US Federal Budget Deficits: To $30 Trillion and Beyond

Interest-Rates / US Debt Apr 05, 2020 - 11:15 AM GMTBy: John_Mauldin

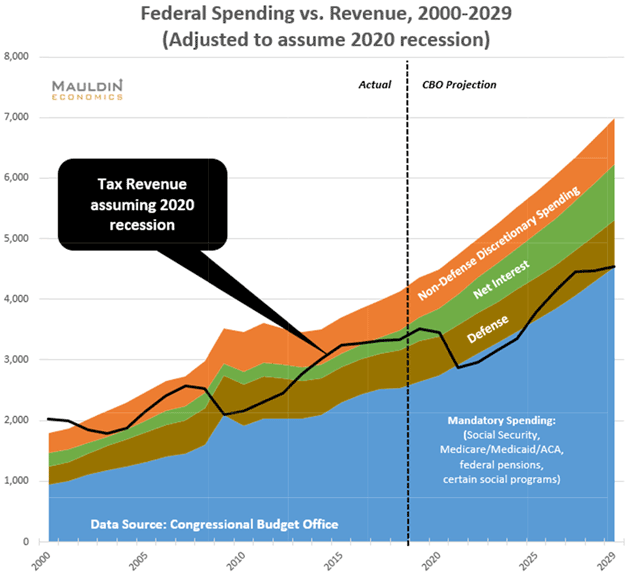

In my decade forecast, I projected that in the next recession that the deficit would climb to over $2 trillion. Clearly, that demonstrates I am an optimist. Here’s a chart I shared back in January.

Between reduced tax revenues and increased spending, I now expect this year’s deficit will be at least $4 trillion.

I will bet you a dollar to 40 doughnuts that we will see at least another $1 trillion emergency spending bill to be spent in the third quarter. My logic is as follows.

The following equation is used to calculate the GDP: GDP = C + I + G + (X – M) or GDP = private consumption + gross investment + government investment + government spending + (exports – imports).

This transforms the money-value measure, nominal GDP, into an index for quantity of total output.

I wrote recently about the long-ago political decision to include government spending in the GDP numbers. U.S. GDP is roughly $20 trillion a year (using numbers that are easy to divide). That means $5 trillion per quarter.

If the economy falls 20% in the third quarter (not a prediction, but work with me) adding an additional $1 trillion worth of government spending will restore the GDP equation.

The first estimate of that number will come out in late October, shortly before the Nov. 3 election. Both parties in Congress will want to see it positive. Care to bet we don’t see another stimulus package?

We could have 2020 and 2021 deficits of a combined $6 trillion-plus. Add off-budget spending, and we should see $30 trillion total national debt by the end of 2021.

I naïvely projected total national debt to be $39 trillion by 2030. See, I keep telling you I’m an optimist.

We will be in that $40 trillion range somewhere around 2026-‘27.

We are experiencing a practice round for The Great Reset. Sometime late this year or early next, we need to look at what happened and then think what it will look like in the late 2020s.

A number of factors will all converge to give us a true Fourth Turning generational crisis, part of which will be The Great Reset.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could be triggered in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.