What Huge US Jobs Number Means For Your Market Positions

Stock-Markets / Stock Markets 2020 Jun 10, 2020 - 04:37 PM GMTBy: Chris_Vermeulen

The Huge Non-Farm Payroll number released on Friday, June 5th, shocked the market. A massive 2.5 million jobs were created in May 2020. If you were paying attention to the data, you’ll also understand that 1.87 million new jobless claims just last week. In fact, over the month of May 2020, a total of 12.58 million jobless claims were filed. Taken into consideration, the new jobs created in May represent less than 20% of the total job losses over the same span of time.

Our researchers believe the jobs number is representative of a phased reopening of many US states and correlates directly with the extended opportunity for further re-engagement of the US economy over time. The current social unrest taking place throughout the US will likely result in a new spike in COVID-19 cases as well as extended losses for certain businesses.

The rioting seems to be taking place in more populated states right now – which suggests some real concerns for many of these states in regards to scheduled reopening phases and the potential for a spike in COVID-19 cases.

Before you continue, be sure to opt-in to our free-market trend signals before closing this page, so you don’t miss our next special report!

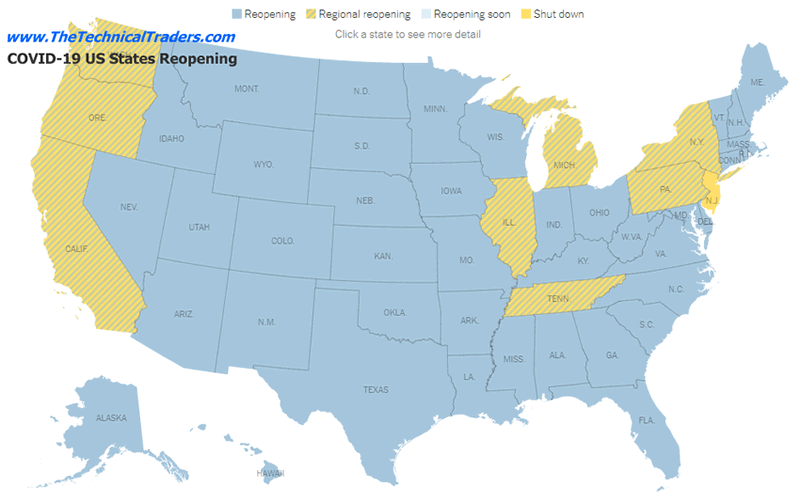

US MAP – STATES REOPENING STATUS

As you can see from the US map, below, the number of states that have started to reopen over the past 30+ days exceeds the number of states still shutdown or partially open. Our researchers believe the migration of the protesters from state to state as well as the continued unrest throughout the US may prompt a new spike in COVID-19 cases – particularly within states that have had the highest transmission rates and are more populated than other states.

US NON-FARM PAYROLL MONTHLY

The May 2020 Non-Farm Payroll number is a welcome positive surge after many months of negative data. Still, as we suggested near the start of this article, the 2.5 million new jobs created did not offset the 12.58 million jobs lost in May 2020. Anyone capable of doing simple accounting can figure out that we need to see more continued new job creation levels to begin to offset the massive layoffs and job losses as a result of the COVID-19 shutdown event.

The US Stock market is hungry for any positive news right now, so the markets look at this data as a very positive sign that a recovery will happen and could be a stupendous opportunity for future growth. Our researchers are still very cautious about this recovery simply because the underlying data is still very negative overall.

US JOBLESS CLAIMS – WEEKLY

As you can see from this Weekly Jobless Claims chart, below, the spike in new jobless claims happened in early April 2020 with 6.86 million new jobless. Since then, the number of new jobless has continued at levels greater than 2 million per week and have slowly been decreasing. We are aware that many states are reducing state and educational employment budgets as a result of the COVID-19 virus event. These budget cuts and layoffs may continue throughout all of 2020 and into 2021 unless a strong recovery event takes place before the end of 2020.

State budgets and the continued risks of a COVID-19 case spike present very real concerns in the minds of our researchers as we have just begun the initial reopening phases for many states. If our presumptions are correct, the social unrest and rioting may prompt a major spike in COVID-19 cases across many states and present a very real extended shutdown event that could last well into late-Summer.

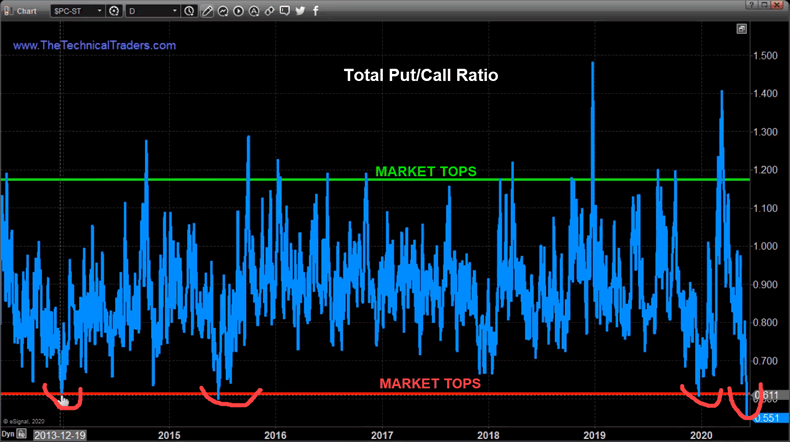

PUT/CALL RATIO – DAILY

This next chart suggests there is “No Fear” in the markets right now as investors pile into the long trades. This Put/Call ratio chart highlights one simple fact that the market can stay irrational for much longer than many traders can handle.

The Fed intrusion into the markets on March 20, 2020, created a bullish foundation in the markets. Traders have piled into this bullish trend over the past 45+ days and this Put/Call chart highlights how extended the rally has gotten recently. Normally, the extremely low levels on the Put/Call chart would suggest a massive market top setup is about to happen – yet, traders may push the markets further into an irrational bullish phase with their exuberance.

We put together a short yet detailed video that will open your eyes to what the market data and charts are pointing to. If you are short the market of having FOMO (Fear Of Missing Out) on this rally be sure to click and watch this video right after you finish this article.

Concluding Thoughts:

The reason we stay cautiously related to this bullish price trend in the US stock market is that we believe technical patterns have already set up that suggest a downward price cycle must complete before the bottom in the markets is settled. In Part II of this article, we’ll go over additional charts and data to help you plan for and prepare for the next big move in the markets.

If the markets are able to push much higher after today’s big jobs number, we urge all long/bullish traders to lock in gains with protective stops and to adopt a very cautious outlook going forward. It appears the markets have over-extended this rally and we are still very concerned that a sudden breakdown in price will happen.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is an incredible year for traders and investors. Don’t miss all the incredible trends and trade setups.

Subscribers of my Active ETF Swing Trading Newsletter had our trading accounts close at a new high watermark. We not only exited the equities market as it started to roll over in February, but we profited from the sell-off in a very controlled way with TLT bonds for a 20% gain. This week we closed out SPY ETF trade taking advantage of this bounce and entered a new trade with our account is at another all-time high value.

Ride my coattails as I navigate these financial markets and build wealth while others watch most of their retirement funds drop another 35-65% during the rest of this financial crisis going into late 2020 and early 2021.

Just think of this for a minute. While most of us have active trading accounts, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during the next bear market, you could lose 25-50% or more of your net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how. One of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position but we do have a way for you or your advisor can take advantage of the market gyrations with our Technical Wealth Advisor investing signals.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Passive Long-Term ETF Investing Signals which we issued a new signal for subscribers.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.