The Stocks Hit Worst From the Coronavirus

Companies / Pandemic Feb 18, 2020 - 03:25 PM GMTBy: Submissions

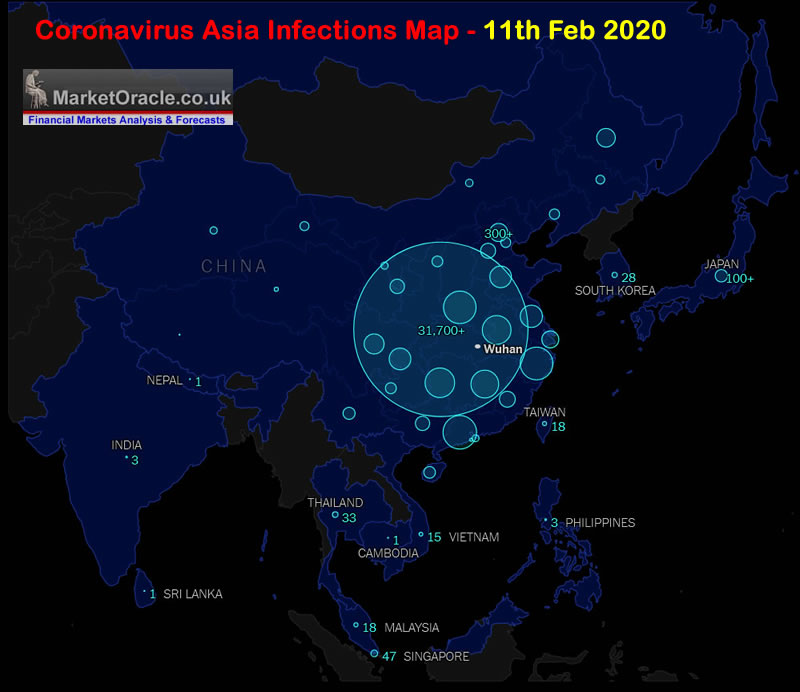

Coronavirus concerns are on the rise, and the stock market has taken a hit. The fast-spreading respiratory virus, which was first identified in Wuhan, China, has so far killed more than 630 people and infected 31,40 people globally.

It seems the victims of the virus are far more than the infected – a large number of stocks have been impacted since mid-January.

Analysts at Morgan Stanley created a list of 18 companies the most largely affected by the coronavirus. We’ll be covering a few of them in more detail below:

1. Corning Inc.

Corning Inc.’s stocks have been steadily falling since December 2019, and it looks as if the coronavirus has hurt stocks some more this year.

2. The Dow Jones

The Dow Jones dropped 418 points in Monday trading at the end of January, which represents its worst daily decline since October 2.

3. Qualcomm Incorporated

Semiconductor and telecommunications equipment company Qualcomm Incorporated has seen a dip in stocks over the last few days, and has reported that the coronavirus outbreak poses a potential threat to the mobile phone manufacturing and sales industry.

4. BorgWarner Inc.

Efficient engine production company BorgWarner’s stock dropped 21% in January, and it’s thought that the coronavirus may have affected this somewhat.

5. Caterpillar Inc.

Engineering and manufacturing machinery company Caterpillar Inc. dropped 1.8% in premarket trading Friday, citing “global economic uncertainty” as the cause of the reduction of dealer inventories.

6. Booking Holdings Inc

Shares of online travel booking service Booking Holdings Inc. fell 11% in January amid fears of how the coronavirus would affect travel.

7. Estee Lauder

Cosmetics manufacturer and retailer Estee Lauder has seen downgraded stock as a result of the coronavirus. Stocks went down sharply at the end of January, and continue to fall, seeing a 1.2% decrease on February 7.

So, why are some of the big-name stocks affected by the coronavirus? Largely, it’s down to manufacturing and consumers. Many of these businesses rely on China to produce or sell wares. The timing of the coronavirus is also terrible – with the Chinese Lunar New Year, travel within and around China has been greatly impacted.

As the virus continues to spread, Apple Inc. and Tesla Inc. have both reported that they expect to see a dip in sales as a result of their reliance on China for sales. Apple has already closed one of its stores in China due to the virus, and Tesla has reportedly shut its Shanghai factory over coronavirus fears.

On the other hand, safety, healthcare and consumer goods service 3M Co. is reportedly increasing production of protective face masks in light of the virus, after sharing its unexpectedly weak fourth-quarter earnings.

If you’re looking for the safest, low-cost opportunities in the stock market, unsurprisingly, you should stay away from the stocks mentioned in this article for the time being. In the meantime, head over to The Stock Dork for a compilation of the best stocks under $1 that could take off big time any moment now.

By Jamie Bell

© 2020 Copyright Jamie Bell - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.