Markets Ignore FED Rate Cut: SPX Could Break 2600 with Force

Stock-Markets / Stock Markets 2020 Mar 07, 2020 - 07:31 PM GMTBy: Mehabe

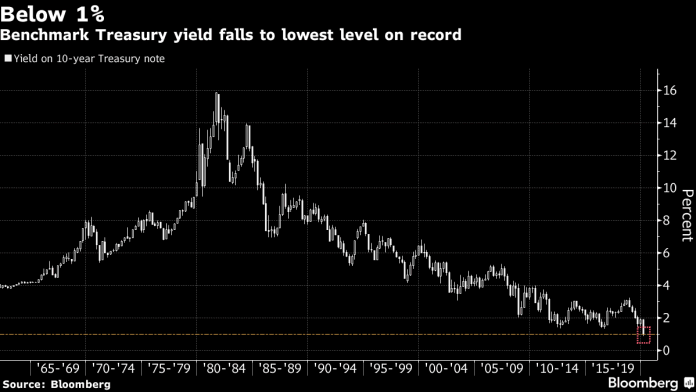

Dow Jones closes down almost 800 points, as investors worried the Fed's emergency cut won’t be enough to combat the economic impact of the coronavirus. US 10y yield drops <1% for first time.

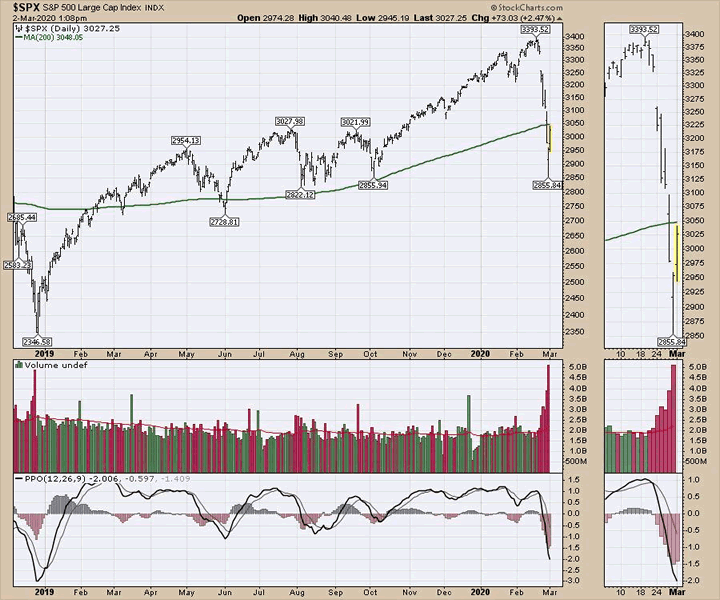

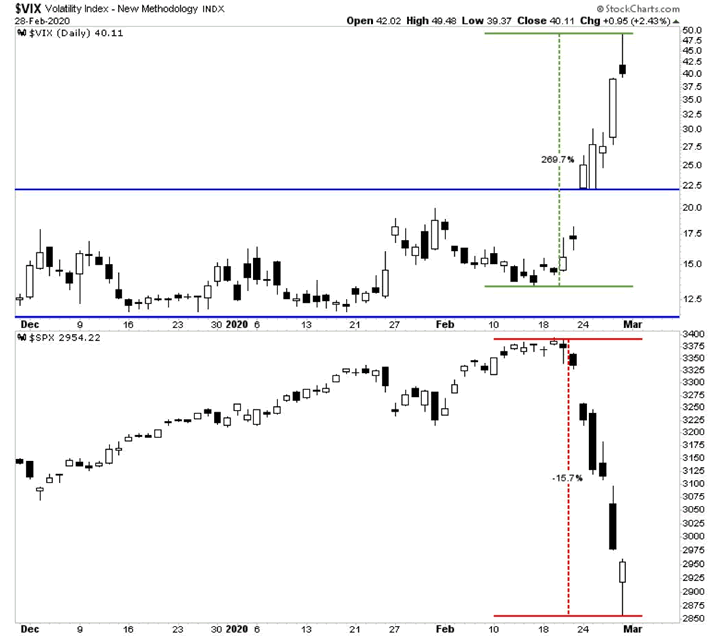

The S&P 500 has plunged 15.7% from its high to low while the volatility index (VIX) has risen 270%. After a massive down week last week, the markets are trying to recover with a strong push to start Monday. What is difficult to assess is how much economic damage has been done. If the world slows, is that already priced in with a 15% pullback on the Nasdaq and the $SPX? I realize how many downside projections there are for the economic squeeze coming. The question is, with Apple (AAPL) and Microsoft (MSFT) market caps dropping 20% into a bear market correction, is the damage already priced in?

Else where the US treasury yields are running lower again.

In the absence of any firm political news, the most defining characteristic of financial markets in 2020 continues: Treasury yields drifting lower, again

SPX : Volumes 8 year highs

On the $SPX, we also hit 8-year highs in volume.

