The Bullish Case for Stocks Isn't Over Yet

Stock-Markets / Stock Markets 2020 Aug 01, 2020 - 05:01 PM GMTBy: Paul_Rejczak

The bulls didn't seize upon Monday's stock upswing, and prices declined in what might look as a good-bye kiss to the horizontal line connecting the early June highs. Are stocks about to roll over to the downside? Despite yesterday's deterioration in the credit markets, I think it's too early to jump to such a conclusion.

Technology is holding up, semiconductors aren't weakening relatively to the sector, and the rotation into healthcare, materials, and industrials is very much on. The defensives (utilities and consumer staples) are also improving their posture. Consumer discretionaries are firm, and financials are getting better relative to the index.

Yes, going into today's Fed and especially into Thursday's aftermarket with earnings from selected tech behemoths, the market is likely to move higher if yesterday's AMD results are any indication.

But let's assess where we stand after yesterday's closing bell.

S&P 500 in the Short-Run

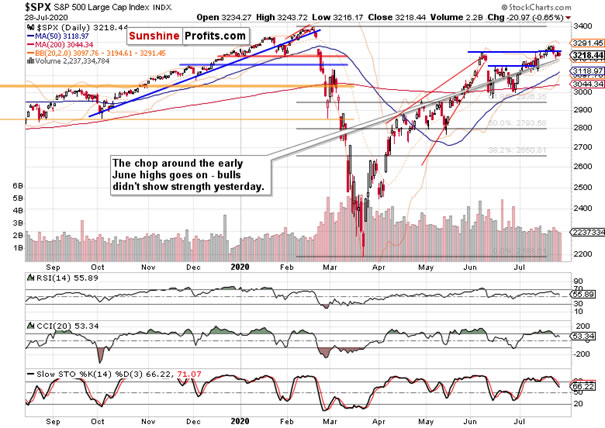

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Stocks didn't really improve their short-term posture yesterday. On the other hand, the renewed decline below the early June highs happened on mediocre volume, which means that it lacked broad participation by the bears. If they are serious about taking advantage of the daily indicators' sell signals, they better show up fast.

Could the Fed be the catalyst of such a move? Hawkish policy surprises are out of the question, so would a cautious tone on the recovery perils do the trick, and send markets plunging? Regardless of the real action in precious metals (canary in the coal mine), the Fed would err on the side of not fighting inflation too soon. And thus far fighting the deflationary corona effects, the stimulus is winning and being embraced with open arms by stocks.

So, I think that the bears would be getting ahead of themselves expecting a lasting downturn right now – I treat the consolidation as one with a higher likelihood of a bullish resolution than a bearish one.

Let's see the opinion of the credit markets.

The Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) lost ground yesterday (please see this and many more charts at my home site), but again, the volume didn't dazzle. Thanks to the expectations from the Fed, the sideways consolidation is more likely to resolve with an upswing than not.

Investment grade corporate bonds (LQD ETF) also declined yesterday, but the limited price move attracted significantly more in terms of daily volume increase than was the case with HYG ETF. That smacks of accumulation to me, and could point to a move higher being not that far off.

These are the indications during the current soft patch in both debt instruments. Now, it's about those clues manifesting in their respective price actions.

Both the leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – finetune the short-term picture of weakness. No market goes up or down in a straight line, and the ratios' swing structure is still favoring another advance, which is more apparent from the following chart.

Overlaying the S&P 500 closing prices against the HYG:SHY chart captures the momentary dynamics. Monday's upswing rejected, yet Tuesday's decline can't take prices below Friday's lows. Another rebound attempt in stocks is likely – just take a look at the early July chop, and what followed next.

Smallcaps, Emerging Markets and S&P 500 Market Breadth

Neither the Russell 2000 (IWM ETF), nor the emerging markets (EEM ETF) have sent any clear signals yesterday. IWM ETF mirrored the S&P 500 perfectly yesterday, and EEM ETF keeps consolidating in its bid to outperform the U.S. index.

That's as bullish as it gets. Another indication – this time that yesterday's downswing didn't gain much traction, as most stocks refused to participate. With such a protracted consolidation, the ball is in the bulls' court now. How far will they run with it?

Summary

Summing up, the S&P 500 downswing appears to have the nature of wear you out rather than scare you out. With credit markets not sending a clear-cut message, one has to rely on the healthy rotation and technology not leading to the downside. With current corona cases being a non-event to stocks, it's renewed lockdowns (dialed back reopenings), real flare-ups in the U.S. – China tensions, or policy missteps sapping the fragile recovery, that can hurt the stock bull. Tomorrow's tech heavyweights' earnings will be THE bellwether, and it pays going into that moment with one's guard up. Judged today, a renewed stock upswing is still the more likely scenario.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter - it's absolutely free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock & Oil Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Monica Kingsley is a trader and financial markets analyst. Apart from diving into the charts on a daily basis, she is very much into economics, marketing and writing as well. Naturally, she has found home at Sunshine Profits - a leading company that has been publishing quality analysis for more than a decade. Sunshine Profits has been founded by Przemyslaw Radomski, CFA - a renowned precious metals investor and analyst.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.