Coronavirus Stock Market Trend Implications, Global Recession and AI Stocks Buying Levels

Stock-Markets / Stock Markets 2020 Apr 19, 2020 - 07:07 PM GMTBy: Nadeem_Walayat

Coronavirus Stock Market Trend Implications

Whilst the UK's trend trajectory appears to be stabilising, which offers some light at the end of Britains' dark coronavirus tunnel. However, the key driver for stock market trends, the US is still accelerating away which means more uncertainty that the stock markets are likely to seek to discount as the markets are seeking numbers that are first stabilising in the rate of increase and then to start decreasing on a daily basis, instead were still in the DOUBLING ever 2 to 3 days phase!

This implies to continue expect a bearish trend trajectory despite Fed panic actions, and the US sending $1200 checks to every american who earns under $75,000 per year, with likely several more payments over the coming months. Though Dr Fauci putting a number of 100k to 200k deaths may shock americans and the markets, especially given Trump's ramblings of how it will all be over by Easter. Nevertheless gives a number against which the general public and markets will be measuring relative strength and weakness. For instance the US is currently trending towards 38,000 deaths by the end April in the face of which the markets could out perform if the number of deaths is seen to far under achieve the bottom figure of 100k.

So is the stock market discounting the current trend trajectory?

I don't think so, as currently there is no sign that this trending well for the US, thus the general stock market indices such as the Dow are likely to trade lower over the coming week or so to trade back down to Dow 20k, and likely dip below, though I don't see a return to the recent low of 18,200.

The whole of this extensive analysis was first been made available to Patrons who support my work - US and UK Coronavirus Trend Trajectories vs Bear Market and AI Stocks Sector

- Paying the Price for Acting Too Late

- UK Coronavirus Trend Trajectory - Deviation Against Forecast

- US Coronavirus Trend Trajectory - Deviation Against Forecast

- Coronavirus Stock Market Trend Implications

- Coronavirus Global Recession 2020

- Existing Stock Market Trend Expectations

- AI Stocks Q1 Buying Levels Current State

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Coronavirus Global Recession 2020

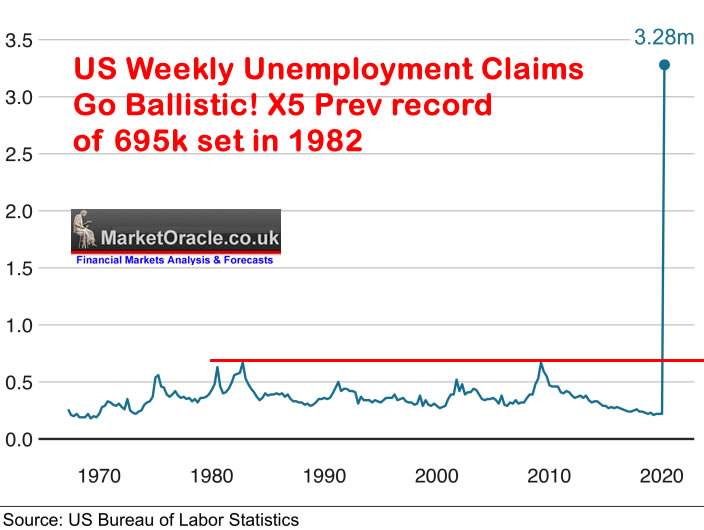

This one graph says it all as to the magnitude of the consequences of the Corona lock downs, economic shocks that rippling out across the western world that are several orders of magnitude greater than the Financial crisis of 2008.

I could continue with a myriad of other graphs but they would just paint a similar picture of economic activity in many sectors of the economy coming to a virtual standstill all as a consequence of gross negligence in handling of the Coronavirus pandemic.

However, to counter this economic catastrophe is the fact that ALL nations are viewing the the Corona crisis as being temporary and thus are going out of their way to take equally unprecedented actions far beyond that of 2008 aimed at keeping as much of their economies intact as possible as we ride out the Pandemic waves as the populations and the economies gradually become immune to the consequences of Coronavirus.

For instance no one would ever have thought that a Labour government let alone a Tory government would be making announcements to finance of 80% of the pay of ALL employees AND self employed upto £2,500 per month who are forced to stay at home as a consequence of the lock downs!

Similar the US has announced the first of a series of bailouts that starts at $2 trillion that make the 2008 Financial Crisis bailout of $787 billion look like a pin prick in comparison to.