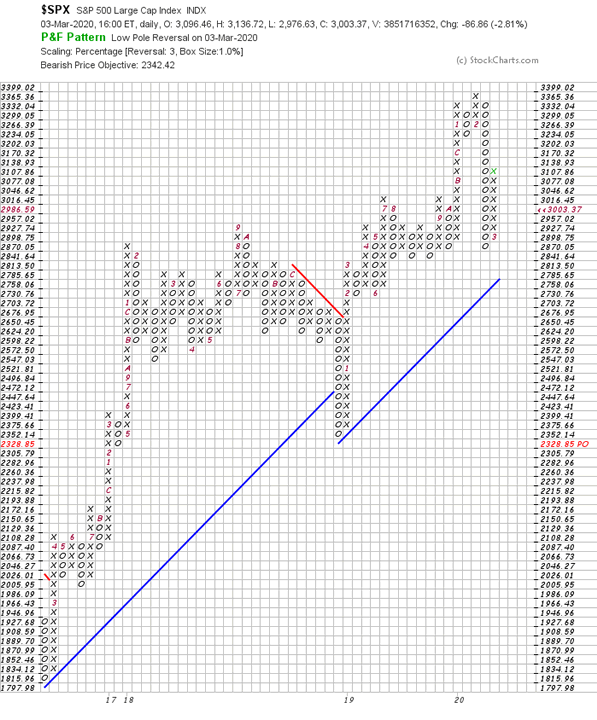

On the P&F chart the SPX downtrend ignited this month is not yet over. The measured downside target is near 2300.

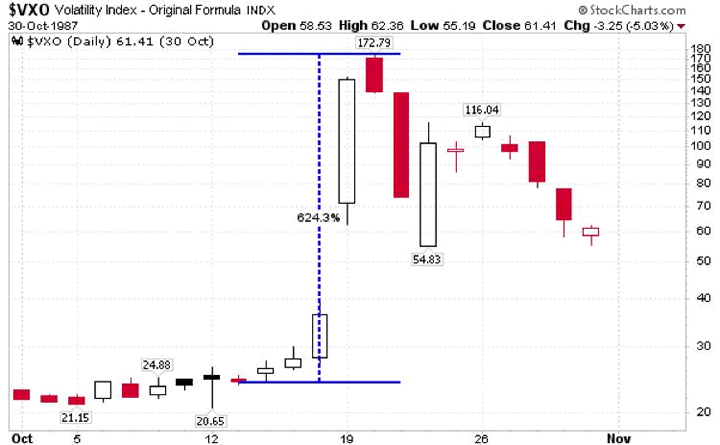

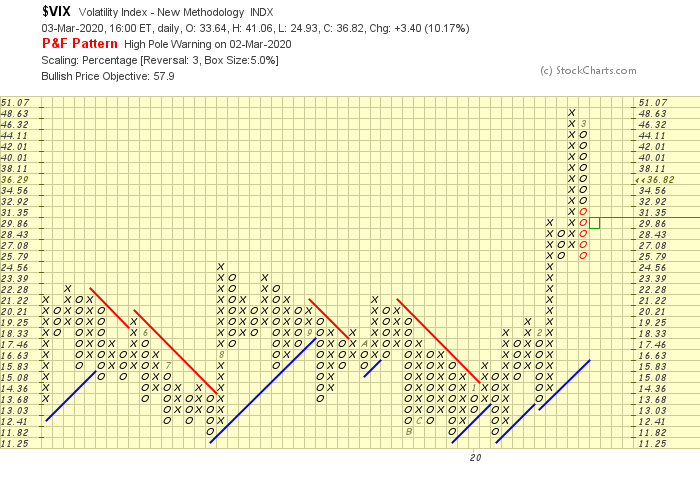

Spiking Volatility

The VIX has a measured upside at 57 which will tie in with the more downside coming in equity markets.

SPX bounced but is too little

From a volume perspective, we had more than enough volume to mark a low. On December 26th, 2018, the Dow rallied 1000 points. On March 2nd, 2020 (a.k.a. Monday) the intraday high is up around 780 points just after lunch in NYC. So the rally attempt is underway, even in the face of massive momentum to the downside.

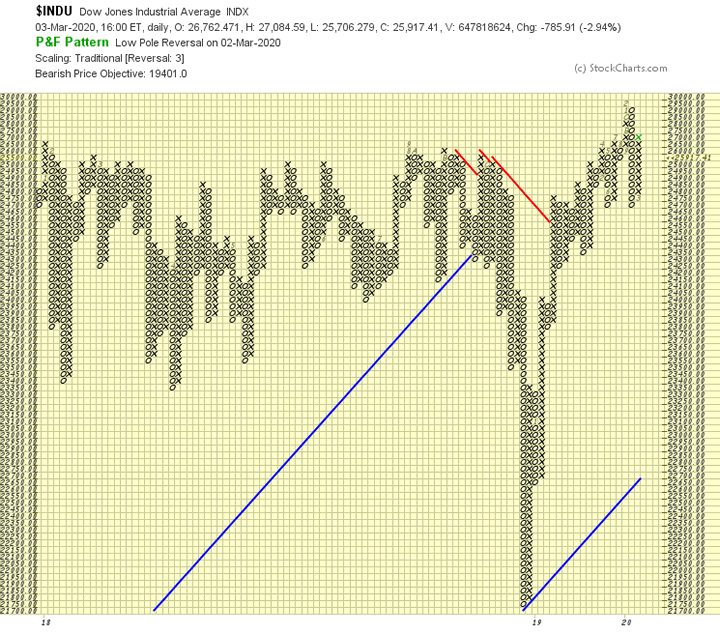

Dow Jones: More downside

The dow jones has a P&F target at 19000. Significant deleverage on the way.

Mehabe is a high performance trading system operation on global clients forex accounts.

Trades are taken based on a powerful ECHO STATE NETWORK A.I. Program. The system has never had a negative month of returns. FEB returns have crossed +30%.

The system is trading on LIVE MASTER ACCOUNT.

If you want to get started email us at fundsupport@mehabe.com and we will help you get started and you will get same returns as above.

Mehabe is a Artificial Intelligence driven quantitative investing firm offering managed account, tradecopier and custom tailored investing solutions for global clients. We have a history of industry leading performance.

Website: https://mehabe.com

Email : fundsupport@mehabe.com

Copyright 2020 © Mehabe.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.