Trump or Sanders? Both will pile up the Debt

Politics / US Debt Feb 27, 2020 - 06:13 PM GMTBy: Richard_Mills

Whether it’s a Democrat or a Republican installed in the White House this November, you can count on fiscal discipline going out the window. Neither the incumbent, President Donald J. Trump, nor the leading Democratic contender to replace him, Bernie Sanders, appears to give a hoot about shoveling more onto the enormous pile of debt that a few months ago shot past $23 trillion.

Why does this matter? Because debt impedes economic growth . And just like a business, if a country isn’t growing, it’s dying.

Keep that in mind as we explain how the real problem with the US economy, and what is driving gold prices ever higher, is not the coronavirus (though Covid-19 is certainly making things worse), but the 500-pound debt gorilla that is sitting on Uncle Sam’s chest, fattened by an all-you-can-eat buffet of dollar-denominated debt.

Let’s start with the financial news.

Gold nears $1,700

A wild day on Wall Street Monday paired a US stock market rout with tumbling US Treasury yields, as gold pushed to new heights.

A risk-off mood that started building last week, due to the spread of the coronavirus and what that means for economic growth, continued to steer investors towards the safety of US government bonds and gold.

US equities slumped alongside stocks in Europe and Asia, after finance ministers and central bankers over the weekend warned the virus poses significant downside risks to global growth.

US Treasuries were a go-to refuge, with heavy buying pushing up bond prices and lowering yields. The 10-year note slid to 1.377% - its lowest since July 2016 - the 2-year ell to 1.287%, and the 30-year bond yield tumbled to 1.849%, Marketwatch reported. Bond prices and yields move in opposite directions.

The 10-year rate is important to watch, having fallen below the Bank of America’s 1.4% “tipping point”. When that happens, there is a greater than 50% probability the Federal Reserve will cut interest rates back to 0% from their current 1.5% to 1.75% range. A <1.4% rate also means a recession is likely, according to the New York Fed’s recession probability indicator.

“Global pandemic concerns catalyzed an intuitive rotation out of risk assets and into safe havens to start the week,” Bloomberg quoted Ian Lyngen, BMO’s head of U.S. rates, in a note Monday. “The most important number in the US Treasury market has become ... the all-time record low yield mark set in the aftermath of Brexit [in 2016]. If that level is breached, look out below.”

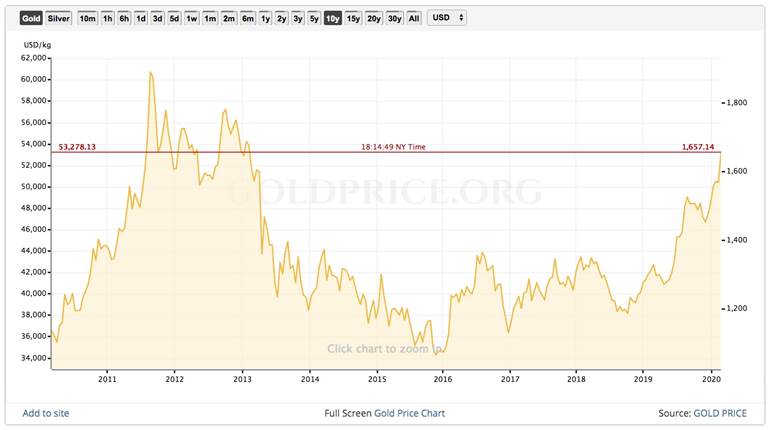

Spot gold moved as high as $1,683/oz in early trading, before settling back to $1,6757.14, at time of writing - its best showing since Feb. 4, 2013.

According to the 10-year gold chart, bulls have been firmly in control of prices since the second quarter 2019, when central banks around the world, including the Federal Reserve, began lowering interest rates to rejuvenate slowing economies. From April 13, 2019 to present, spot gold has risen a whopping 38%.

While some are questioning “gold’s peculiar surge”, ie. Adam Hamilton who evokes gold’s sudden and devastating pullback in 2013 as a harbinger, we at AOTH are not. It is perfectly natural for the coronavirus to be a short-term catalyst for gold. However we do not believe Covid-19 is the only factor pushing gold higher…

Minsky Moment

To understand the long-term trend we need to go back to the thesis we presented last week, on the coming Minsky Moment for Gold.

Many things can happen to cause instability in the global economy and a flight to safety, including a worsening coronavirus, a slowdown in shipping, a denting of the largest economies – the US, China, Germany, Japan – and in the worst of cases, a war (though that would be good for the military-industrial complex) or another global recession.

