United States Coronavirus Infections and Deaths Trend Forecasts Into End April 2020

Stock-Markets / Pandemic Mar 29, 2020 - 06:46 PM GMTBy: Nadeem_Walayat

This is the final part of my analysis that concludes in detailed trend forecasts for UK and US Coronavirus Infections and deaths into the end of April 2020. The importance of which being to act as indicators for the primary driver for stock market trend since Mid February. Where as was the case with my preceding forecasts into the end of March, deviations against the Coronavirus trend warned of worse prospects for stock prices as the UK and US FAILED to follow the South Korean model of containing the pandemic, instead either proved completely incompetent in doing nothing despite having had well over a months advance warning of what to expect. Or perhaps by design so as to allow the virus to infect the general population as it was deemed to be impossible to prevent in the long-run given the movement of people, goods and services and so a quick sharp deadly shock was deemed to be the most cost effective solution.

The whole of this analysis was first been made available to Patrons who support my work- US and UK Coronavirus Pandemic Projections and Trend Forecasts to End April 2020

- Dark Pools of Capital Profiting from the Coronavirus CRASH

- UK Coronavirus Infections Trend Trajectory Worse than Italy

- US Coronavirus Infections and Deaths Going Ballistic

- Herd Immunity and Flattening the Curve

- Case Fatality Rate Analysis

- Italy CFR and Infections Trend Analysis

- US and UK CFR

- UK Coronavirus Trend forecast

- United States Coronavirus Trend forecast

- Vaccines and Treatments

- CoronaVirus Forecast Stock Market Trend Implications

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

United States Coronavirus Trend Forecasts Into End April 2020

The US has had a major advantage over the rest of the western world, which is that it has had a LOT MORE TIME TO PRPARE FOR THE PANDEMIC, Unfortunately the US only really started to actually act in any significant manner when the stock prices started to collapse early March. However, that still gave the US a good head start on the likes of the UK, which is reflected in the US's low CFR rate of 1.3%.

Which suggests that the US DOES have a chance to get a grip on the pandemic and veer more towards South Korea then Italy or Britain where the pandemic is more less now baked in.

Whilst federal government actions has been found lacking the state governments such as California and Florida have announced lock downs for all of their citizens this week, totaling 75 million americans, with likely more states to follow. Though the broadcast media reports that many people are flouting the lock downs. However this gradual ratcheting up of measures 'should' slow down the spread of the virus, and also suggest to expect a lower CFR.

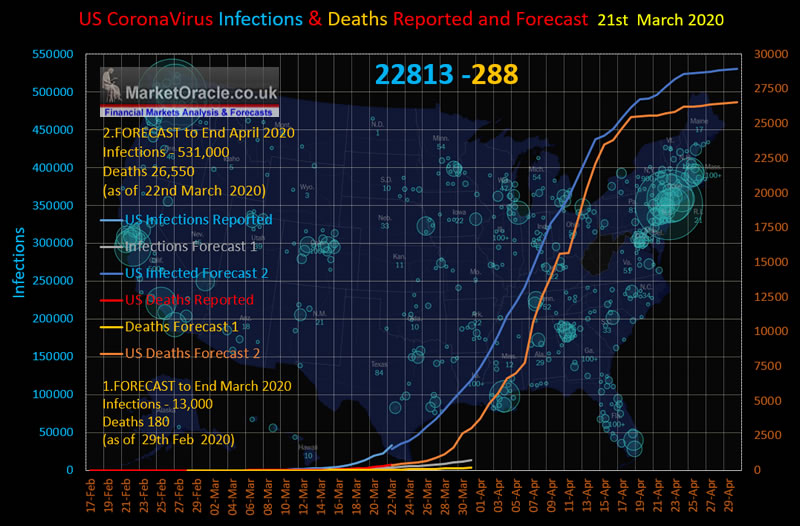

The existing forecasts US trend trajectory into the End of March puts the US on 40,000 infections and 1200 deaths. However actions announced this week and more expected over the coming week are likely to dampen the parabolic curve that the US is currently on, slowing it's progress greatly by the end of April..

Therefore my US infections trend forecast is for the US experience approximately half that which Italy has experienced. Which translates into 531,000 officially recorded infections and 26,550 deaths resolving to a CFR of about 5% by the end of April as illustrated by my trend forecast graph.

As for the actual number of infected, well as is the case for the UK then the real number of infected is likely to be many times the official number, at least X15 higher which by the end of April would imply 8 million infected in the US, and possibly as high as X30 or 16 million. Whilst the actual number today is probably between 350,000 and 700,000 which is why the UK abd US are on a parabolic curve due to the mass of hidden infected who will make their way into the official statistics over the coming week as more are TESTED! And whilst a death toll of 26,550 will be painful. However, my forecast conclusion is far removed from some of the prominent doom merchants out there that start at 200,000 and rise to 1.7 million deaths!

