Precious Metals Hit Resistance

Stock-Markets / Stock Markets 2020 May 27, 2020 - 11:45 AM GMTBy: Jordan_Roy_Byrne

The precious metals sector may have begun a correction on Wednesday.

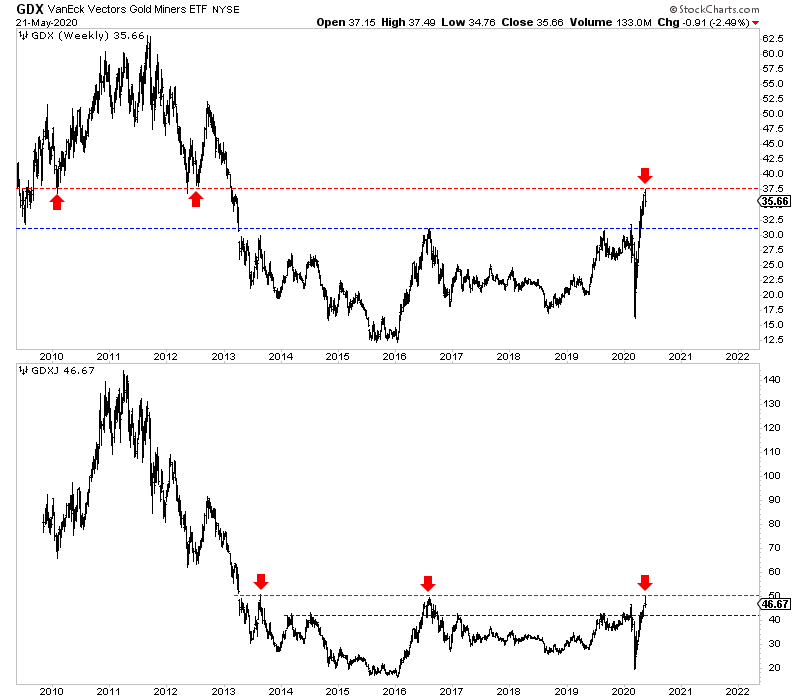

The miners (GDX, GDXJ) sold off after reaching significant resistance levels while the metals are trading just below significant resistance levels.

We mentioned these targets in our article last week.

GDXJ has pulled back a bit after testing 7-year resistance while GDX has pulled back after hitting a key pivot point and 50% retracement of the bear market.

GDX & GDXJ Weekly Bars

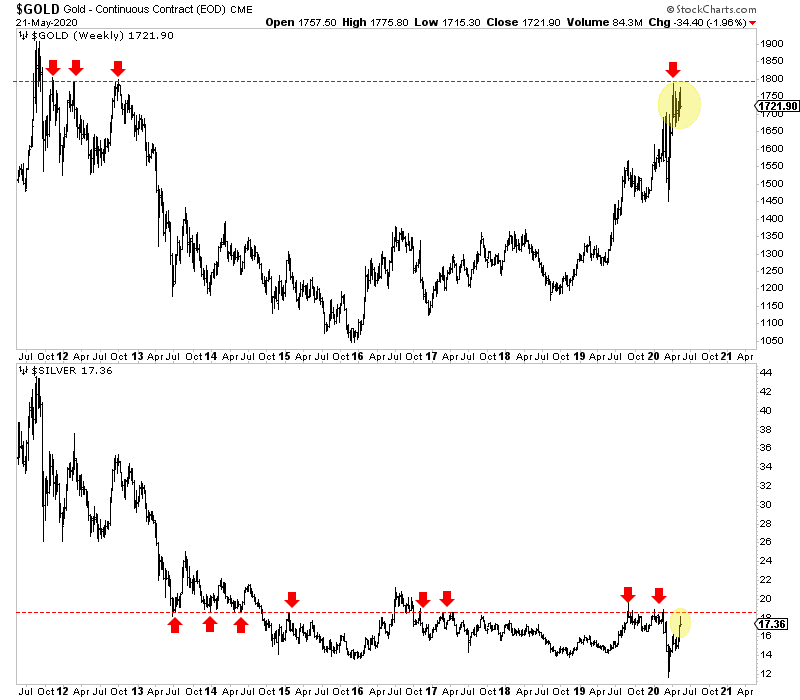

The metals (Gold & Silver) have yet to hit resistance at $1800 and $18.50, but we can call it close enough.

The chart below shows Gold battling resistance in the $1750 to $1800 range, while Silver has traded up into the $18 to $18.50 range. The resistance around $18.50 is hugely significant.

Gold & Silver Weekly Bars

The miners often lead the metals at various points, and it’s possible Gold and Silver could push up to $1800 and $18.50, even as miners correct or consolidate.

In the larger picture, GDX remains in breakout mode with a measured upside target of $50. A retest of previous 7-year resistance around $31-$32 would be healthy and normal.

Meanwhile, a correction in GDXJ could set up the next move, an advance through 7-year resistance at $49-$50. GDXJ traded as low as $45.80 Thursday. There is gap support at $43, and $42 marks a retest of previous resistance dating back to 2013.

In a bull market and especially one in precious metals, you do not want to trade in and out. You will make the most money by buying the best stocks and holding.

Now isn’t a time to buy.

If we are wrong and the sector continues to push higher, then that would not be time to buy either as the following correction would be more severe than the potential one, which started Wednesday.

Here’s what to do.

If you are fully invested or close, hold your positions.

If you missed this rebound and have waited for a correction, then start paying closer attention. Wait for the market to approach the support, as mentioned earlier, and then pounce on your favorite stocks.

We continue to focus on identifying and accumulating the stocks that have significant upside potential over the next 12 months.

To learn the stocks we own and intend to buy during the next correction that have 3x to 5x potential, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.