Unemployment Rate Drops. Will It Drag Gold Down?

Economics / Employment Sep 10, 2020 - 01:05 PM GMTBy: Arkadiusz_Sieron

The U.S. labor market improved in August, although headlines paint too rosy a picture. What does it all mean for the gold market?

The U.S. labor market improved in August, although headlines paint too rosy a picture. What does it all mean for the gold market?

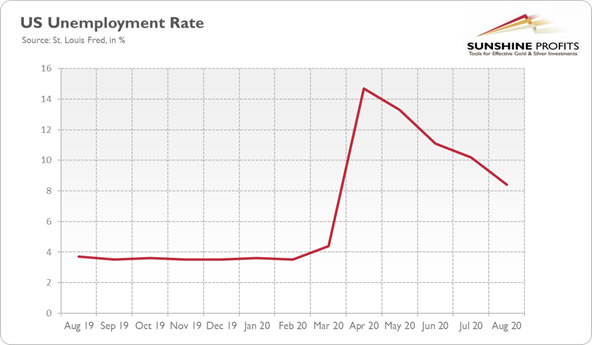

Great news for the U.S. labor market: according to the BLS, the American economy regained 1.4 million jobs, while the unemployment rate fell below 10 percent for the first time in the pandemic era! To be more precise, the unemployment rate declined from 10.2 percent in July to 8.4 percent in August, as the chart below shows.

Importantly, the fall in the unemployment rate was bigger than expected – and it was accompanied by an increase in the labor-force participation rate, from 61.4 to 61.7 percent, which makes the decline in the unemployment rate even better.

The headline numbers are, thus, negative for the gold market. They reflect improvements in the labor market and the continued recovery of the economic activity from the coronavirus crisis and the Great Lockdown.

However, when we dig deeper, we would see less rosy picture. First of all, as one can see in the chart below, the pace of the U.S. employment growth has seriously slowed down from gains of 2.7 million, 4.8 million, and 1.8 million in May, June and July, respectively. It indicates that the nonfarm payrolls are clearly losing momentum.

Moreover, the 238,000 jobs were created only temporarily due to the Census 2020. And we cannot forget that the unemployment rate remains relatively high, especially when compared with a 3.5 percent rate before the outbreak of the epidemic. So, there is still a long way to get back to the pre-COVID levels and trajectory.

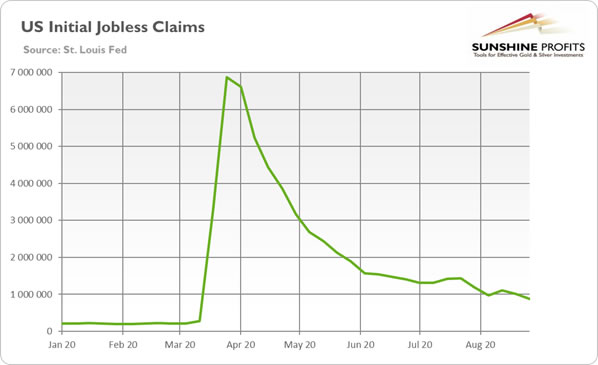

Another example showing that investors should always take headline numbers with a pinch of salt, are the initial jobless claims. They fell sharply by 130,000 to a seasonally adjusted 881,000 in the last week of August (see the chart below), but the decrease was caused by a methodological change in how the data is adjusted to account for seasonal swings in employment.

Implications for Gold

What does it all imply for the gold market? Well, the decline in the unemployment rate is negative for gold prices, as it could restore the confidence in the vigorous economic rebound. Indeed, the price of gold declined initially in response to the release of the Employment Situation Report.

However, the fact that the U.S. job growth slowed further in August is worrisome. The slowdown shows the fragility of the current economic recovery and puts its stability into question without the new government’s financial stimulus package. The uncertainty about the pandemic and economic recovery should maintain the demand for gold as a safe-haven asset and a portfolio diversifier.

So, in the short-term, the correction in the gold market could continue. The inability of gold to rally after the Fed announced its dovish change in the inflation-targeting regime looks bearish and may indicate that gold has already priced in a more inflationary Fed. The improved epidemiological situation and economic recovery could also add some downward pressure on the gold prices.

However, the fundamental outlook for gold remains bullish. The monetary policy remains easy, while the real interest rates will remain ultra low or even negative for years. The fiscal deficits and public debts are ballooning. In such a macroeconomic environment, gold should shine in the long-run.

And do not underestimate the power of the dovish side! After all, last week, the Fed acknowledged that the Philips curve is dead, so it will permit the economy to expand and inflation to increase to a higher level without the need to hike interest rates. In other words, the Fed promised to keep the federal funds rate near zero for a few more years without worrying about inflation. As it has become even clearer that the Fed is more concerned about the weak economy than inflation, we are even more certain that the real interest rates will remain at ultra low levels for years, which will continue to push investors toward gold.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.