If Stock Investors Crunched Economic Data Like This Their Expectations Would Change Dramatically

Economics / Coronavirus Depression Apr 18, 2020 - 04:26 PM GMTBy: Chris_Vermeulen

New economic data being released as earnings start to hit may alter how investors perceive the recent price recovery in the US and global markets. Many institutional analysts began suggesting “the bottom is in” and recently began to issue stronger forward guidance. The new data suggests we are seeing an economic contraction that, in some cases, maybe 2x or 3x the contraction that took place in the 2008-09 Credit Crisis.

The US stock markets reacted to this news and earnings data by collapsing over -2% in early trading. Gold and Silver are both lower as we write this article which would indicate weakness across the broader market. We continue to believe a deeper price low will set up in the near future with the US and global stock prices attempting to retest recent price lows – possibly falling below these levels. We believe the collateral damage to consumer engagement, manufacturing, transportation, retail/leisure, real estate and other sectors of the economy is just now starting to become evident. What the economy may look like near Mid-May is anyone’s guess.

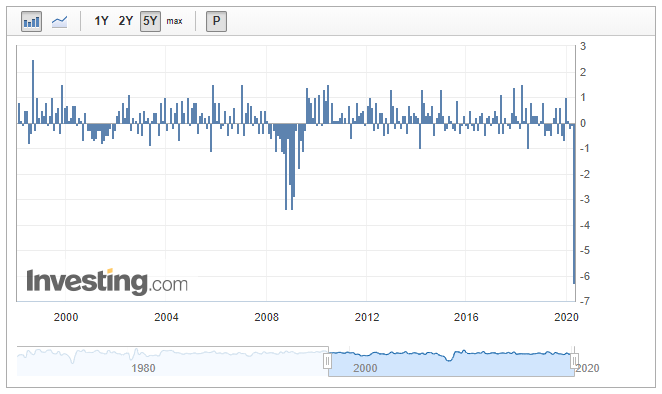

Manufacturing Output Index

One of the most interesting data items published recently in the US Manufacturing Output Index which reported at -6.3%. This is the largest downside (negative) print going back over 20 years. It is nearly 2x larger than the deepest levels from the 2008-09 Credit Crisis and nearly 6x the levels of the 2001 9/11 terrorist attacks. This time it really is different.

Before we continue, be sure to opt-in to our free market trend signals before closing this page, so you don’t miss our next special report!

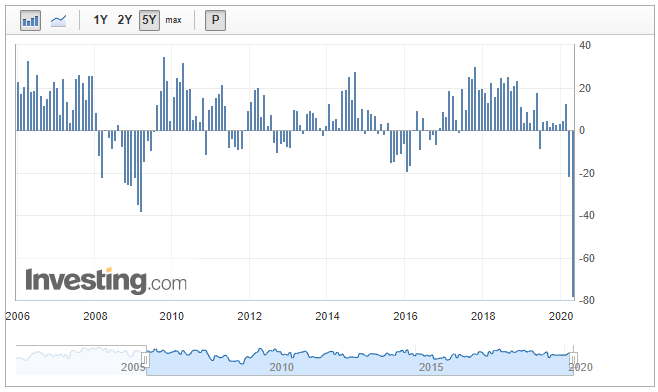

New York Empire State Manufacturing Index

The New York Empire State Manufacturing Index was no different – posting a level at -78.20%. This massive negative number is nearly 2x the deepest levels printed during the 2008-09 Credit Crisis and clearly illustrates how the COVID-19 virus event has disrupted manufacturing output across the globe. Depressed manufacturing translates into decreased shipping, decreased supply, decreased demand, and decreased overall economic engagement (employment, support services, taxes, and others). A number similar to the lows of 2008-09 would be sufficiently terrible. A number that is 2x below the lowest levels in 2008-09 is absolutely destructive to forward expectations.

