In The Year 2025 If Fiat Currency Can Survive

Currencies / Fiat Currency Jun 30, 2020 - 05:40 PM GMTBy: Bob_Kirtley

Introduction

We are presently enduring a period of great change due to the Coronavirus which has already cost many lives and inflicted untold damage to the global economy.

Alongside the damage caused by this virus the world has also entered a recession having been through an eleven-year period of expansion.

To make matters worse many nations are shouldering massive debts raising questions about the possibility of debt defaults on a grand scale.

Today we are taking a peek into what the future might look like and it is not a pretty sight.

Issues For Consideration

There is a myriad of threats to our current way of life and the global economy which include but are not limited to:

Pandemics, Trade Wars, International Incidents, Social Unrest, Civil Rights Protests, Acceleration in the speed of change, Debt default, Confiscation of Assets, etc. Much has been written on the above-mentioned issues so today I would like to take a quick look at the issue of Debt and what might be in store for us over the next five years.

The US Dollar is currently the worlds reserve currency with many commodities such oil, copper, grains, gold, etc. being traded in the main for US Dollars. As the Dollar strengthens these commodities become cheaper and visa versa. Over the recent past and for a myriad of reasons governments and central bankers have seen it necessary to create more money in order to alleviate a problem, some real and some perceived. These debts are mounting on a daily basis, not just for the US but for many nations across the globe. The US debt according to the US Debt Clock is $26.1 trillion and the Debt to GDP ratio is 131%.

There are a few ways to deal with debt such as sustained economic growth which is unlikely given that we are in a recession. A hefty dose of austerity might help but given the current hardship that people are suffering I doubt if there is the political will to propose such a policy. A period of accelerating inflation could reduce the impact of this debt, however, attempts to ignite inflation by the authorities has not materialized. To summarize we are locked into a cycle of government spending and central bank money printing which will continue until the ‘Law of Diminishing Returns’ kicks in and at that point all confidence in our leaders and our financial system will dissipate into insignificance.

The US Dollar will be tested and may well lose its status as the worlds reserve currency; however, the other currencies are not in great shape and could suffer a similar plight. Where does this leave us one ponders, back to bartering and exchanging goods and services or will we see the emergence of a new asset backed currency. A new currency could take the form of paper exchangeable for a fixed amount of hard assets which could include the precious metals and maybe property and land.

It is hard to imagine just how this would be managed but without a solid backing a new medium of exchange would lack credibility.

A solution that I believe could work would a gold backed currency, or a gold backed type of Bitcoin. I am biased as I am a gold bug at heart and see gold as a segue into a more stable, disciplined financial system that the world could utilize with confidence.

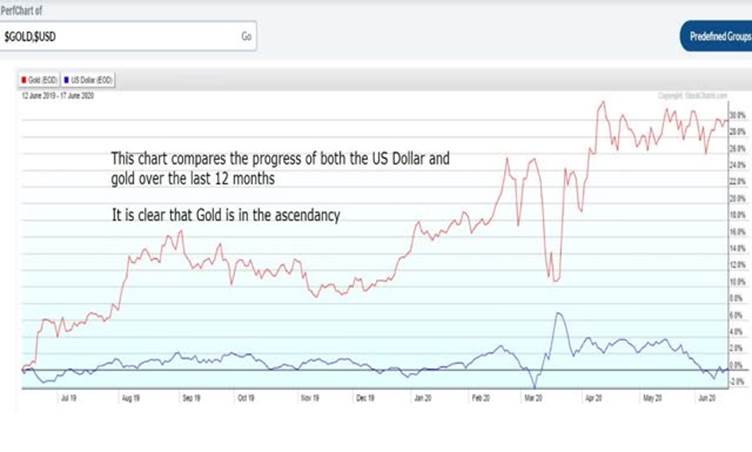

If we now compare the US Dollar to gold in terms of their performance over the last twelve months, we can see that the value of gold has increased by around 30% when measured against the Dollar. This could be an early indication of what is to come as the US Dollar loses its buying power and gold emerges as a candidate to fill that vacuum.

US Dollar and Gold Comparison Chart

Chart courtesy of Stockcharts

It is clear to me that something has got to give and so I am turning away from Fiat currencies such as the US Dollar and seeking refuge in hard assets. Land, property, and precious metals all have a part to play and will be of vital importance in the year 2025 as paper loses its fight for survival.

As investments physical gold and silver sit at the top of my list. As a speculation the gold and silver producers are worthy of consideration as they can generate spectacular returns if you can get the timing right. If your aversion to risk is cast iron, then you could consider a well thought out options trade where the risk is ever present, but the rewards can be awesome.

Conclusion

There is no doubt that the global economy is problematic, and the solution is not Quantitative Easing on steroids.

All Fiat currencies eventually attain their intrinsic value which is zero so look for alternatives to paper currencies.

Gold and silver can be acquired in small amounts and kept in your possession and not in the hands of the banks.

In the year 2025 Fiat currencies may not survive so protect yourself now by protecting at least some of your buying power for your future needs.

Take care.

Bob Kirtley

Email:bob@gold-prices.biz

www.gold-prices.biz

URL: www.skoptionstrading.com

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.