But these are just reactions, symptoms of the disease… which is paper money, a global fiat currency system. The uncontrolled printing of paper money has caused consumer debt, business debt and government debt to reach out-of-control proportions and the country in the worst debt shape is the United States, which also happens to have the world’s reserve currency.

We know from previous articles that the United States cannot have the reserve currency and also have a low dollar - the fact that commodities are priced in US dollars, that the US Treasury is the most popular non-metalllic safe haven, and because most international transactions are cleared in US dollars, means the USD must remain strong.

But President Trump doesn’t seem to understand or care about this, the Triffin Dilemma, and has made his entire presidency about narrowing US trade deficits with other countries, particularly China, and bringing back US manufacturing jobs through a low dollar that makes exports cheaper and imports more expensive.

The US can’t simply devalue (it has the world’s reserve currency and always-in-demand US Treasuries) so the only way to weaken its currency is to start a trade war, and now a currency war, where countries with cheaper currencies, or industries that are out-competing their US counterparts, are targeted with tariffs to eliminate their competitive edge.

As we have seen, there are repercussions from this aggressive stance.

China, Russia, Turkey and others are moving away from pricing trade in US dollars, and have slowed or stopped their US Treasury purchases. Central banks have been stocking up on gold instead of buying Treasuries.

Will the rest of the world follow and punt the US$ as the world’s reserve currency? We at AOTH think so and we await gold’s coming Minsky Moment.

But let’s go further into this problem of mounting debt…

Trump and debt

What’s wrong with a little debt? If you’re Donald Trump, the answer is, nothing! At Mar-al-Lago, the president recently blasted critics of rising federal spending under his watch.

“Who the hell cares about the budget? We’re going to have a country,” Trump said during the lavish January fundraiser, according to The Washington Post.

After three years of Trump, the deficit has risen by more than 16% and the national debt has increased by $3 trillion to over $23 trillion.

The Committee for Responsible Federal Budget, a non-partisan watchdog, estimates that Trump’s spending will add $4.7 trillion to the debt through 2029. The 2017 Tax Cuts and Jobs Act will cost $1.9 trillion over the next decade, according to the Congressional Budget Office, on top of the $1.4 trillion budget in December that boosted defense spending.

The Post reportedly said President Trump bragged about increasing the defense budget by $2.5 trillion - an amount equal to several years of defense spending. His $1.5 trillion tax cut blew up the federal deficit, making the 2019 deficit near $1 trillion, a 26% jump from the year before, Markets Insider calculated.

This would be expected under a tax and spend Democrat, but Trump is supposedly leading the GOP, the party of the fiscally prudent. In 2016 Trump campaigned on eliminating the federal deficit in 8 years - something Republicans railed against Obama during his two terms.

Business Insider notes the hypocrisy of the Republicans on the budget deficit, reporting that in 2012, Sen. Majority Leader Mitch McConnell asked President Obama to be “the adult in the room” in discussions about spending and debt with congressional leaders. Seven years later, the two-year budget deal struck last August raises spending by $320 billion and lifts the debt ceiling, the legal limit on the amount of debt the federal government can have.

The spending bill is expected to add $1.7 trillion to the national debt over the next decade.

Sanders and debt

Of course it’s no different on the other side of the aisle, in fact the Democrats’ position on debt calls for outrageous amounts of spending.

Modern Monetary Theory is a new way of approaching the US federal budget that is both unconventional and absurd. It posits that rather than obsessing about how large the debt has grown (over $23 trillion) and the ongoing annual deficits that fuel debt, we should focus on spending, specifically, how the government can target certain spending programs that will cause minimal inflation. Fiscal policy on steroids is, according to its proponents, to be the new engine of US growth and prosperity.

Government is therefore given a free pass on spending, because the only thing that we have to worry about with the national debt is inflation. Curb inflation and the debt can keep growing, with no consequences. This is because the US government can never run out of money. It just keeps printing money, because dollars are always in demand (with the dollar being the reserve currency, and commodities are traded in dollars).

Modern Monetary Theory and the ideas of the Democratic Party’s far left fit like hand and glove. Pleas for universal medical coverage, free college tuition and a minimum $15 per hour wage can all be paid for by setting the money presses free.

Read more at MMT is a spectacularly Dem idea

Fans of the bizarre economic theory include Bernie Sanders, Stephanie Kelton, an economics professor who advised Sanders’ 2016 presidential campaign, and Alexandria Ocasio-Cortez, the far leftest wingnut New York Democrat who proposed that MMT become a vehicle for to pay for her “Green New Deal” - a 14-page manifesto of climate change-related spending costed at up to $1 trillion.

