Stock Market S&P 500 ADL Predictions

Stock-Markets / Stock Markets 2020 Jun 17, 2020 - 05:40 PM GMTBy: Chris_Vermeulen

Our research team authored an article suggesting that our Adaptive Dynamic Learning Predictive Modeling system indicated the US major markets were 12% to 15% overvalued on May 23, 2020. This was just before the last “euphoric” phase of the recent rally took began the week after our prediction. From the date of May 23, 2020, to the recent peak in the markets, the SPY rallied another 9.72% above the price levels when we made the ADL prediction. This suggests that the major markets rallied to levels near 21% to 24% overvalued near the recent peak.

Please take a moment to review our original ADL article here: https://www.thetechnicaltraders.com/predictive-modeling-suggests-us-markets-12-over-valued/

In keeping with our research team’s conclusions, the downside price move that initiated on Wednesday, June 10, 2020, after the US Fed statements, and really broke down on June 11, 2020, will likely continue resulting in the US major markets attempting to find support near our ADL predictive modeling system levels. The downside price trend could extend below our ADL price target levels if the selling in the markets pushes into an extreme selling event. It is not uncommon for the price to attempt to move through the ADL price levels attempting to find support and/or resistance.

Before you continue, be sure to opt-in to our free-market trend signals before closing this page, so you don’t miss our next special report!

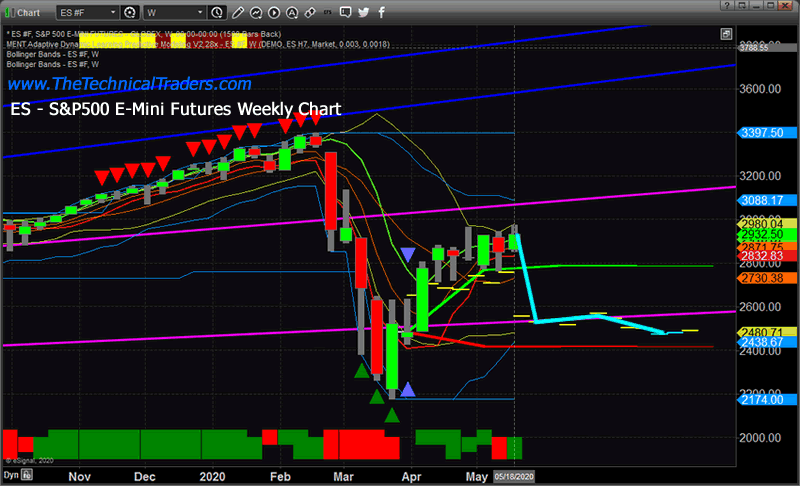

ORIGINAL ES ADL PREDICTED TARGET LEVEL WEEKLY

This is the ES chart showing our ADL predictive modeling system results from the May 23, 2020 date. You can see the ADL predicted price levels near 2520 on this chart and the fact that the markets rallied away from these levels in late May created what we call a “price anomaly”. This is when price moves away from the ADL levels in a manner that is somewhat unreasonable. The same thing happened during the peak price level in early February 2018 and the October peak in 2018.

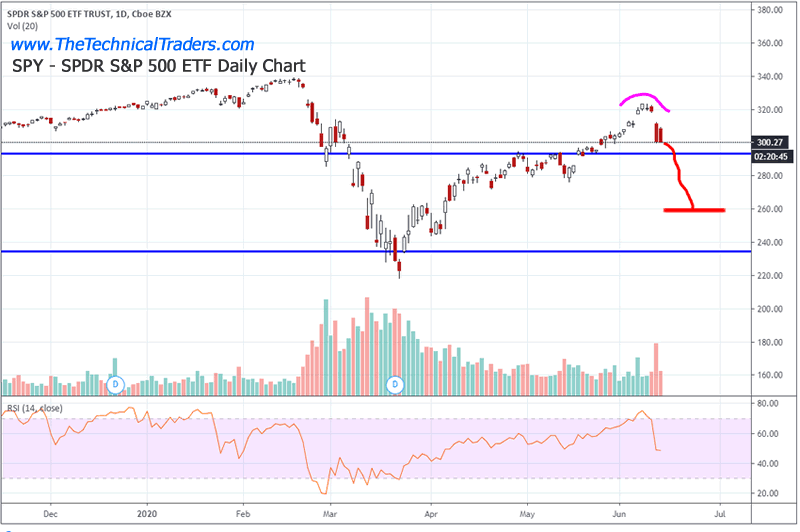

SPY ADL PREDICTED TARGET LEVEL DAILY

Based on our ADL predictive modeling system and the targeted price levels, we believe the SPY will fall to levels close to or below $260 over the next 10 to 15+ days. It makes perfect sense that the markets over-extended a speculative price rally based on the context that the US economy would rebound from the COVID-19 shutdown.

Now that the US Fed has deflated that expectation and the riots and other issues related to social and political events are pending, we believe a “sudden realization” within the markets could send the US stock market price levels much lower over the next 2+ weeks – eventually attempting to find support near recent lows.

We actually posted our technical forecast for the market crash, the 30% rally, and called this blow-off top and reversal 4 days before it happened in this video a while back.

Concluding Thoughts:

Remember, developing a winning strategy is not about trading every trend and day-trading every move, it is about timing your trades and strategically positioning your portfolio to take advantage of the “best asset now”. We’ve developed proprietary technology that assists us in determining the best assets to be invested in and our predictive modeling and other proprietary tools assist us in identifying confirmed trade triggers. Our objective is to assist our clients in generating consistent profits – not hundreds of trades.

If you were caught on the wrong side of this move recently, please remember that we tried to warn you of our multiple research articles and clear content. We’ve been warning that this upside rally was a speculative price move driven by foreign and US investors believing the V-shaped recovery was real. The reality of the situation is that this recovery is going to be much more volatile than many people believe. This is a global economic event – not just a Fed Blip or some other isolated panic volatility.

You better stay on top of these trends and risks in the markets to stay ahead of these bigger moves.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is an incredible year for traders and investors. Don’t miss all the incredible trends and trade setups.

Subscribers of my Active ETF Swing Trading Newsletter had our trading accounts close at a new high watermark. We not only exited the equities market as it started to roll over in February, but we profited from the sell-off in a very controlled way with TLT bonds for a 20% gain. This week we closed out SPY ETF trade taking advantage of this bounce and entered a new trade with our account is at another all-time high value.

Ride my coattails as I navigate these financial markets and build wealth while others watch most of their retirement funds drop another 35-65% during the rest of this financial crisis going into late 2020 and early 2021.

Just think of this for a minute. While most of us have active trading accounts, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during the next bear market, you could lose 25-50% or more of your net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how. One of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position but we do have a way for you or your advisor can take advantage of the market gyrations with our Technical Wealth Advisor investing signals.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Passive Long-Term ETF Investing Signals which we issued a new signal for subscribers.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.