This means demand for quality utility stocks around the world will be strong, and if the US dollar falls, utility stock in other parts of the world will be attractive. A good place to hunt for Wyckoff, cycles and Gann angles.

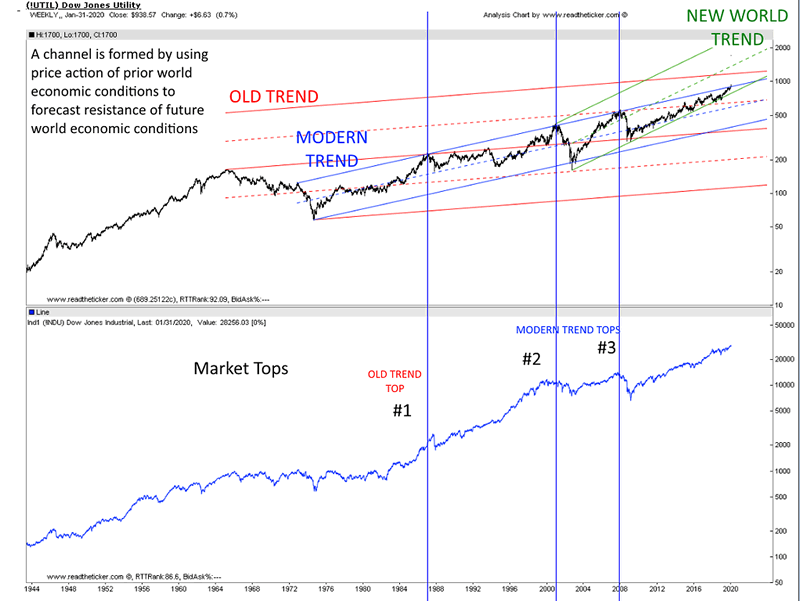

Long term channels

Fundamentals are important, and so is market timing, here at readtheticker.com we believe a combination of Gann Angles, Cycles, Wyckoff and Ney logic is the best way to secure better timing than most, after all these methods have been used successfully for 70+ years. To help you applying Richard Wyckoff and Richard Ney logic a wealth of knowledge is available via our RTT Plus membership. NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net Investing

NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net

Readtheticker

My website: www.readtheticker.com

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2020 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.