Does the Stock Market Really "See" the Future?

Stock-Markets / Stock Markets 2020 Sep 12, 2020 - 04:02 PM GMTBy: EWI

Addressing the notion that the market "discounts" future events

Let's start off with an August 26 quote from Marketwatch:

[F]rothy financial markets ... currently are discounting the nirvana of an uninterrupted V-shaped recovery. ...

Of course, that statement means that the reason investors have been bidding stock prices higher is that they collectively anticipate a strong economic recovery.

But is that the real reason that stock prices are in record-high territory again?

Well, financial history seems to suggest otherwise.

Here's a classic statement from the founder of Elliott Wave International, Robert Prechter:

The idea that the mass of investors possess near-omniscience about the economic future is difficult to defend. It does not explain why in 1928 the market foresaw nothing but blue sky, in 1929 very suddenly foresaw depression, and in early 1930 anticipated a recovery that never happened.

Because markets are patterned, the concept of near-perfect collective forecasting must be false.

The market also saw "blue sky" when the Dow reached its then all-time high in 2007, right before the market collapse and the economy fell into the "Great Recession." And, the same applies to early 2020, before the stock market fell 38%.

No, the real reason why the stock market has risen since the March low is contained in that phrase from the Robert Prechter quote: "Markets are patterned."

And, it's investor psychology that creates the price pattern of the market -- not "near omniscience" about future events.

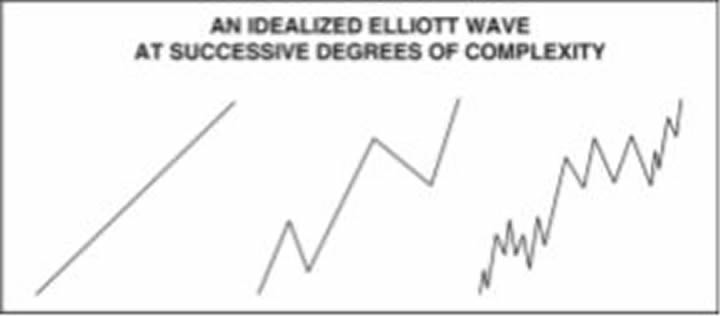

These Elliott wave patterns show up time and again in market charts -- at all sizes of trend.

Here's a look at a simple, idealized Elliott wave at increasing degrees of detail:

The bottom line is that the market follows the Wave Principle. It is not governed by the anticipation of future events, or for that matter, current events or anything external to the market.

Further, because Elliott wave patterns are repetitive, they are predictable!

Let's shift focus now to wave categorization. This is from the book, Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter:

All waves may be categorized by relative size, or degree. The degree of a wave is determined by its size and position relative to component, adjacent and encompassing waves. [Ralph N.] Elliott named nine degrees of waves, from the smallest discernible on an hourly chart to the largest wave he could assume existed from the data then available. He chose the following terms for these degrees, from largest to smallest: Grand Supercycle, Supercycle, Cycle, Primary, Intermediate, Minor, Minute, Minuette, Subminuette. Cycle waves subdivide into Primary waves that subdivide into Intermediate waves that in turn subdivide into Minor waves, and so on. The specific terminology is not critical to the identification of degrees, although out of habit, today's practitioners have become comfortable with Elliott's nomenclature.

Get more insights into the Wave Principle by reading the online version of the Wall Street classic, Elliott Wave Principle: Key to Market Behavior.

Just sign up for a free membership into Club EWI, the world's largest Elliott wave educational community, and free access to Elliott Wave Principle: Key to Market Behavior becomes instantly available to you.

Learn how the Elliott wave model can help you forecast widely-traded financial markets by following this link: Elliott Wave Principle: Key to Market Behavior -- free access.

This article was syndicated by Elliott Wave International and was originally published under the headline Does the Stock Market Really "See" the Future?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.