Stocks Hanging By the Fingernails?

Stock-Markets / Stock Markets 2020 Apr 05, 2020 - 11:21 AM GMTBy: P_Radomski_CFA

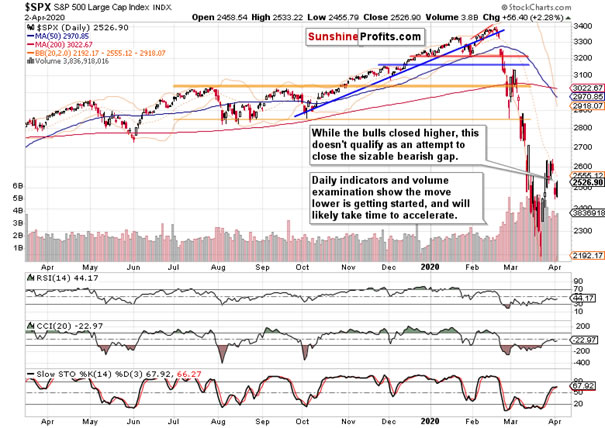

After Wednesday’s slide, the S&P 500 moved higher yesterday. While the move itself hadn’t surprised us as we’ve earlier called for a pause in the downswing, the question is whether we can expect some more upside shortly.

Long story short, that’s unlikely. Let’s open today’s analysis with the daily chart examination (charts courtesy of http://stockcharts.com).

Considering Wednesday’s bearish gap, stocks have retraced a measly part of the preceding decline. Let’s recall our Wednesday’s observations:

(…) Stocks closed near the daily lows on Tuesday, and did so on higher volume than was the case on Monday. Another point speaking for the bears is that yesterday’s upswing attempt was again soundly rejected. And still, the daily indicators are increasingly and tellingly curling lower.

After Thursday’s session, the daily indicators are overall positioned more bearishly than the day before, lending credibility to the claim of yesterday’s session being merely a pause in the downswing. The bearish gap continues to support the sellers, and we certainly expect the downside move to continue over the coming days.

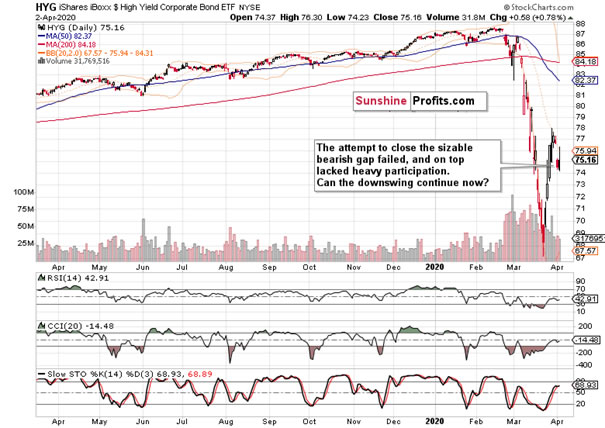

But doesn’t yesterday’s action in the high-yield corporate debt (HYG ETF) constitute a fly in the ointment? After all, the intraday move made us issue this intraday Alert yesterday after the regular Stock Trading Alert was published:

(…) Stocks not merely paused, but also slightly recovered during today’s session so far to trade slightly below 2500 currently. Yet it’s the corporate debt market that is the reason behind this intraday Alert. It recovered and the bulls attempted to close yesterday’s sizable gap. Despite their failure and HYG trading close to its yesterday’s closing prices, stocks are trading higher than they were yesterday – in line with the discussed need to pause in their downswing.

However, should HYG continue its recovery attempts, that wouldn’t be without consequences for the S&P 500. While we continue to think that the stock downswing will carry on in the coming days, it makes sense to tighten the trade position’s parameters and improve its risk-reward ratio – please see the trading position for full details.

The exact position details are reserved for our subscribers. Let’s quote from our yesterday’s regular Alert first as it explains why the debt market is key to stocks:

(…) Comparing the magnitude of yesterday’s downswing shows that stocks are a bit ahead in the sliding game. Unless HYG declines more meaningfully today, stocks are likely to take a short-term pause as they have declined more profoundly yesterday. The emphasis here goes to short-term (which implies that any potential upswing certainly isn’t going to be a tradable opportunity) – unless we see a turnaround in the debt market, any potential stock upswing doesn’t really have legs.

Now, we’ll take a joint look at the HYG action that made us cautious:

The upswing ran farther than expected, and while the odds remain stacked against its possible repetition, it pays to be reasonably suspicious and conservative in one’s trading decisions. After all, we’re in it for the long run and in order to help people fulfill their many dreams.

Summing up, the bears enjoy the upper hand as can be seen on both the weekly and daily charts. The renewed downswing is underway, and lower S&P 500 (and SPY ETF) values are ahead. The daily indicators, high-yield corporate debt market and fundamental prospects of more coronavirus pain and its reflection in market prices mean that our open and increasingly profitable short position remains justified.

We encourage you to sign up for our daily newsletter - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock & Oil Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Monica Kingsley is a trader and financial markets analyst. Apart from diving into the charts on a daily basis, she is very much into economics, marketing and writing as well. Naturally, she has found home at Sunshine Profits - a leading company that has been publishing quality analysis for more than a decade. Sunshine Profits has been founded by Przemyslaw Radomski, CFA - a renowned precious metals investor and analyst.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.