So as I stated in my update of early March, yes ALL western nations are heading for SHARP economic slowdown and contraction starting Q1 and continuing into Q3. However I still view this as a V shaped short sharp shock as with each week and month of the lock down will result in ever increasing pent up demand to be unleashed once we start to return to normality which at a worse case scenario would be early 2021, but more likely during Q4 of 2020.

In terms of the prospects for the stock market trend then the extreme INFLATIONARY measures being deployed to keep economies alive during the lock down coupled with known prospects of first herd immunity and then treatments and finally vaccines, all of which show a clear path towards an end to the corona crisis. Then the stocks markets SHOULD be discounting this future reality for don't forget that no matter how bad things get over the next few weeks, the stock markets DISCOUNT THE FUTURE, so much of the bad news has already been discounted.

Existing Stock Market Trend Expectations

My existing forecast as of 9th March is for the Dow to make a low late March and then to target a volatile uptrend into the end of April 2020.

The trend to date has tracked my forecast remarkably closely, which suggests that it is highly probable that we have seen the Coronavirus stocks bear market bottom at Dow 18,200, though do bare in mind that the US infections trajectories are currently worse than my forecast which means the current rally is likely to resolve in the Dow revisiting at least 20k as being the immediate direction of travel over the next week or so.

(Charts courtesy of stockcharts.com)

Therefore I see no reason to undertake a more in-depth technical analysis at this point in time, just that as the US is currently tracking less than half the number of deaths that Dr Fauci has stated then this should also resolve in a stable trend with an upward basis. Though the trend will continue to be very volatile.

AI Stocks Q1 Buying Levels Current State

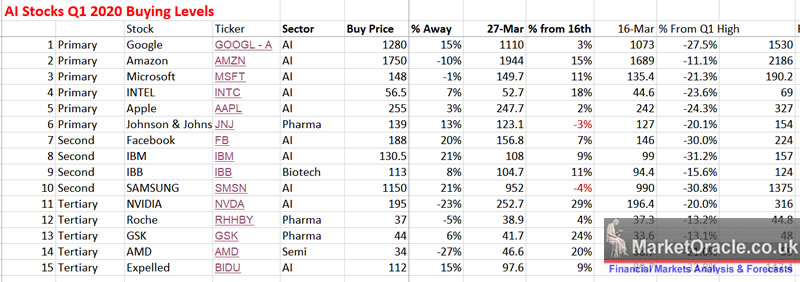

If you have taken one message away thing from my articles during the past month then it should have been that this Coronavirus stocks bear market is presenting investors with a BUYING OPPORUTNTY OF A LIFE TIME in AI stocks! For instance the last time I updated my AI stocks table on the 16th of March I wrote:

All of the stocks except AMD have now moved below their Q1 buying levels, and many stocks by a significant degree! The most notable biggest bargains of the bunch are Google, Intel, Facebook and IBM, especially when compared against their Q1 highs.

The recent panic sell off also acts as an important indicator of underlying relative strength of Apple and Amazon. One would have imagined that these two stocks having greater exposure to the real world than the virtual world would have faired worse then the likes of Google, i.e. being disruptive to Apples production of iphones and Amazon's supply chains. But no, so far they are showing that the market is already starting to discount recovery for these two stocks. And if one thinks about it then it makes sense that China will lead the V shaped economic bounce back by a couple of months ahead of the West, and thus improve the prospects for Apple and Amazons supply chain.

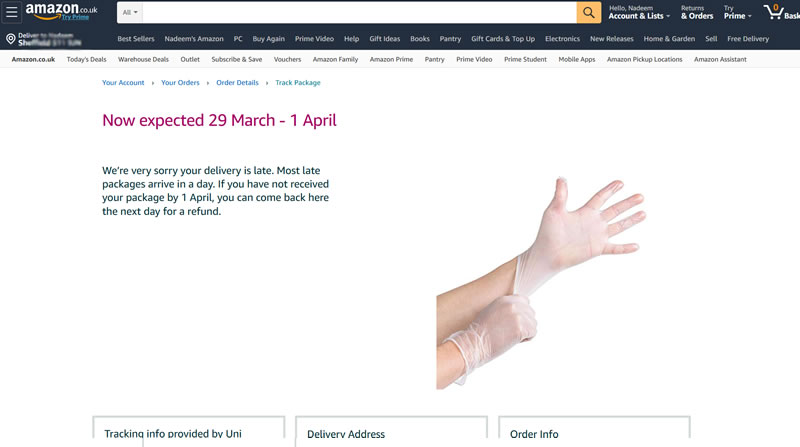

That and so many people choosing not to risk catching Coronavirus will increasingly put greater demands on Amazon for all sorts of goods and services. Though I have noticed a number of their prices have started to creep up over the past week or so.