Surely MMT will rise again in the Democratic consciousness should Sanders be nominated to run against Trump. On Monday he unveiled a 10-year, $1.5 trillion plan for universal childcare. The Vermont senator said the funds would guarantee child care through age 3, followed by free pre-school education.

The program would be paid for by taxing individuals whose wealth exceeds $32 million. The self-proclaimed “democratic socialist” is currently the front-runner in the Democratic primaries to choose their candidate for president. Sanders also wants to implement a single-payer medical system, cancel student debt, make public college education free, hike the minimum wage to $15 per hour and strengthen labor rights.

It’s hard to imagine any of these policies could be accomplished without adding prolifically to the national debt.

The problem with debt

These days, it’s not easy to find a lot of critics of debt. Banks, car dealerships, credit card companies, payday loan stores, and the biggest debtor of them all, the US government, all encourage consumers to get out there and spend, spend, spend!

No surprise considering that the US consumer makes up 70% of GDP.

The New York Times quoted a report by S&P Global stating that government debt around the world will hit $53 trillion this year.

Wolf Street wrote earlier this month that consumer debt including credit cards and personal loans, but excluding mortgage debt, jumped by $187 billion in the fourth quarter of 2019 - an increase of 4.7% from Q4 2018 - to a record $4.2 trillion. Could interest rates under 2% have anything to do with this?

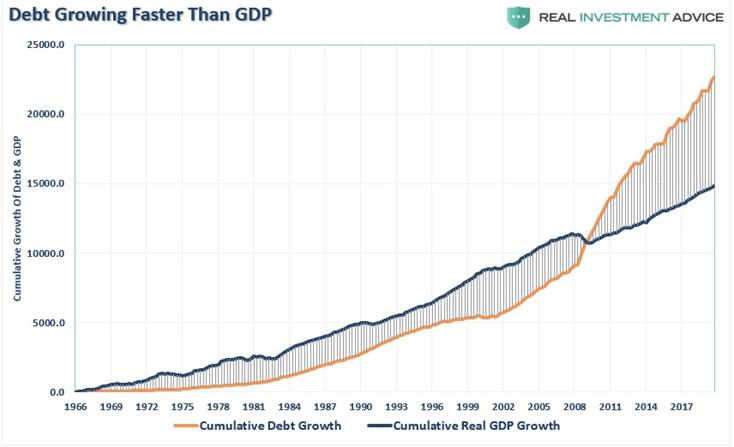

According to a piece on Real Investment Advice, Excessive borrowing by companies, households or governments lies at the root of almost every economic crisis of the past four decades, from Mexico to Japan, and from East Asia to Russia, Venezuela, and Argentina. But it’s not just countries, but companies as well. You don’t have to look too far back to see companies like Enron, GM, Bear Stearns, Lehman, and a litany of others brought down by surging debt levels and simple “greed.” Households, too, have seen their fair share of debt burden related disaster from mortgages to credit cards to massive losses of personal wealth.

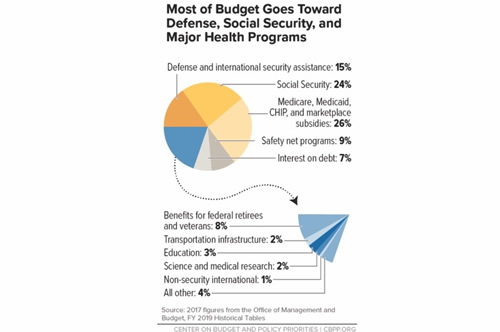

Why do governments borrow? To pay for its programs, obviously, including expensive health care and social spending priorities. Increasingly however, governments are relying on debt to grow their economies. The above-mentioned article makes some interesting points about debt and economic growth. It quotes the Center on Budget & Policy Priorities saying that roughly 75% of every current tax dollar goes toward non-productive spending such as welfare, versus productive spending like large infrastructure projects.

The latter investments pay for themselves over time whereas non-productive spending has a negative rate of return.

There is also evidence that increasing, debts and deficits lead to neither stronger economic growth nor increased productivity. This is because the higher the debt, the more money is taken away from productive investments, in order to pay interest on the rising debt.

Since Obama and Trump began piling on debt, it has taken an ever-increasing amount of debt to generate $1 of economic growth, the Real Investment Advice piece reads: For the 30-years, from 1952 to 1982, the economic surplus fostered a rising economic growth rate, which averaged roughly 8% during that period. Today, with the economy expected to grow at just 2% over the long-term, the economic deficit has never been higher. If you subtract the debt, there has not been any organic economic growth since 1990.

