UK Government Acts To Prevent Collapse Of Banking System

Politics / Credit Crisis Bailouts Oct 08, 2008 - 04:36 AM GMTBy: Mike_Shedlock

Bloomberg is reporting U.K. to Inject About $87 Billion in Country's Banks .

Bloomberg is reporting U.K. to Inject About $87 Billion in Country's Banks .

Prime Minister Gordon Brown's government will invest about 50 billion pounds ($87 billion) in an unprecedented step to prevent a collapse of the U.K. banking system.

As part of the plan, the government will buy preference shares, and the Bank of England will make at least 200 billion pounds available for banks to borrow under the so-called special liquidity plan, the Treasury said in a statement today. The government will also provide a guarantee of about 250 billion pounds to help refinance debt.

The steps to partially nationalize the banking industry provide "the necessary building blocks to allow banks to return to their basic function of providing cash and investment for families and businesses," Chancellor of the Exchequer Alistair Darling said in a statement.

The worsening credit crisis has forced the U.K to join the U.S., Ireland, Iceland, Belgium and Spain in rushing out untested bailout measures to save their largest banks.

The government said it will make 25 billion pounds immediately available in the form of preference shares and stands ready to provide an additional 25 billion pounds. The amount available to each bank will vary and will depend on their dividend payouts, executive pay policies and will require the banks to lend to small businesses and home owners, the government said.

Besides RBS and HBOS, Abbey, Barclays Plc, HSBC Holdings Plc, Lloyds TSB Group Plc, Nationwide Building Society and Standard Chartered Plc are eligible under the U.K. plan.

Text of British Bailout Plan

Here is the complete Text of British support plan for banks . Following are some highlights:

In these extraordinary market conditions, the Bank of England will take all actions necessary to ensure that the banking system has access to sufficient liquidity.

At least GBP200 billion will be made available to banks under the Special Liquidity Scheme. Until markets stabilise, the Bank will continue to conduct auctions to lend sterling for three months, and also US dollars for one week, against extended collateral.

The following major UK banks and the largest building society have confirmed their participation in a Government-supported recapitalisation scheme:

Abbey (STD), Barclays (BCS)(UK:BARC), HBOS (UK:HBOS), HSBC Bank plc (HBC) (UK:HSBA), Lloyds TSB (LYG) (UK:LLOY), Nationwide Building Society, Royal Bank of Scotland (RBS) (UK:RBS), Standard Chartered (UK:STAN).

These institutions have committed to the Government that they will increase their total Tier 1 capital by GBP25bn. This is an aggregate increase and individual increases will vary from institution to institution.

If the Government is to provide the capital, the issue will carry terms and conditions that appropriately reflect the financial commitment being made by the taxpayer.

In reaching agreement on capital investment the Government will need to take into account dividend policies and executive compensation practices and will require a full commitment to support lending to small businesses and home buyers.

UK Taxpayer Stake

It is difficult to project how UK taxpayers will fare under the above scheme. However, the plan itself seems to do a better job of protecting UK taxpayers than the Paulson ripoff plan does for US taxpayers.

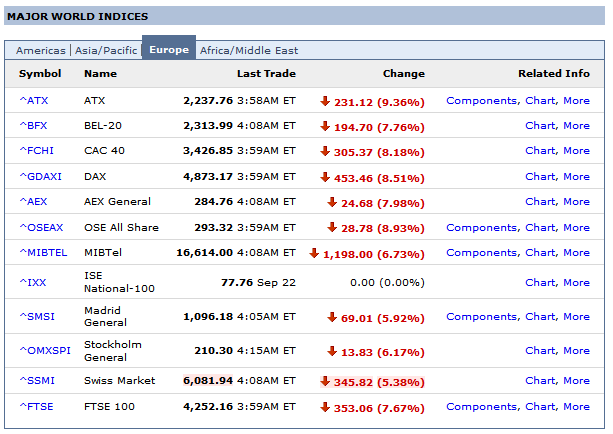

Europe Indices Plunge

Europe is following Asia sharply lower as the following table shows.

Chart courtesy of Yahoo Finance .

See Global Equities Rout Continues As Toyota Drags Nikkei Lower for additional details on the bloodbath in Asia.

US Futures Plunge

Prior to the announcement, S&P futures were down about 22 points. On news of the UK bailout plan, the S&P futures rallied to -6. The market has since had second thoughts. At 3:24 AM central, futures were -40 points (about 4%). Gold is +23 and crude is down $3 near $87.

Look for the Fed, the Bank of England, and the ECB to announce rate cuts. Options expiration is next Friday. Action between now and October 17th is quite likely.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.