Gold Makes Record High and Targets $6,000 in New Bull Cycle

Commodities / Gold & Silver 2020 Jul 28, 2020 - 06:14 PM GMTBy: Jason_Hamlin

The gold price made a new all-time nominal high today at $1,945 per ounce. This move should not come as a surprise to anyone paying attention to the current financial landscape. The FED has injected an unprecedented amount of new money/debt into the economy since March in efforts to avoid a collapse from the impact of the Covid-19 virus and subsequent restrictions of business activity globally. Over $6 trillion in stimulus so far is roughly double the entire amount injected during the financial crisis of 2008/09. And they are just getting started.

The Federal Reserve has stated that stimulus efforts will last for years and they have committed to do “whatever it takes” to keep the economy afloat. The Federal Reserve balance sheet has shot from $4 trillion pre-crisis to $7 trillion today. This is the highest level on record by a wide margin and the fastest it has ever increased. And this is before the 2nd round of stimulus, which is currently being negotiated. While there are plenty of dollar bulls amidst a global dollar shortage, they have been incorrect in their bullish outlook thus far. The dollar index has dropped from a high of 103 on March 20th to just 94, a significant drop in just a few months to the lowest level since September of 2018.

It turns out that when the money printer goes brrrrrr, it is indeed bearish for the dollar and bullish for gold, which is now up 25% year-to-date. This compares to a loss of 0.5% for the S&P 500 and even outpaces the gains of the red-hot NASDAQ, which is up 15% in the same time period. While we advocate holding some physical gold, it has been mining stocks that have generated the best gains in 2020. The VanEck Vectors Gold Miners ETF (GDX) is up 42% year-to-date and many of the junior miners that we hold in the Gold Stock Bull portfolio are up 100%. Miners see their profit margins increase at a faster pace than the gold price, which often results in leveraged gains.

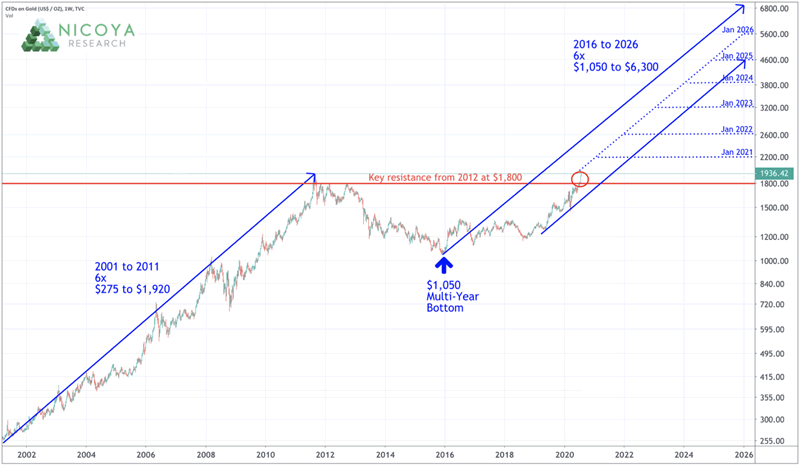

The recent breakout above resistance at $1,800 (red circle in the chart) was very significant for gold and was followed by a quick rally of an additional $150 toward $1,950 per ounce. And there is plenty of upside left in this rally in our view, with the price still below the mid-point of the trend channel. If we use the last major bull cycle in gold as a guide, we forecast the price to climb toward $6,000 by the start of 2026. This would represent another 10-year cycle and 6x move from the December 2015 bottom around $1,050.

Forecasted Gold Price Targets

We have added price targets for the start of each year that fall in the middle of the trend channel. This analysis gives us the following median price points for the years ahead:

- January 2021: $2,250

- January 2023: $3,200

- January 2025: $4,600

- January 2026: $5,600

These are just the mid-points and not the highs for each year. At the top of the trend channel, we get the following price forecasts:

- January 2021: $2,700

- January 2023: $4,000

- January 2025: $5,750

- January 2026: $7,000

This gives us some indication of where we might expect the gold price to peak in the years ahead and the magnitude of gains that we expect.

If the 250% advance to a potential high around $7,000 seems exciting to you, consider that quality mining stocks will typically offer leverage of around 3x during these periods, suggesting the potential for gains of 750% over the next 5.5 years. Of course, there are all types of variables that could impact the price trajectory for gold, but this gives us a rough idea of the potential ahead. To the downside, I suppose the government could display fiscal restraint and the FED could raise interest rates and reduce their balance sheet. Perhaps the annual deficit could shrink and the debt-to-GDP ratio could fall as the United States shifts to a surplus and pays down debt. But yeah, those odds are incredibly slim.

On the other side of the spectrum, we could be conservative in our estimates of how much new money will be created and how low interest rates could go in an effort to avoid a stock market collapse and the political fallout that would accompany it. A steady rise in inflation could give way to rapid inflationary pressure or even hyperinflation in the years ahead. If the dollar loses its world reserve status and people lose faith in governments and central bank fiat money, the upside price target that we listed (denominated in dollars) could end up being very conservative. In that case, we would want to start measuring the value of gold based on a basket of other scarce assets/commodities, rather than fractional reserve fiat money.

At any rate, we believe that gold and gold miners are currently very undervalued and expect the price to increase rapidly over the next few years. Prices for the metals and miners could get dragged down if the stock market has another major correction to March levels or lower, but we believe the dip in gold will be shorter and shallower than most are expecting. As with past stock market crashes, there is usually only a short window when leveraged longs and weak-handed speculators are forced to cover or panic out of positions. This is typically followed by capital flowing back into the sector, partially due to the inevitable response of governments and central banks to further debase their currencies in an attempt to stimulate growth. So, we think it makes sense to remain long with core positions and keep some cash on the sidelines to take advantage of any such dips.

If you are interested in receiving our investment research, please check out our new website at nicoyaresearch.com. We offer 4 different newsletters covering different investment sectors and have added a chat room where we are busy daily posting news, charts and trading ideas for subscribers. We have a track record of outpacing the market and believe you will find that the research pays for itself many times over.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling.

Copyright © 2020 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.