What’s Next for Crude Oil Price?

Commodities / Crude Oil Apr 26, 2020 - 05:41 PM GMTBy: Nadia_Simmons

From the unimaginable lows, crude oil is shaking off the dust. Moving higher, can it rise like a phoenix?

Before moving to the technical part of today’s analysis, it seems that a quote from yesterday’s Oil Trading Alert would be appropriate:

Crude oil was just trading below 0. Well, not completely, but the nearest futures contract was trading below 0 for the first time ever.

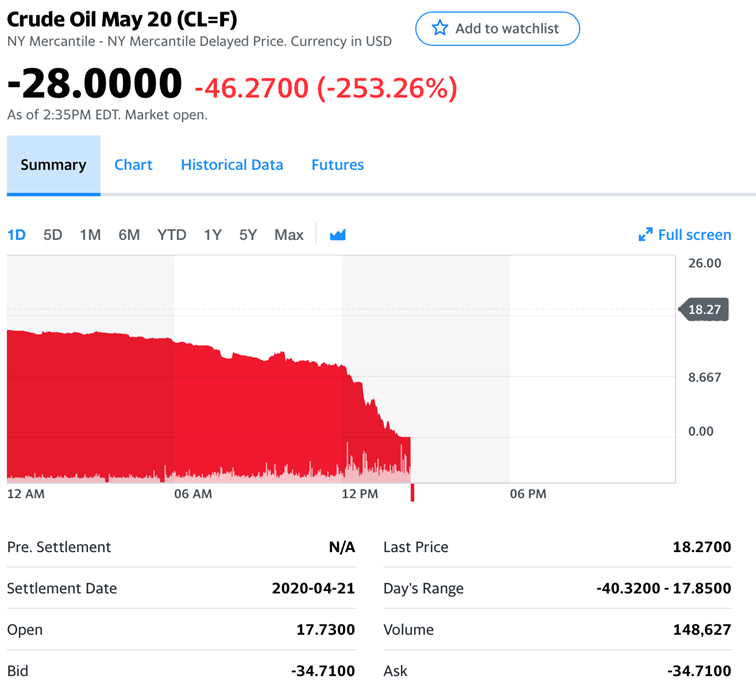

In case you missed it, here’s the screenshot from finance.yahoo.com and yesterday’s price quote as it was falling.

Crude oil was just trading below 0. Well, not completely, but the nearest futures contract was trading below 0 for the first time ever. Ridiculous, right? Well, yes, and no. It’s not that ridiculous if you take into account bigger supply due to earlier OPEC+ disagreement and lower demand due to Covid-19. Producers have to produce crude oil on a daily basis, because shutting down production is costly. One cannot store oil just anywhere and the facilities designed for it were already getting full. This means that people were unwilling to buy it, because it was not really possible to store it. To encourage people to buy it (and take delivery) anyway, producers paid extra instead of charging per barrel – more than $30 per barrel.

Sure, it was just the May contract, which expires today and the delivery is next month. The following futures contracts (the ones that expire in the following months) are priced at about $20 or higher. But will they be able to remain as high? The market thinks that the situation will somehow be resolved within a month. But will this really be the case? If not, we could see something similar once again.

Crazy times, and economic history in the making.

Since the situation in the futures market is too unclear right now, our chart analysis will focus on the most popular crude oil ETF, the USO ETF.

This is what we wrote in our yesterday’s Oil Trading Alert:

(…) What’s next?

Taking into account this month’s breakdown not only below the thin red line, but also below the last month’s low, we think that further deterioration may be just around the corner.

How low could the USO go if the sellers move on?

In our opinion, the first downside target will be around 3.36, where the lower border of the orange declining trend channel currently is. Nevertheless, if it won’t stop the bears, the next support could be around 2.90, which is where the lower border of the red declining trend channel currently is.

From today’s point of view, we see that the overall panic in the oil marked took the USO ETF not only to our downside targets, but also below both support lines.

After a fresh 2020 (and also an all-time) low of 2.31, the ETF pulled back quite sharply, which shows that the bulls were active around the mentioned price level. Thanks to this price action, the USO moved to the previously broken lower border of the red declining trend channel. Unfortunately for the bulls though, this could be just a verification of the earlier breakdown.

Should it be the case, another move to the downside and likely a fresh low (maybe even around 0.50-0.70), is a strong possibility.

Nevertheless, if the bulls show strength once again (similarly to their rebound from yesterday's lows) and manage to invalidate the above mentioned breakdown (closing the day above 2.90), an attempt to close the gap created at the beginning of yesterday's session wouldn’t surprise us.

Before summarizing, let’s keep in mind that the ETF rose in pre-market trading. Coupled with all the yesterday-discussed technical signs (the bullish divergences, indicators’ posture and the similarity to what we saw in the past) could trigger further improvement and a test of the lower (or even the upper) border of yesterday’s gap.

However, in our opinion, it is too early to say that the worst is already behind the bulls, the USO ETF and the oil market. The rush to open any positions can easily prove premature.

Summing up, while it seems that crude oil might drop some more before rebounding, it might also be the case that the short-term outlook turns bullish if crude oil successfully tests the previous lows. After Monday’s enormous and unbelievable profits in crude oil, it doesn’t appear that opening new positions right now is justified from the risk to reward point of view. Soon, it might be though.

If you enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Oil Trading Alerts as well as Gold & Silver Trading Alerts. Sign up now.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski

Founder, Editor-in-chief

Sunshine Profits: Gold & Silver, Forex, Bitcoin, Crude Oil & Stocks

Stay updated: sign up for our free mailing list today

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.