In sum, if you want to grow the economy, don’t go into debt!

We've lived under US dollar rule since 1944 but history shows us that all currencies have a shelf life. As we wrote in The Later United States Empire, history is marked by empire after empire that has over-extended itself, militarily; the US is no different.

The Roman and British empires were underpinned by strong militaries that both expanded territories and defended them. The same can be said for other empires throughout history - the Akkadians, Vikings, Greeks, Gauls, Spanish, Portuguese and Soviets, to name a few, all seized power by conquering or seizing other lands.

The United States since World War Two has been the street cop on the global block – occasionally challenged but never (yet) surpassed in economic nor military power.

World domination however comes at a heavy price to the national budget. Military spending is the main reason for the spiraling debt over the past few years; as a line item, it is second only to Social Security. If Special Forces, nuclear weapons and the VA budgets were added to the military budget, military spending would dwarf all other spending programs.

The missing moderate

Back to the 2020 presidential election, we have a very curious race developing, in that Trump is a Republican in name only, considering his profligate spending. Sanders is not a true Democrat either, in the tradition of moderates like Clinton and Obama. His idea of spending would well surpass Trump’s largesse; the only difference between the two is that Sanders has stated he plans to divert military spending into social spending.

Imagine if Sanders were to win the nomination and becomes the candidate to take on Trump, say with AOC or Elizabeth Warren, one of two “progressives”, as his running mate? And then wins to become president and Warren or AOC as vice president. You think $23 trillion in debt is unworkable now? Consider how much debt these folks would pile up under the guise of Modern Monetary Theory and unlimited money-printing?

To guard against this happening, the Democratic Party needs to take a defensive stance against Sanders at the upcoming “Super Tuesday” when 1,379 of the 3,979 pledged delegates will be awarded to the eight candidates still left in the race: Sanders, Sen. Elizabeth Warren, South Bend Indiana Mayor Peter Buttigieg, former Vice President Joe Biden, Minnesota Sen. Amy Klobuchar, former New York Mayor Michael Bloomberg, Hawaii congresswoman Tulsi Gabbard, and billionaire donor/ liberal activist Tom Steyer.

That would mean the so-called “moderates” - including Biden, Buttigieg, Klobuchar and Bloomberg - would unite behind one candidate, bringing all their delegates into one camp to prevent Sanders from winning a majority of delegates come Super Tuesday. There is already talk on Twitter of Elizabeth Warren dropping out of the race to help consolidate such efforts against Sanders.

At AOTH we will be watching very closely to see what happens on Super Tuesday, March 3. It is our opinion that should Sanders collect enough delegates by mid-March that no-one else can catch him, the Democrats are setting themselves up for a Trump coronation in November. Sanders was unelectable to the American public in 2016 and nothing has changed since then other than for him to galvanize his current supporters. A Sanders versus Trump election will be a fight for the mushy middle voter, one in which we predict most will hold their nose and mark an X beside The Donald.

Conclusion

Gold is reacting to global flash points as it always does, powering to within a few dollars of $1,700 an ounce - prompting comparisons to the heady gold market of early 2013 before the crash.

While it’s the spreading coronavirus catalyzing support for the yellow metal, there is an underlying problem with the US economy that we think is keeping prices buoyant, and that is debt.

Trump wants a low dollar to fix the bulging US trade deficit and attract manufacturing investment so that he can claim, while out stumping for re-election, that he’s “Made America Great Again”. His plan isn’t working though because the dollar is the reserve currency and demand for Treasuries, which also means demand for dollars, is very strong amid the coronavirus scare, and other global hot spots. Instead, Trump has used trade wars to weaponize the dollar - even starting a currency war which is really a race to the bottom where the lowest currency loses. There’s no way America’s competitors can win against the strong US dollar especially with the new Currency Rule that allows the Commerce Department to levy tariffs carte blanche on governments and individual companies/ sectors it sees as a trading threat.

Eventually their only hope will be to dump the US dollar, which is already on its way to losing reserve currency status.

That’s option 1, if Trump gets back in. More of the same trade wars, belligerent foreign policies, abandonment of constitutional principles, etc.

Option 2 is Bernie Sanders, unless things take a moderate turn over the next few weeks. Sanders, the furthest left among the Democratic field, would take the United States in an even bolder direction, debt-wise, than Trump. Adherence to MMT all but guarantees a road to economic ruin as runaway spending leads to money-printing, inflation, horrendous debt and eventual US dollar collapse.

Is it any wonder given these two scenarios that gold is going through the roof?

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.