US and UK Case Fatality Rate Forecast for End April 2020

Politics / Pandemic Mar 27, 2020 - 06:49 PM GMTBy: Nadeem_Walayat

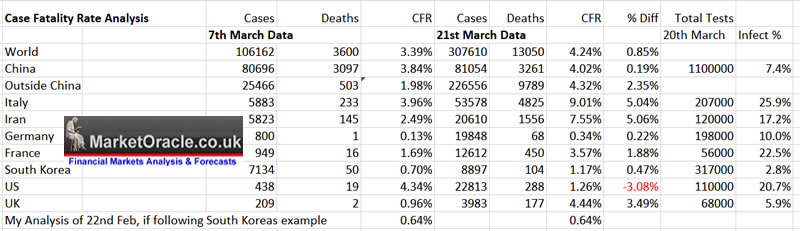

The US AND France are on a similar trend trajectory of under testing, thus as I have been warning for a month now that the US has probably a huge pool of infected, circulating and doubling every 3 or 4 days. That I estimated 2 weeks ago to be about ten times the official number to total at least 4000. Where US current tally of 23,000 suggests that the actual number of infected could easily exceed 250,000, more than ten fold the recorded infected number due to the fact the US IS STILL NOT TESTING ENOUGH!

110,000 tests to date is a mere pinprick, the US should be testing that number EVERY DAY!

Thus the current US CFR rate of 1.26% that many are cosying upto for comfort is NOT RELIABLE! Not when we look at Italy, France and the UK amongst which the US is most likely to emulate rather than South Koreas 1.17%

So people in the United States should not be lulled into any false sense of security by today's low CFR rate as it is purely as a consequence of continuing gross negligence in testing. The only advantage the US has time, maybe 2 weeks ahead of the UK and 4 weeks ahead of Italy, so at an advantage to act now to prevent catastrophe and avoid Italy's' fate, though with over 250,000 infected roaming the streets a lot of deaths are already baked into what happens over the next 2 weeks.

Therefore this analysis resolves in the US targeting a CFR rate of 4% when the US curve starts to flatten during early May. Though this means the CFR will be higher at the April 2020, probably at about 5%.

Whilst the UK's CFR of those tested rocketed from 1% to to 4.4% and given my earlier analysis is on a steeper trend trajectory than Italy! So implies a just as bad outcome as Italy! However the UK still has 2 weeks to ACT, and this week we saw the Government panic to act. Nevertheless the UK is heading for a CFR spike that could be as bad as Italy's 9% before it starts to flatten out and moderate towards the end of April as the UK has wasted valuable time and acted LATE, which will cost lives. So it is highly probable that UK's CFR by end of April will be at about 6.6%.

The whole of this extensive analysis that concludes in detailed Coronavirus trend forecasts for the UK and US, folowed by stock market implications of has first been made available to Patrons who support my work - US and UK Coronavirus Pandemic Projections and Trend Forecasts to End April 2020

- Dark Pools of Capital Profiting from the Coronavirus CRASH

- UK Coronavirus Infections Trend Trajectory Worse than Italy

- US Coronavirus Infections and Deaths Going Ballistic

- Herd Immunity and Flattening the Curve

- Case Fatality Rate Analysis

- Italy CFR and Infections Trend Analysis

- US and UK CFR

- UK Coronavirus Trend forecast

- United States Coronavirus Trend forecast

- Vaccines and Treatments

- CoronaVirus Forecast Stock Market Trend Implications

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.