We Are Facing a Depression, Not a Recession

Economics / Economic Depression Mar 26, 2020 - 03:44 PM GMTBy: John_Mauldin

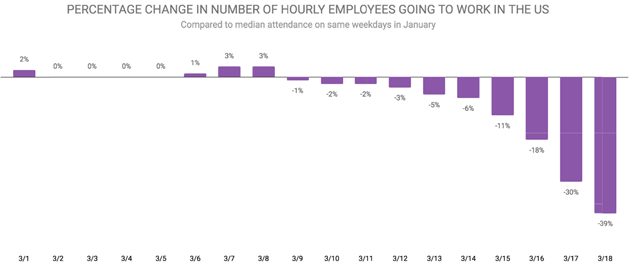

We are already seeing large increases in request for unemployment insurance. It is going to explode. Let’s look at this data from Homebase.

A stunning 39% drop in the number of hourly employees going to work in the U.S. just in the 10 days ended Friday, March 20.

Is there anybody who thinks that’s not going to increase?

Quoting from Homebase:

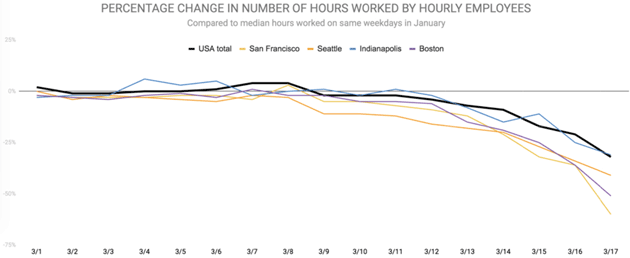

Many of the hardest-hit cities—San Francisco, San Jose, Seattle, New York—showed steep declines last week that align with the rise in coronavirus cases. Seattle was the first to see significant impact early last week, but other cities quickly caught up. The introduction of forced closures and shelter-in-place orders has furthered the slowdown. San Francisco, Boston, Pittsburgh, New York, and San Jose currently have the greatest reduction in hours worked, down by more than 50% in each city on Tuesday.

3 out of 5 workers in San Francisco did not go to work last week. It will get worse. The reduction in work hours there was 64%. Middle America cities are in the 40 to 50% range.

Mike Shedlock has been tracking government data on employment. Extrapolating the loss of jobs would mean an unemployment rate of close to 12% and a U-6 rate of 39%.

Even if Shedlock is wrong by half, that unemployment number ALREADY is staggering. We are literally down well over 10 million jobs and going to 20 million.

Amazon is hiring 100,000 workers and giving them all a raise. Good on Jeff Bezos. Seriously. But that is only a fraction of 1% of the jobs we are losing. We the People, the government collectively, should step in to help the remainder of those people. The coronavirus is not their fault.

Just a small snapshot of how the virus is hurting healthy people:

- A hotel exec friend who runs 125 hotels has let 90%–95% of the staff go. Literally tens of thousands. There are 54,000 hotels in the country. Do the math.

- Another friend handles the backroom for 2,200 dentists. 80% have shut down because they can’t get the masks and other things they need. There are 100,000 dentists with an average employment of maybe 10 people. Minimum 500,000 employees, plus dentists, without income. Average income per employee is $50,000. Dentists are critical, but they need basic gear to do their jobs.

There are literally hundreds of examples.

Nobody in their right mind, given what might happen this week, can possibly think these employment numbers will not get worse.

These are not recession numbers.

They are depression numbers.

Let me be clear. The U.S. is facing a deflationary depression. One cannot have the economic impacts we are seeing and think they will magically go away when the virus does. That’s not how economics and business work.

I am not the first person to say it, but we need something like a Marshall Plan for the U.S.

I recognize that Europe and the rest of the world are struggling too. I get it. But the entire world will go into a deflationary depression if we do not solve the crisis in the U.S. Hopefully an eventually strong U.S can help lead the world out.

I am calling for significant quantitative easing or whatever you want to call it. I get the irony in that. The Federal Reserve is largely responsible for where we are today, keeping rates too low for too long, and the government running deficits way beyond nominal GDP. These are bad things.

But we have to deal with the situation as it is today. And today, much of our country is under stress and wondering how they’re going to feed their families. How do they pay their rent? Electric bills? 100 other items?

Some of us can individually help our family and friends, but collectively we need to step in and help everyone.

Grousing about bad policies and mistakes of the past doesn’t solve the problems we face today. There is no need to punish the average American for bad Federal Reserve policy that they had no control over any more than we should punish them for the coronavirus.

When this is all over, we can think about how we ensure better policy in the future.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could be triggered in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.