The Prospects of S&P 500 Above the Early June Highs

Stock-Markets / Stock Markets 2020 Jul 24, 2020 - 02:27 PM GMTBy: Paul_Rejczak

The announced S&P 500 upswing is underway, and the early June highs have been overcome on a closing basis. Will the regular trading's final hour sprint carry over into today's session? Are the bulls as strong as the one-sided result of Monday's trading suggests?

That's not a foregone conclusion, because we've seen quite a shift from Friday's sectoral dynamics. In today's analysis, I'll dive into the internals and lay out the case why the bulls still enjoy the benefit of the doubt, regardless of the persisting bearish sentiment and double top talk.

S&P 500 in the Short-Run

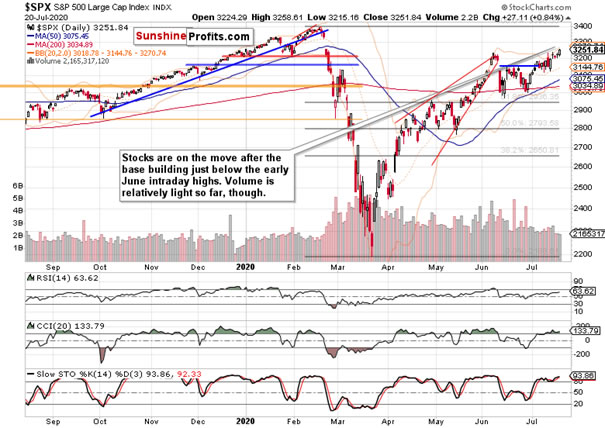

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The extended launching pad above the mid-June tops propelled stocks above the early June highs. The volume of the move has been relatively muted, though. On a standalone basis, that's not an issue, as rising volume can confirm higher prices in the coming days. The white body without a striking upper knot shows that the bulls are in the driver's seat – that's no sign of a reversal.

Are the credit markets in tune with the daily chart's perspective?

The Credit Markets’ Point of View

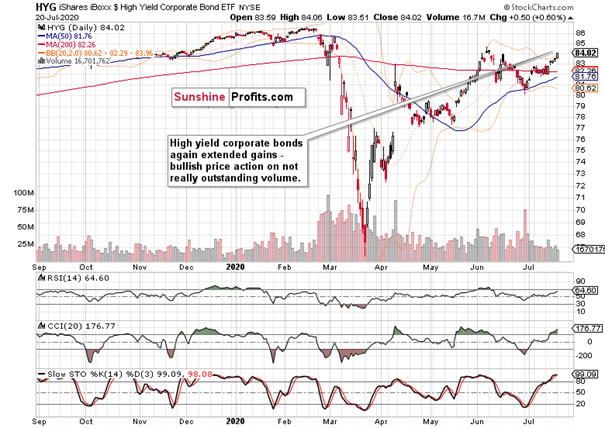

High yield corporate bonds (HYG ETF) indeed scored strong gains yesterday, but on really low volume. One day isn't a cause for a full-blown concern, but I would prefer to see it improving over the coming sessions so as to confirm the HYG price direction more convincingly.

The investment grade corporate bonds (LQD ETF) support the HYG upswing to continue – just as the HYG swing structure does.

The high yield corporate bonds to short-term Treasuries (HYG:SHY) ratio is in tune with the overlaid S&P 500 closing prices (please see this and many other charts featured on my home site), and both are moving higher. Stocks are already above the early June highs, while HYG:SHY has a bit more to go still. The current setup is not a screaming divergence, though – the bulls have the initiative to solve that constructively.

Spotlight on Market Breadth, Smallcaps and Emerging Markets

Both the advance-decline line and advance-decline volume have seen better days, and their readings reflect a short-term non-confirmation. Narrowing leadership is not a good omen for the bulls.

The Russell 2000 (IWM ETF) didn't rise yesterday – the smallcaps have paused when they instead could have risen in line with Friday's spirit of rotation into value plays. This is as well concerning on a short-term basis.

On the other hand, emerging markets (EEM ETF) did confirm yesterday's S&P 500 upswing, which adds weight to the bullish side of the story. It's never a good idea to act solely based on some short-term non-confirmations – instead, it pays to form as comprehensive picture as it gets, and then act on it.

The USD adds more color to the emerging markets story. There is no mad rush into dollars underway as the measured move lower attests to, which highlights no deflationary squeeze in the moment.

S&P 500 Sectors in Focus

Technology (XLK ETF) was the driver of yesterday's upswing, and its heavyweight stocks significantly gained ground. Incresing volume also lends credibility to the daily upswing.

Crucially, the semiconductors (XSD ETF) outperformed again, foretelling further tech gains as very likely indeed.

The value plays, the former laggards, disappointed yesterday, but let's discuss the sectors one by one.

Healthcare (XLV ETF) treading water, materials (XLB ETF) declining on inconclusive volume, and consumer discretionaries (XLY ETF) closing at new 2020 highs. The defensive plays (utilities and consumer staples – XLU ETF, XLP ETF respectively) took it on the chin yesterday, but their daily volumes aren't convincing enough to call the moves as reversals – daily consolidations are more probable scenarios.

Summary

Summing up, the S&P 500 made the anticipated move higher, and the bulls can deal with the very short-term non-confirmations accompanying the upswing in the coming sessions. The path of least resistance in stocks still appears to be cautiously higher as the bears aren't putting any real pressure on the bulls to prove what they're made of.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter - it's absolutely free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock & Oil Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Monica Kingsley is a trader and financial markets analyst. Apart from diving into the charts on a daily basis, she is very much into economics, marketing and writing as well. Naturally, she has found home at Sunshine Profits - a leading company that has been publishing quality analysis for more than a decade. Sunshine Profits has been founded by Przemyslaw Radomski, CFA - a renowned precious metals investor and analyst.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.