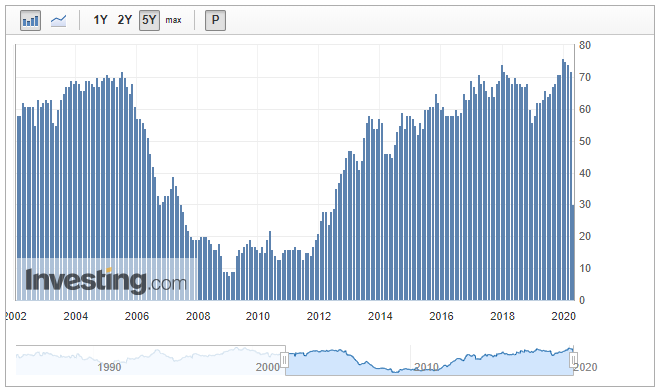

NAHB Real Estate Index

Real estate is starting to feel the pinch too. The NAHB Real Estate Index came in at 30. The only times in history where this level has been reached were September 1990, October 2006, and June 2007. These areas in history clearly point to an early recession indicator in the markets. We found it interesting that September 2001 (9/11) didn’t experience any major downside print in the NAHB index. The lowest level reached after 9/11 was 46 (November 2001). The current 30 level is shocking. If history is any indication of what to expect in the future, this real estate index may attempt to set up an extended bottom near or below 15 to 20 over the next 12+ months.

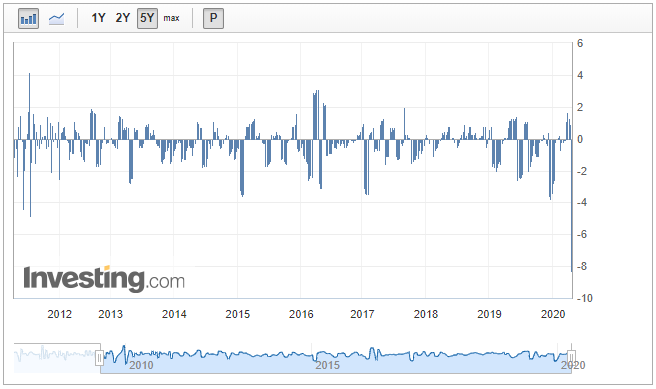

Redbook Index

Lastly, the Redbook Index – which printed a level of -8.3. This index of over 9000 retail locations is one of the broadest market indicators of consumer/retail-based activity in the US. Obviously, with the shutdown taking place within the US and across the globe, we were not expecting any type of fantastic number. Yet our concern is that consumer engagement continues to slowly emerge from the shutdown over the next 12+ months and the collapse in retail may become prolonged

Historically, this is the deepest level printed on the Redbook Index since 2008-09. We believe the continued shutdown and disruption to traditional manufacturing, supply and retail will continue to present very negative outcomes for global economic measures. Thus, we believe the risks to the US and global stock market are still very real for skilled traders.

Concluding Thoughts:

The US Fed and global central banks are doing everything possible to support a shocked global economy – yet they can’t print enough money to replace the global activity of consumers, manufacturers, and traditional economic functions. They can just attempt to “patch things up” while they wait for consumers and manufacturers to begin operating near-normal levels.

It is very important for skilled traders to understand the bigger economic risks that are at play and to understand the process of price moves within the current market cycle. I was recently interviewed about my market opinions and stated very clearly how investors could fall into a “suckers rally” trap. Listen to my talk here.

Be prepared for more downside risks and a potential for a much deeper price bottom over the next 6+ months. Those individuals/firms suggesting “the bottom is in” are certainly jumping the shark, in our opinion, right now. It’s a pretty big event to come out right now and tell investors “buy these dips because we believe the US Fed has everything under control”. Be cautious and use your own skills to wait for a proper bottom setup.

I have to toot my own horn here a little because subscribers and I had our trading accounts close at a new high watermark for our accounts. We not only exited the equities market as it started to roll over we profited from the sell-off in a very controlled way.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is going to be an incredible year for skilled traders. Don’t miss all the incredible moves and trade setups.

I hope you found this informative, and if you would like to get a pre-market video every day before the opening bell, along with my trade alerts visit my Active ETF Trading Newsletter.

We all have trading accounts, and while our trading accounts are important, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during a time like this, you could lose 25-50% or more of your entire net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how and one of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Long-Term Investing Signals which we issued a new signal for subscribers.

Ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.