Why Moores Law is NOT Dead!

Companies / Computing Jul 20, 2020 - 09:52 AM GMTBy: N_Walayat

For as long as I can remember the argument has been that Moores Law (doubling in cpu processing power every 2 years) was always just about to end due to the inability to shrink the cpu dies further and thus an end to exponential increase in processing power that is usually measured in cpu transistor count , I did not agree with this 5 years ago when I first started writing about the exponential AI mega-trend where to date it has not turned out to be true on either transistor count or the COMPUTE power basis which is what people should actually be focused upon, after all that is what one actually utilises COMPUTE POWER.

The rest of this extensive analysis has first been made available to Patrons who support my work. Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035

- Why Investors Should Buy Deviations against the Bull Market Highs

- The AI Mega-trend - Moores Law is NOT Dead!

- QUANTUM COMPUTERS

- The Quantum AI EXPLOSION!

- Capitalising on the AI Mega-trend

- AI Stocks Mega-trend

- Formulating a AI Stocks Mega Trend Forecast

- AI Stocks Mega-tend 15 Year Trend Forecast Conclusion

- Dow Quick Technical Take

- Getting Started with Machine Learning

- Black Lives Matter Protests To trigger 2nd Covid-19 Wave?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

You will also gain access to my most recent exclusive to patrons only content -

How to Get Rich Investing in Stocks by Riding the Electron Wave

- From a stocks bull market far far away

- THIS TIME IT'S DIFFERENT!

- Moores Law and the Inflation Mega-trend

- The Electron Mega-trend

- Investing in Stocks on an Exponential Trend Trajectory

- Eight Rules for Investing Stocks

- Machine Lifelong Learning

- Coronavirus Pandemic UK and US Second Spikes Plus the Doomsday Scenario

- Dow 30k before End of 2020?

Remember during March I repeatedly told my Patrons in unequivocal terms that:

a. That the Corona stocks bear market would prove temproary and likely END BEFORE the end of March.

b. That I was buying AI stocks in what I deemed to be the best buying opporutnity for many years.

16h March : US and UK Coronavirus Containment Incompetence Resulting Catastrophic Trend Trajectories

Remember that whilst the current spread of the Coronavirus may be exponential, so is the AI mega-trend. And who do you think is going to profit from the current crisis? Amazon, Google, Facebook, that's who! i.e. the coronavirus is reinforcing the importance of the virtual world.

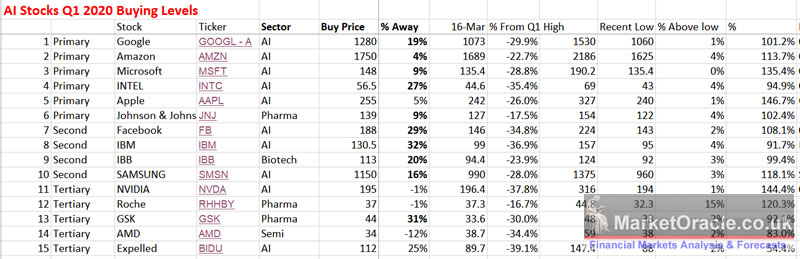

All of the stocks except AMD have now moved below their Q1 buying levels, and many stocks by a significant degree! The most notable biggest bargains of the bunch are Google, Intel, Facebook and IBM, especially when compared against their Q1 highs.

The recent panic sell off also acts as an important indicator of underlying relative strength of Apple and Amazon. One would have imagined that these two stocks having greater exposure to the real world than the virtual world would have faired worse then the likes of Google, i.e. being disruptive to Apples production of iphones and Amazon's supply chains. But no, so far they are showing that the market is already starting to discount recovery for these two stocks. And if one thinks about it then it makes sense that China will lead the V shaped economic bounce back by a couple of months ahead of the West, and thus improve the prospects for Apple and Amazons supply chain.

That and so many people choosing not to risk catching Coronavirus will increasingly put greater demands on Amazon for all sorts of goods and services.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.