Coronapocalypse and Gold - How High Is Too High for the Yellow Metal?

Commodities / Gold & Silver 2020 May 10, 2020 - 04:38 PM GMTBy: Arkadiusz_Sieron

$2,000, $5,000 or even the Jim Rickard’s $50,000 as the next target for gold. How realistic are these figures – could we see the yellow metal at $5,000 or even higher amid the coronavirus crisis? We invite you thus to read our today’s article and find out how high gold prices can go in this downturn.

The first quarter of 2020 was clearly positive for the gold market, as the chart below shows. The yellow metal gained 6.2 percent from December 30, 2019 to March 31, 2020, moving from $1,515 to $1,609. In April, the bullion went up even further to $1,693, increasing gains to 11.7 percent in 2020 (as of April 17).

Chart 1: Gold prices (London PM Fix, in $) in 2020.

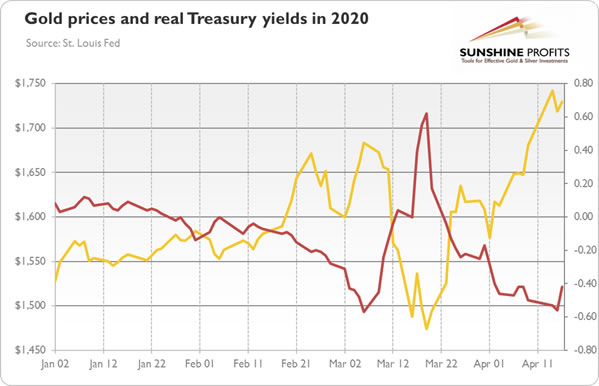

The obvious reason for this bullish move was the COVID-19 pandemic and the resulting shutdown of the global economy. As a result of the coronavirus shock, most of the major drivers of the gold prices improved. In particular, the real interest rates, as measured by yields on the 10-year inflation-indexed Treasuries, dropped, plunging into negative territory. As one can see in the chart below, gold prices behaved like a mirror image of the real government bond yields.

Chart 2: Gold prices (yellow line, left axis, London PM Fix, in $) and real interest rates (red line, right axis, in %, yields on 10-year inflation-indexed Treasuries) in 2020.

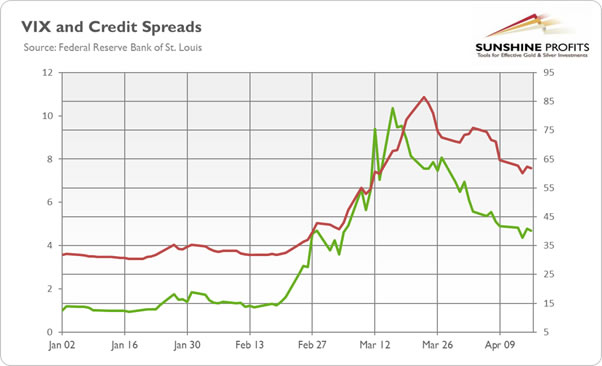

Moreover, the risk premium also surged, which supported safe-haven assets such as gold. As the chart below shows, credit spreads greatly widened, while the CBOE Volatility Index skyrocketed.

Chart 3: CBOE Volatility Index (green line, right axis, index) and ICE BofAML Option-Adjusted Spreads (red line, left axis, %) from January 2 to April 16, 2020

Some people complain that gold’s performance has been rather shy given the depth of the negative economic shock. Well, it’s true that gold has not rallied so far, but achieving almost 12-percent gain when almost all assets plunged makes gold one of the best performing asset in 2020, if not the best.

Gold prices did not soar further because of two factors. First, just as in the immediate aftermath of the Lehman Brothers’ collapse, investors started to liquidate gold holdings in order to raise cash. But when the dust settles and the sell-off inevitably ends, the yellow metal will have a cleared path upward.

Second, the US dollar appreciated amid the coronavirus crisis, as the chart below shows. The greenback is also seen as the safe haven during crashes, so investors switched their funds from all over the world and put them into the US-dollar denominated assets. Given the strong negative correlation between the greenback and gold, the appreciation of the dollar exerted downward pressure on the gold prices. However, gold and greenback can both appreciate during the financial crises, as it was the case in early 2009. Importantly, the surge in the US fiscal deficit and public debt may weaken the dollar in the longer run.

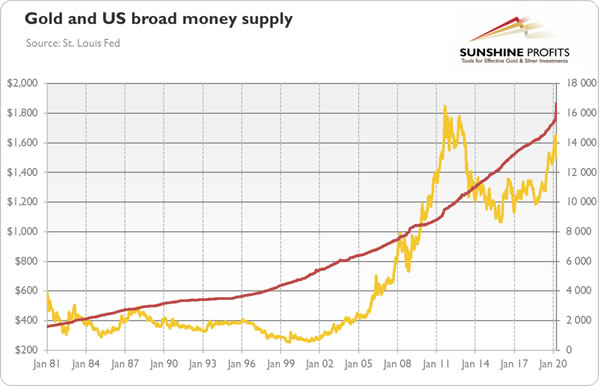

OK, we know what happened, but what’s next for the gold market? Will the price of gold quickly rally to $5,000 or more, as some analysts claim? No. It’s true that the Fed’s balance sheet is going to balloon, and the money supply will soar, but there is no correlation between the money supply and gold prices. As you can see in the chart below, the broad money supply has been rising since the 1970s (the data series we got unfortunately starts only in the 1980s), when Nixon closed the gold window, but the price of gold has not – instead, the yellow metal experienced bull and bear cycle.

Chart 4: Gold price (yellow line, left axis, London PM Fix, in $) and the US M2 money stock (red line, right axis, in billions of $) from January 1981 to March 2020

The ratio between the fiat money supply and gold’s supply is no simple formula for gold’s fair value. You see, the claims that the soaring money supply could push gold prices to a dozen or even tens of thousands dollars are based on the assumption that the global economy will return to the gold standard (then, the price of gold would have to indeed increase to “replace” the value of all demonetized paper money), which is highly unlikely, no matter whether we sympathize with the idea (we do) or not.

Let’s move now to the aftermath of the Great Recession. The price of gold increased 244 percent, from $775 on September 15, 2008 to $1,895 on September 5, 2011. So, if history replays itself, the price of gold could increase to about $4,140. However, it was not a quick rally, it took three years for gold to reach the peak. And history never repeats itself, but only rhymes: remember that it always easier to rise when you start from lower levels.

Does it mean that we are bearish on gold? Not at all. Of course, there is a risk for gold outlook that the pandemic will be quickly contained and the economic growth will swiftly rebound. However, we think that the V-shaped recovery is unlikely. Social distancing will not disappear in one day. You see, the pandemic is not confined in time and space like a hurricane or a terrorist attack. The coronavirus will linger through the year (or even longer, according to Michael Osterholm, an infectious-disease epidemiologist at the University of Minnesota). The problem is that people still do not understand that this epidemic is not a matter of just weeks.

And there are significant downside risks for the economy, which – if they materialize – could push gold prices even further up. In particular, there might be a feedback loop in the financial system that could culminate in a systemic financial crisis. We believe that many analysts underestimate the possibility of further repercussions, hoping for a quick rebound. Remember 2007? Economists believed then that the problems would be limited to the subprime mortgage market and wouldn’t affect the whole economy. Yeah, right.

However, even if the quick recovery happens, the low interest rates, dovish central banks and high debt will stay with us, which would support the gold prices. Thus fundamentally, the coronavirus crisis is very positive for the gold prices, and the outlook for the yellow metal in 2020 has clearly improved compared to a few months ago.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.