The Great Stock Market Disconnect

Stock-Markets / Stock Markets 2020 May 11, 2020 - 09:38 PM GMTBy: Andre_Gratian

SPX: Long-term trend – We are in an official bear market

Intermediate trend – re-testing April high

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Daily market analysis of the short-term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please go to www.marketurningpoints.com and request a trial.

The Great Disconnect

Point & Figure Overview of SPX

Intermediate trend: Re-accumulation suggests ~2970

Important Cycles

Next 80-day cycle due ~6/08

Market Analysis (Charts courtesy of QChart)

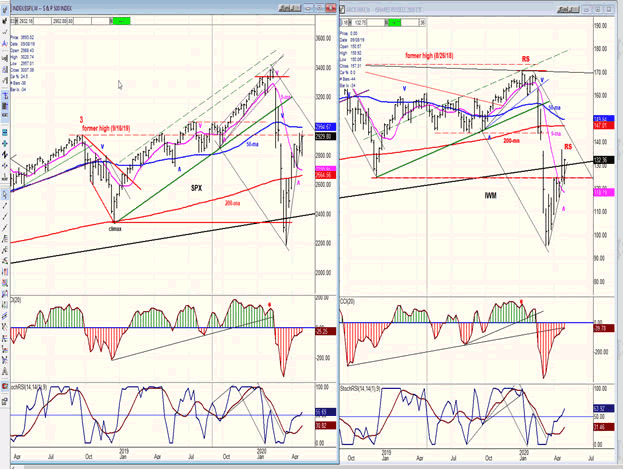

SPX-IWM weekly charts

On Friday 5/8, the labor dpt. released a horrific jobs report! SPX celebrated by tacking a 49-point advance on top of the 33-point rally that it had registered on Thursday. This glaring disconnect can be explained by the fact that investors are looking at this economic devastation as a temporary annoyance which the country has to live with for the next three to six months, after which the virus will go away and it can get back to normal! This rosy scenario is undoubtedly much too optimistic given all the uncertainties that lie ahead, and it has, to some extent, been fostered by bullish cycles which should turn negative in the near future. So, let’s try to be a little more objective about what could materialize between now and the middle of the year.

After retracing during the previous week, the two indices have rallied and, by Friday’s close, they were re-testing their near-term highs. Cycles suggest that a top could form by ~ 5/15. Relative weakness continues to prevail in IWM.

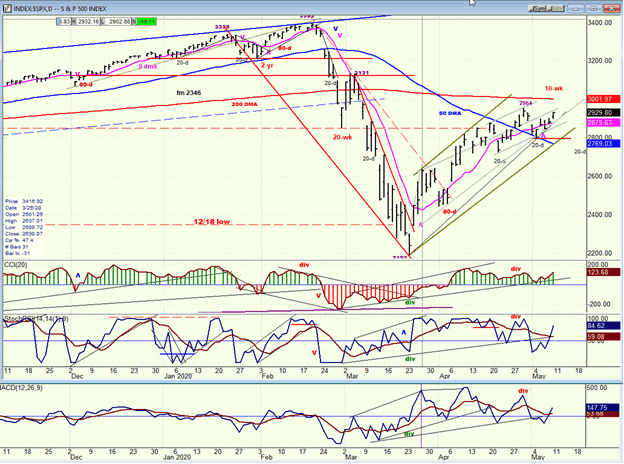

SPX daily chart

On Friday, SPX spurted to 2932 in the last hour of trading and closed at 2929, returning to the level which had been suggested as the high of the countertrend rally from 2192. While this could simply be a re-test of the high of 2955 which occurred a week ago, a slight adjustment to the former projection now targets about 2970, and the strength displayed on Friday supports the new projection. I suspect that a high could come early next week, but we may not be fully ready to put an end to the countertrend rally and have a clean reversal until around May 15.

As discussed earlier, investors may be a little too optimistic about the duration of the economic recovery, and if we indeed put in a top in the next week or two and start the next phase of the correction, it could last until the middle of the year, re-test the 2192 low, and perhaps even exceed it.

I’ll wait until a top is firmly established to venture a P&F projection, but we could already get an inkling of what lies ahead. The first decline amounted to about 45% of the entire bull market from 2009. Since a normal trend retracement is from .382 to .50 of the previous up-trend, even if this is wave 4, the market could decide on a 50% retracement, leading to a new low of about 2025.

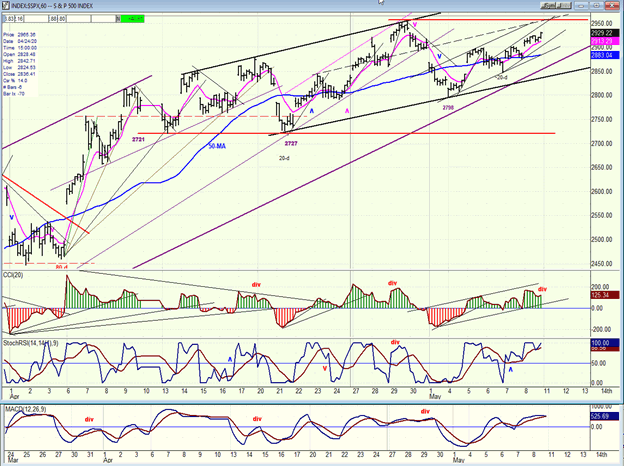

SPX hourly chart

While SPX closed strong on Friday, that last push into the close which registered a new high from 2798 was not matched by a new high in the CCI, thereby creating some negative divergence. This is always a warning sign that we could be at, or close to the end of a move.

