An Economic Renaissance Emerges – Stock Market Look Out Below

Stock-Markets / Stock Markets 2020 May 17, 2020 - 01:25 PM GMTBy: Chris_Vermeulen

Our researchers believe the US stock market has potentially ended the “relief rally” phase where the US Fed stimulus pushed prices off the recent lows and upward towards key Fibonacci retracement levels and will soon engage in a new price exploration phase. We believe this new phase will attempt to properly value the “solvency” question that has become one of the top discussions for our researchers.

The Solvency question equates to this simple issue… How can individuals, companies, states, and other entities continue to operate with greatly reduced income/revenues, moderately high debts, and liabilities throughout a process of an extended shutdown? Certainly, the option of adding more debt to ease the short term pain of lost revenues may be a solution, but we believe this issue is much bigger than these traditional short term solutions. We believe the COVID-19 virus event is presenting a shift in traditional thinking for many economists, individuals, and enterprises.

That shift may be the beginning of a transition away from 19th-century economic thinking/operations and into a more effective transitional process that may take 10+ years to completely rebuild the global economy into a 21st-century powerhouse. This process requires the destruction of old, faulty, and ineffective processes that have become a massive liability for individuals, companies, states, and other entities as well as an “awakening” moment for many technical investors. This is not the same market we experienced over the past 40+ years.

This transition may force states, local governments, corporations and thousands of other enterprises to rethink how they run their accounting as well as what a recovery process really looks like. We believe it certainly does not include the traditional liabilities, asset valuation levels, and ongoing enterprise-level engagement we experienced over the past 25+ years. Things will change because revenue/income, as well as future economic expectations, must be altered to address the post-COVID-19 world. We believe the next phase of the markets will be a revaluation phase that will likely include a “double-dip” bottom set up – as we’ve been predicting for over 8+ weeks.

Before you continue, be sure to opt-in to our free-market trend signals before leaving this page, so you don’t miss our next special report & signal!

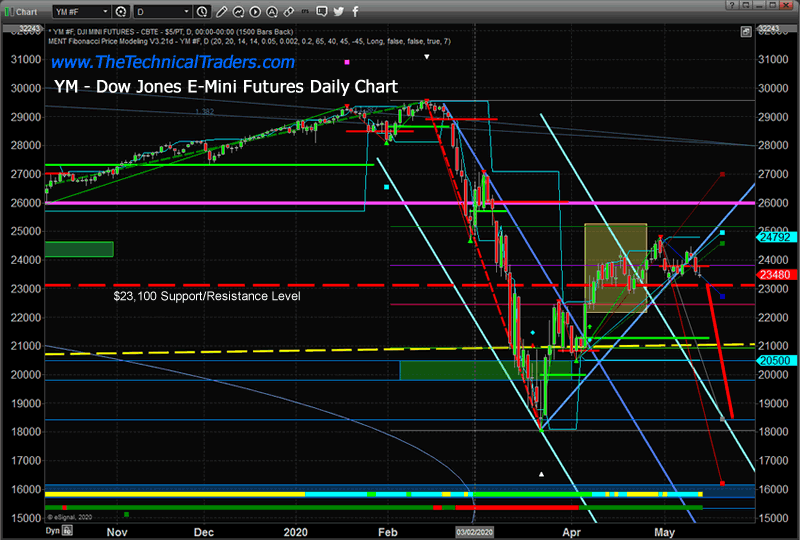

Dow Jones E-Mini Futures Daily Chart

This Dow Jones E-Mini Futures Daily chart suggests the critical Fibonacci level, near $23,100, is a key price support level for the US stock market. Once this level is breached, we believe a new downward price trend will set up quickly and result in a moderately deep downside price move that may retest recent lows near $18,000.

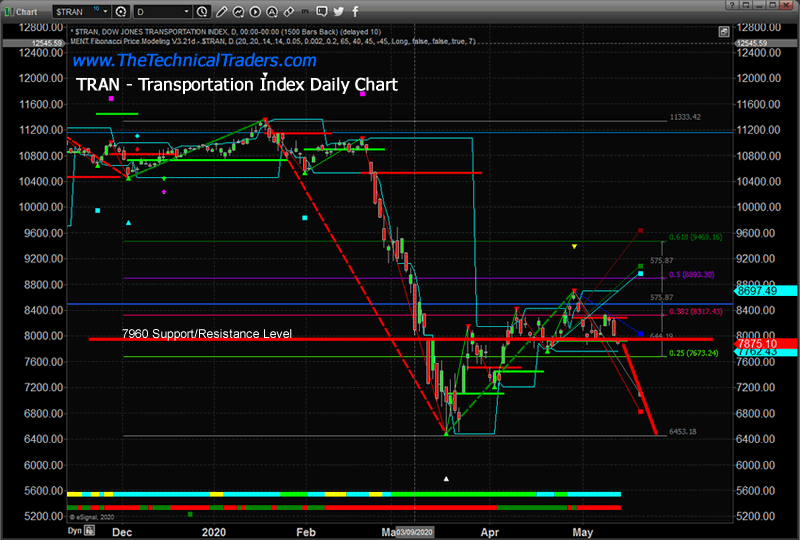

Transportation Index Daily Chart

This Daily Transportation Index chart highlights another critical price support level near 7960 which has already been breached. We believe the Transportation Index and the Mid/Small Cap US stock market indexes have illustrated a very clear breakdown in prices over the past 14+ days and we believe the broader US stock market is setting up for another downside price collapse as the reality of the future global economic recovery sets in.

As we’ve suggested, we believe the process of the post-COVID-19 recovery will be very eventful. We continue to believe the process of the recovery will likely result in a difficult and painful process of shedding economic liabilities as revenues/income continue to falter for state and local governments as well as individuals and corporations. We believe the process that will likely unfold over the next 24+ months will be one where taking on more debt is an unwise solution given the foundational shift that is likely taking place within the global markets.

Emerging markets may be one of the first segments of the global markets to push this shift into momentum. Eventually, we believe, the broader global market will follow this shift and begin to realize that we can’t simply print money to solve these economic issues. A true 21st century economic Renaissance is likely to take place in the future. We believe this is the only real solution given the policies and processes that have taken place over the past 20+ years.

We would suggest reading this research post to gain a better understanding of our thinking and see the type of predictions like this market crash we called well in advance.

If you want to improve your accuracy and opportunities for success, then we urge you to visit www.TheTechnicalTraders.com to learn how you can enjoy our research and our members-only trading triggers (see the first chart in this article). If you are managing your retirement account or 401k, then we urge you to visit www.TheTechnicalInvestor.com to learn how to protect your assets and grow your wealth using our proprietary longer-term modeling systems. Our goal is to help you find and create success – not to confuse you.

Our researchers will generate free research on just about any topic that interests them. As technical traders, we follow price, predict future price moves, tops, bottoms, and trends, and attempt to highlight incredible setups that exist on the charts. What you do with it is up to you. Visit www.TheTechnicalTraders.com/FreeResearch/ to review all of our detailed free research posts.

In closing, we would like to suggest that the next 5+ years are going to be incredible opportunities for skilled traders. Remember, we’ve already mapped out price trends 10+ years into the future that we expect based on our advanced predictive modeling tools. If our analysis is correct, skilled traders will be able to make a small fortune trading these trends and Metals will skyrocket. The only way you’ll know which trades to take or not is to become a member.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.