The Beatings Will Continue Until the Economy Improves

Economics / US Economy Jul 06, 2020 - 05:34 PM GMTBy: John_Mauldin

You can’t live without making certain presumptions. You presume your car will start, your refrigerator will stay cold, and the lights will turn on when you flip the switch.

In fact, you could argue this “predictability” is what separates advanced economies from primitive ones. Most of us don’t have to worry about being attacked in our sleep or having food tomorrow. That security frees us to do other things.

Right now, some basic assumptions are no longer safe. For example, we can’t travel or even go to a restaurant or visit friends without wondering about our health.

The economy will keep suffering until our assumptions are reliable again. Otherwise, we will have to replace them with new assumptions. In the long run (after The Great Reset in the late 2020s), I still foresee a wonderful new world. But we have to get there first.

Economists use the word “recovery” to define a rebound from the previous time period. So if there was a 30% drop, a 10% increase would, for an economist, be a “recovery.” But in the real world, it still means you are 20% below where you started.

Recovery doesn’t necessarily mean recovered. Even optimistic projections say we won’t see anything like 2019 GDP until late 2021. Many suggest it will be even longer.

Even then, the changes we will have to put into our operating business models, not to mention the massive amounts of capital that it will take to start new businesses or resupply old ones, will make the “recovered” economy look significantly different than that of 2019.

For the record, just because I am not optimistic about the speed of economic recovery does not mean that I am necessarily bearish on the stock market. When the Federal Reserve pumps $5 trillion (or whatever) into the system, it is going to find a home. While I think earnings will take a severe hit in 2021, the market could hold simply due to massive Fed support.

There have been numerous times when the economy and the stock market were out of sync. Don’t equate the two. The stock market doesn’t necessarily tell us anything about the economy, or vice versa.

What we can presume is that there will likely be at least a $1 trillion additional stimulus package before July 31 that extends the additional $600-a-week unemployment benefits for some period. There is some debate on the amount. I expect a further multitrillion-dollar stimulus/infrastructure bill before the election.

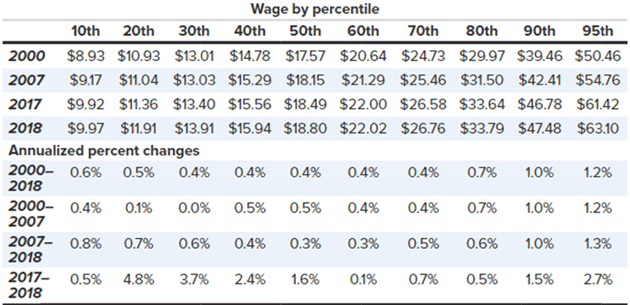

This table from the Economic Policy Institute shows hourly wages of all workers, by wage percentile, for 2000–2018 (in 2018 dollars).

Source: Economic Policy Institute

Current federal unemployment benefits of $600 per week, assuming a 40-hour week, equal $15 an hour (plus the state portion, which varies).

That means the bottom 30% of US workers are better off keeping unemployment as long as they can. Especially the bottom 20%. Even the 40th percentile might be better off taking the unemployment benefit as they have no cost of getting to and from work.

I have no idea what the next level of benefits will be or how long they will last. But as I said earlier, we are moving toward a Guaranteed Basic Income which, added to other entitlement spending, would push us closer to $2 trillion-plus annual deficits.

The world will not come to an end with a $30 trillion US debt. How far will future US Congresses push that number? Explaining to the average politician that debt is a drag on future growth is futile. Spending money today helps them get reelected tomorrow.

This, along with Federal Reserve policy, is going to push us to a very uncomfortable place towards the end of this decade.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could be triggered in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.