There is a fairly consistent minor cyclic rhythm displayed in the hourly chart. At times it is easier to discern than at others, but divergence in the CCI is normally a sign that we are at, or close to, the top of the cycle phase – providing it is not erased by the next move in the index. The fact that it displayed on Friday suggests that we should be on alert early in the week for a minor top which, if the 2970 level is reached or approximated on Monday or Tuesday and the negative divergence remains in place, we should next look for the short-term trend line from 2798 to be broken. That would most likely give us a sell signal, especially if the index goes on to break the longer trend lines below it.

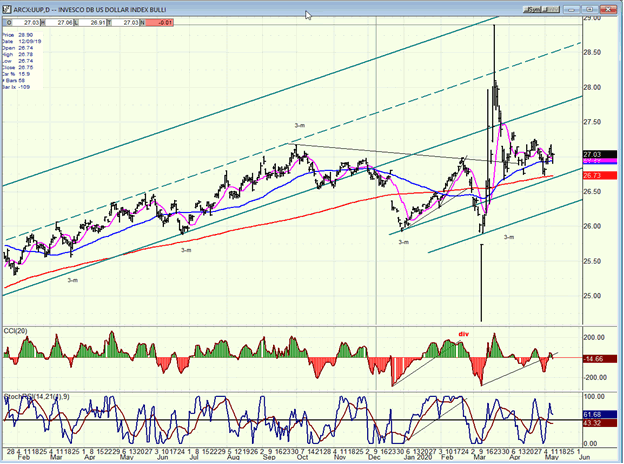

UUP (dollar ETF) daily

UUP continues to trade in a narrow range, but as it gets closer to its 3-m cycle low it should begin to succumb to some selling pressure.

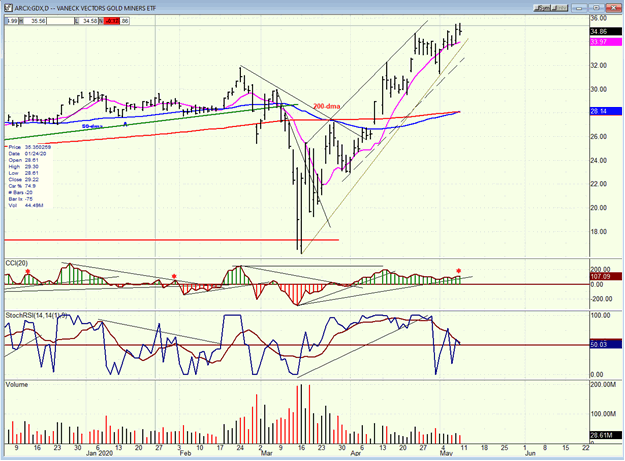

GDX (Gold miners ETF) daily

This may be the last chance for GDX to extend its move. If it does, it can reach 37.50 but if it begins to roll over and the CCI goes negative, it will have started a correction phase.

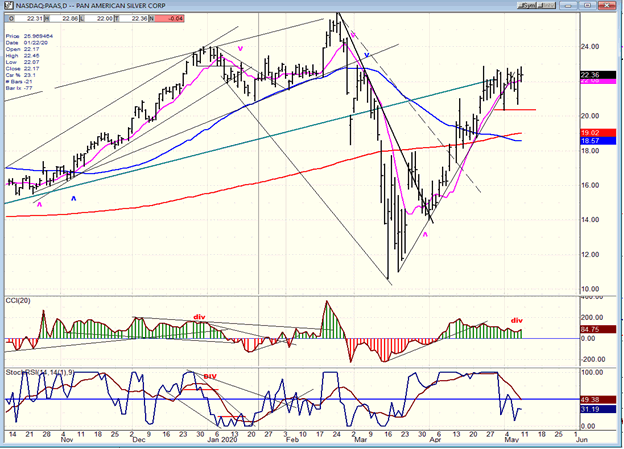

PAAS (Pan American Silver Corp.) daily

Ditto for PAAS which continues to trade in tandem with GDX.

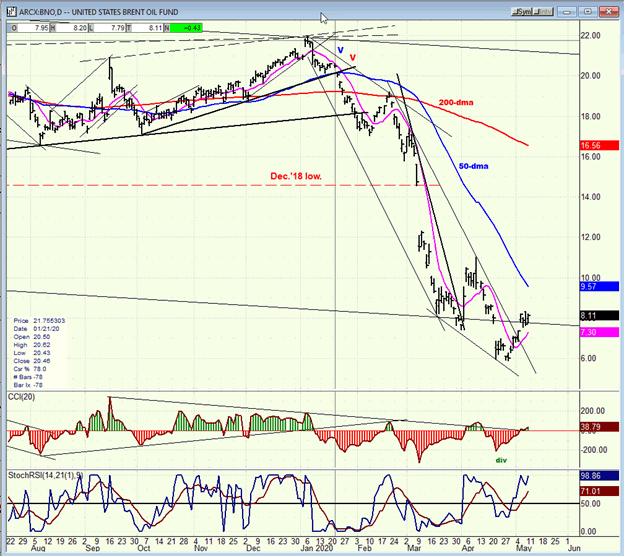

BNO (U.S. Brent oil fund) daily

BNO is likely to be limited to the formation of a base for the foreseeable future.

Summary

The stock market is following its own logic, or rather collective investor logic which must be observed, no matter how disconnected it appears to be from what we perceive as reality. Technical analysis of SPX suggests that it could be in the process of ending the counter-trend rally which started from 2192.

Andre

FREE TRIAL SUBSCRIPTON

For a FREE 4-week trial, send an email to anvi1962@cableone.net, or go to www.marketurningpoints.com and click on "subscribe". There, you will also find subscription options, payment plans, weekly newsletters, and general information. By clicking on "Free Newsletter" you can get a preview of the latest newsletter which is normally posted on Sunday afternoon (unless it happens to be a 3-day weekend, in which case it could be posted on Monday).

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.