Crude Oil Prices Go NEGATIVE! What's Next?

Commodities / Crude Oil May 02, 2020 - 12:51 PM GMTBy: Nadeem_Walayat

Negative oil prices is another corona consequences that no one saw coming. A 30% drop in world oil demand due to the corona lockdown's resulting in demand falling to 70m barrels per day, whilst the producers are pumping out over 90mbd meant that storage faculties had become saturated, thus nowhere to transport new supply to.

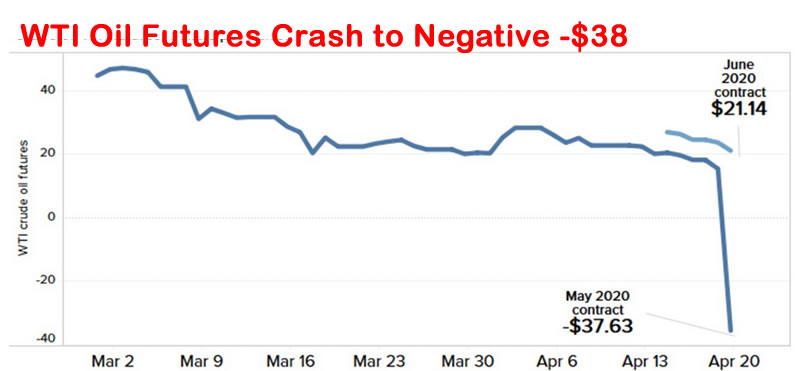

What actually triggered the collapse was the expiry of May NYMEX oil futures contracts on the 20th of April for DELIVERY in MAY. Only problem is given the lockdown no one wants to take delivery for May, as there's nowhere to put hundreds of thousands of more barrels of crude oil into storage. So those who usually are expected to take delivery were not buying into expiry which left traders LONG futures contracted who never intended on taking delivery but were just trading the futures, to panic sell to try and liquidate their positions into expiry at any price which given that there weren't many buyers sent the price NEGATIVE i.e. traders LONG oil futures were willing to PAY buyers to take delivery. An unprecedented event in the oil markets.

It would be like your local petrol station paying YOU to fill up your car at their pump!

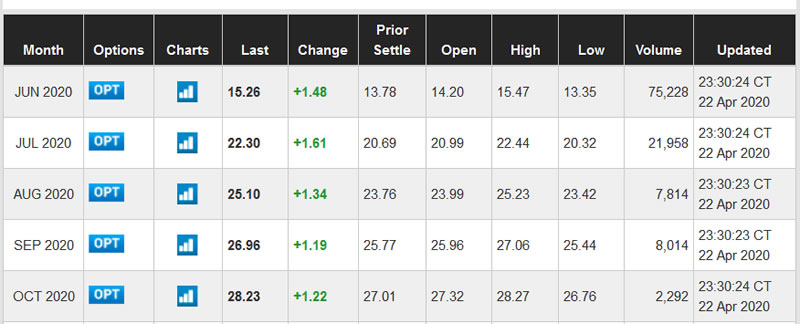

Negative oil prices whilst being a shockingly an unpremeditated event, and whilst there is a great deal of uncertainty in the markets nevertheless it should be temporary as open interest dries up and many futures traders avoid ending up in a similar position at the next futures expiry around the 20th of May as the current futures prices already illustrate.

However, there is still the issue of producers producing oil that no one wants to buy, which means prices going negative again is more probable than not.

This unprecedented event also confirms my message of several years primarily as a consequence of the climate change megatrend which is to disinvest from the oil sector, this industry is going to continue to experience more pain with or without covid-19 lockdown's..

This also flags a potential issue with ETF's that track the oil price like USO being forced to take delivery, and I would not be surprised if it could even cease trading, which is another reason why I generally prefer not to invest in funds but rather individual stocks because instead of reducing risks as the investors assume, they in fact INCREASE risks at times of crisis.

So what's next for oil prices?

In terms of price the trading range is $20 to $29 as I imagine a lot of supply destruction is taking place below $20, in fact I suspect anything below $40 is destroying supply. Which means that the oil price should resolve to it's trading range of $20 to $30 from the current $13. However that does not include the front month going into expiry i.e. June which could go negative once more as likely most western nations will remain locked down into late May and thus far more supply than demand and storage.

Fundamentally, the corona depression means that the supply far exceeds demand for crude oil price, so unless there is a supply shock where OPEC cuts production by a further say 20% then it's going to be difficult to see crude oil price going anywhere north of $30 anytime soon.

Again in terms of the big picture this just confirms to avoid oil stocks at all costs! No matter how enticing the collapse in their prices looks, just as they might have looked to all those who were tempted into buying oil stocks during March, only to see them go cheaper still during April.

The rest of this analysis has first been made available to Patrons who support my work: Is the Stock Market Correct to Ignore The Great Coronavirus Economic Depression?

- Rabbits in the Headlights

- Paving the Way for War with China

- The Coronavirus Greatest Economic Depression in History?

- Crude Oil Prices Go NEGATIVE!

- UK Coronavirus Catastrophe Current State

- US Coronavirus Catastrophe Current State

- Stock Market Implications and Forecast

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.