The updated AI stocks table shows that many of the AI stocks have already significantly deviated strongly to the upside since the 16th of March, which in itself was not the low for AI stocks, i.e. if you were nimble footed then you could have picked up stocks at even cheaper levels.

Current state of the AI stocks as of 27th March relative to 16th March and Q1 Highs.

Google at +3% from 16th March and -27% from it's Q1 high is still cheap! Don't blow this long-term opportunity!

Amazon at +15% and -11% illustrates what I stated on the 16th of March is coming to pass, investors are waking up to realise that the big winner here is Amazon! And you could have picked up Amazon 20% cheaper than where it closed Friday. And before you ask, no I don't think we will see Amazon trade anywhere near back down to below $1700, if were really lucky we might see $1830.

Microsoft at +11% and -21%, again similar performance to Amazon, another stock I doubt we'll see trade anywhere near it's recent lows.

Intel at +18%, -24%. Still trading well below it's Q1 buying level, and offered plenty of opportunities to buy Intel at dirt cheap prices of as low as $43! At best going forward we could see $48.

Apple at +2%, -24%. It might not look like it but Apple has performed much better than I expected it would, after all it is reliant on manufacturing output rather than cloud services and so should have suffered more. Similarly I don't expect Apple will see 212 again, at best 238.

J&J at -3%, -20%. It was pot lock which of the Big Pharma's had treatments in the pipeline going into the Corona crisis, unfortunately J&J is not one. But Roche my 2nd Pharma on this list is!

And Similarly for the remaining stocks on my list most notable of which are AMD and NVIDIA both of which have rocketed by 20% and 29% since 16th of March, with plenty of opportunities to pick these highly leveraged to AI mega-trend stocks.

The bottom line remains, the Coronavirus continues to present a buying opportunities of life time in AI Mega-trend stocks, whilst it will clearly take some time for the general stock market indices to recover to anywhere near their all time highs. However, I would not be surprised to see financial press headlines in a few weeks time stating that the Amazon stock price just set a new record high with many of the other stocks on this list not far behind.

So I continue to view any market PANICS during April as BUYING OPPORTUNTIES. As I continue to view this coronavirus stocks bear market in AI stocks at least as being TEMPORARY! Which is being reflected in the likes of Amazon now just 11% away from their Q1 high. SO BUY FEAR! And given the current Coronavirus trend trajectory there's likely to be many more fear opportunities ahead against this we have investors increasingly starting to wake up and start buying AI stocks on this list which means don't waste time waiting for dips, scale in because the trend trajectory for most of this stocks on this list is towards new all time highs, this year!

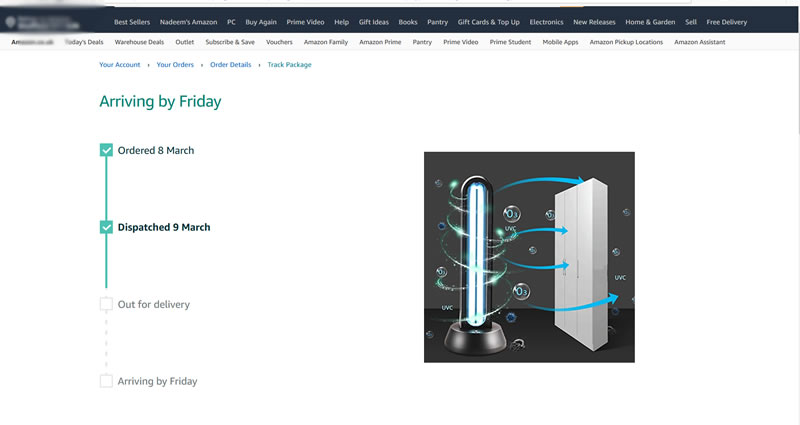

Your out of disposable gloves analyst and still waiting for the UV-C lamp from China to land.

The whole of this extensive analysis was first been made available to Patrons who support my work - US and UK Coronavirus Trend Trajectories vs Bear Market and AI Stocks Sector

- Paying the Price for Acting Too Late

- UK Coronavirus Trend Trajectory - Deviation Against Forecast

- US Coronavirus Trend Trajectory - Deviation Against Forecast

- Coronavirus Stock Market Trend Implications

- Coronavirus Global Recession 2020

- Existing Stock Market Trend Expectations

- AI Stocks Q1 Buying Levels Current State

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.