Fed Caught Off Guard by Coronavirus Economic Shock. And Gold?

Economics / Coronavirus Depression Apr 16, 2020 - 01:42 PM GMTBy: Arkadiusz_Sieron

Another week passed, and the number of jobless claims increased further. That was clearly not expected by the Fed, as the recent minutes shows. What does it all mean for the gold market?

Unemployment Claims Rose Further

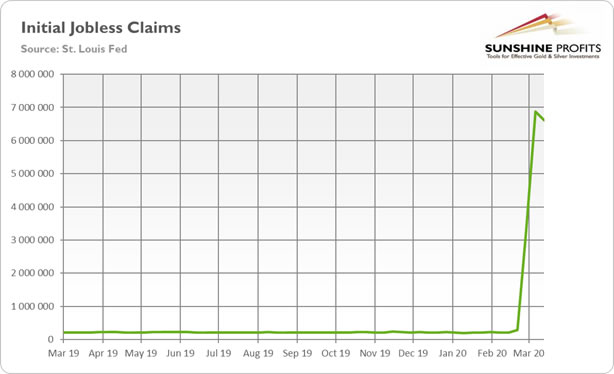

Initial jobless claims have become one the most important data about the US economy these days. So, let’s take a look at the chart below, which offers the updated graph revealing the number of new claims for unemployment benefits.

Chart 1: US Initial Jobless Claims from March 23, 2019 to April 4, 2020

As one can see, in the week of March 28 to April 4, 6.6 millions of Americans applied for the unemployment benefit. As the chart shows, this is a lower number than the 6.9 million in the previous week. Still, it means that in just three weeks, almost 16.8 million of US workers applied for unemployment benefits! Surely, part of that number is caused by the poor construction of the government rescue package, which encourages people to go for unemployment, simply because the average worker can get 16 percent more collecting unemployment than he would on the job.

However, the number remains unbelievable high. The official unemployment rate increased from 3.5 to 4.4 percent in March, but it did not capture the full monthly data. Given that 16.8 million of US workers have applied, the real unemployment rate is likely to be higher than 15 percent! It would mean that the US unemployment rate is already above the Great Recession levels – and that it could increase further toward the level last time seen during the Great Depression.

FOMC Minutes

The recently published minutes of the FOMC meeting from March 15 show that the Fed did not understand the gravity of the situation. Although all participants saw US economic activity as likely to decline in the coming quarter and viewed downside risks to the economic outlook as having increased significantly, they have been clearly caught off guard by how quickly the economy has actually deteriorated.

Indeed, the minutes show that “Participants observed that businesses would be more likely to lay off workers on a major scale if the downturn in economic activity came to be perceived as likely to be protracted.”

Well, it turned out that almost 17 million of Americans applied for unemployment benefits in mere three weeks. The Fed clearly did not expect such a rapid and deep economic shock! Their poor judgement is striking. Please read this part of the minutes:

Several participants emphasized that the temporary nature of the shock to economic activity, the fact that the shock arose in the nonfinancial sector, and the healthy state of the U.S. banking system all implied that the current situation was not directly comparable with the previous decade's financial crisis and it need not be followed by negative effects on economic activity as long-lasting as those associated with that crisis.

First of all, this is not a temporary shock – unless you “define” temporary as “until the accepted treatment slash vaccine arrives”. We will have social distancing – in one form or another – for months. In the last Fundamental Gold Report, I explained thoroughly why I don’t buy the story of V-shaped recovery.

Second, the US economy is not healthy. To be clear, commercial banks have more capital and are indeed in better shape. But if they are so rock-solid, why the Fed intervened in the repo market even before the pandemic? As a reminder, the corporate debt of the US nonfinancial companies is at record highs. We could thus expect corporate defaults in the coming days and weekls. Moreover, the US households have little savings or cash buffer. More than 30 percent of renters did not pay their rent by April 5, according to data from 13 million units published by the National Multifamily Housing Council, compared to almost 20 percent who didn’t pay by March 5. The segments of the economy are interconnected, so the problems of companies and renters can easily turn into issues for the financial institutions, including commercial banks.

Third, the current economic crisis could prove worse than the Great Recession. In terms of the unemployment rate and jobless claims, it is already much more worse!

Implications for Gold

All this means that the Fed’s worst case scenario, which assumes no recovery until next year, is more likely to happen that the more optimistic one, in which economic activity starts to rebound in the second half of this year.

Indeed, the Fed is slowly learning that the situation is really serious. This is why on Thursday, the US central bank took additional steps to provide up to $2.3 trillion in loans to support the economy. In particular, the Fed started the Main Street Lending Program to ensure credit flows to small and mid-sized businesses.

However, as I explained it before, fiscal and monetary stimulus will not fully compensate for loss of output and income. The US economy is simply too big. And please remember that there is no free lunch. It means that all these rescue packages will increase the public debt and hamper productivity growth.

It is, of course, possible that the worst is behind us, the scientist will develop the new silver bullet, and the economy and the stock market will recover quickly. However, I think that we are just entering a recession. And no stock market bottom has never occurred outside of a recession. So, if history is any guide, the worst might actually be yet to come. It means that the price of gold is likely to go higher later this year, when the full scale of the economic calamity will be clear to all investors.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.