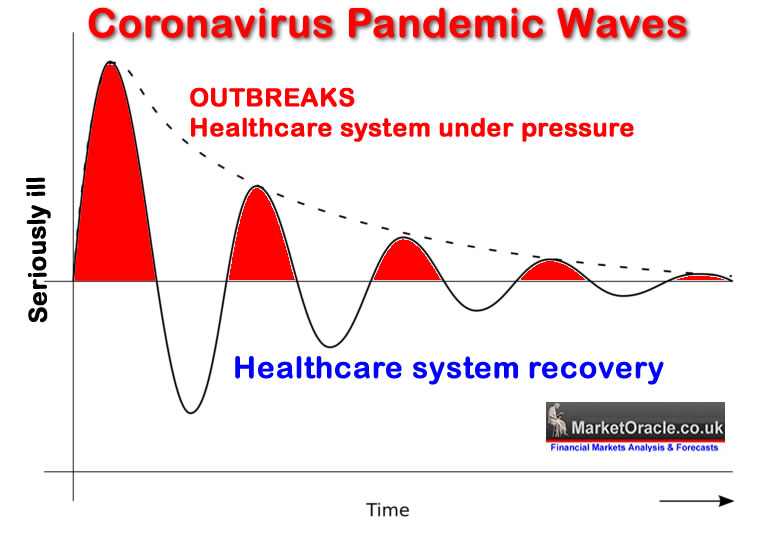

Also I expect subsequent pulses to result in far fewer deaths as the pandemic waves are better managed than this first wave.

Vaccines and Treatments

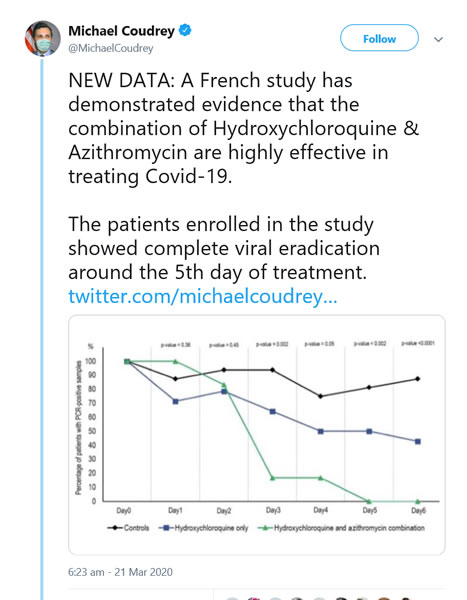

From what I understand it is relatively easy to make a vaccine, and so literally dozens of vaccines have already been made. However, it could take as long as a year for the testing to make sure the vaccine does not end up doing more harm than good, though I suspect we'll see at least one start being administered widely before the end of the year.

In the meantime there are promising noises around several possible treatments such as Hydrosychloroquine that could impact on reducing the consequences of future pulses.

CoronaVirus Forecast Stock Market Trend Implications

My next analysis will convert the Coronavirus trend trajectories into a probable stock market trend forecast.

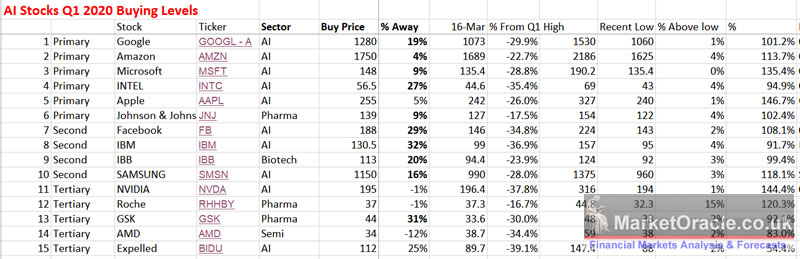

In the meantime my primary message remains unchanged in that I view this coronavirus bear market as being TEMPORARY.

Coronavirus Dow Stocks Bear Market - March and April 2020 Trend Forecast

And thus a buying opportunity for AI sector stocks.

US and UK Coronavirus Containment Incompetence Resulting Catastrophic Trend Trajectories

The whole of this analysis was first been made available to Patrons who support my work- US and UK Coronavirus Pandemic Projections and Trend Forecasts to End April 2020

- Dark Pools of Capital Profiting from the Coronavirus CRASH

- UK Coronavirus Infections Trend Trajectory Worse than Italy

- US Coronavirus Infections and Deaths Going Ballistic

- Herd Immunity and Flattening the Curve

- Case Fatality Rate Analysis

- Italy CFR and Infections Trend Analysis

- US and UK CFR

- UK Coronavirus Trend forecast

- United States Coronavirus Trend forecast

- Vaccines and Treatments

- CoronaVirus Forecast Stock Market Trend Implications

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Your analyst hopeful that the Coronavirus first wave will be contained to allow for treatments to be developed that will negate the seriousness of Covid-19 beyond this first wave.

By Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.