A Greater Economic Depression For The 21st Century

Economics / Coronavirus Depression Sep 19, 2020 - 10:21 AM GMTBy: Kelsey_Williams

Some are calling it the “Greater Depression” but that still makes last century’s Depression of the 1930’s the point of reference. The Great Depression of the 1930s was bad, but what we are facing now is worse.

The Depression Of The 21st Century will likely end up being the new singular event of discussion and comparison for all financial and economic catastrophes. Questions of how much worse and how long it will last are difficult to answer. Predictions about the type and strength of potential recovery could be premature.

THE GREAT DEPRESSION

After the stock market crash in October 1929, the situation was bleak. Formerly wealthy investors literally lost everything. Unemployment surged, especially with the layoffs on Wall Street.

The onset of the new year, 1930, brought new-found optimism. Banks and brokerage firms began hiring again, confidence increased and stocks recovered a majority portion of their previous losses.

Unfortunately, things didn’t get better. The new-found optimism was lost, stocks collapsed again, and the layoffs continued. Over the next two years, stock prices declined by more than ninety percent.

What if something like that happened today? A similar percentage drop in the Dow Jones Industrial Average would take it from 29,000 to 2900. There is not much allowance for confidence to reassert itself in the face of stocks dropping to a level last seen in November 1991. A nearly 30-year period of higher and higher stock price gains would be wiped out in two short years.

Taking only two years to find a bottom might be the best news. It took the stock market (DJIA) twenty-three more years (twenty-five years in all) to regain its all-time price peak from August 1929. That is in nominal terms. In inflation-adjusted terms, the stock market did not regain and exceed its previous all-time high until May 1959 – thirty years after the crash.

As bad as the stock market numbers sound, other events and circumstances reflect a clearer picture of the financial and economic turmoil which followed the crash.

The ranks of unemployed grew to more than twenty-five percent, then declined to approximately twenty percent and remained at that level until dropping sharply with the concurrent rise in manufacturing and industrial activity associated with the United States involvement in World War II.

Homeless people on the streets, long lines at soup kitchens, beggars, and tent cities were obvious indications of the depressed state of the economy. Week after week, month after month, year after year, the Great Depression lingered on.

The conditions accompanying the bleak economic environment were exacerbated by bank failures. People who thought they had some money safely deposited at their local building and loan institution or commercial bank saw their hopes and dreams dashed. Bank failures became an almost common threat to financial stability.

How much more difficult would it be for us today to deal with similar events and circumstances? Probably much more difficult. We might not be able to cope with it.

As a society today, we are far removed in experience and memory from hard times. We have become accustomed to being taken care of. Part of that coddled feeling is due to the extreme level of government guarantees and our expectations that ‘Big Brother’ will always be there to do something.

Investors and consumers like guarantees; and they want to see evidence that a guarantee is more than just an empty promise.

During the 1930s, with the alarming numbers of bank failures and the Great Depression at its full-blown worst, confidence was almost nonexistent. Bank runs and depressed stock prices had created an atmosphere of financial panic.

President Roosevelt’s answer was a bank “holiday”. Not too long afterwards, Congressional legislation authorized the formation of the Federal Deposit Insurance Corporation (FDIC) and the Federal Savings And Loan Insurance Corporation (FSLIC).

Use of the terms ‘federal’ and ‘insurance’ in the names of the new institutions was meant to help restore lost confidence and maintain it. Apparently it worked. Confidence in the banks improved.

The money wasn’t really there to back up the guarantees. It was an empty promise, but people felt better; and that seemed to be good enough. Fragile as the banking system was – and still is – people preferred having their money in the bank.

That preference did not in any way, shape, or form, translate to investor participation in the stock market. Still reeling from the collapse in stocks, people would sooner lend or give money to family members. If someone had any money to invest they usually bought bonds. It took almost two generations for stocks to become fashionable again.

NO RESERVATIONS FOR TODAY’S STOCK INVESTORS

The almost casual attitude towards selloffs in the stock market that exists in this century is the result of assuming that the market will right itself and go right back up in short order. Or, if things are serious enough, the Federal Reserve Cavalry will ride to the rescue – every time.

The expectation that the Fed will always bail out the banks and the financial markets has muted the word ‘caution’ when it comes to investing. Some people seem to fancy themselves as smart investors because they bought stocks this past spring and are now feeling the euphoria from the effects of the Fed’s injection of the money drug into their financial veins.

We seem to have forgotten how difficult it was to extricate ourselves from a similar mess little more than a decade ago. The financial markets may have recovered more quickly this time but the economic backdrop is more characteristic of a patient that is “terminally ill but resting (un)comfortably”.

The Fed is very aware of how precarious the situation is. They have pulled out all the stops in their quest to “bring back inflation”. They are fighting an uphill battle. The chart below shows the declining effects of the inflation created by the Fed over the last half-century…

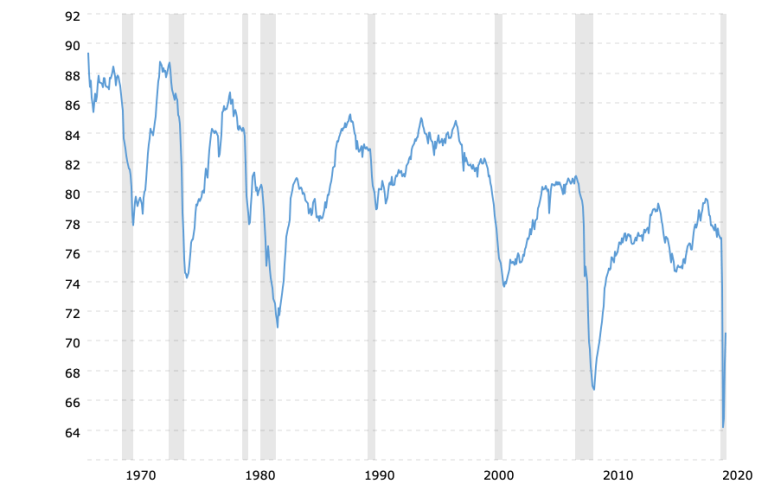

Capacity Utilization Rate – 50 Year Historical Chart

This chart (source) shows capacity utilization back to 1967. Capacity utilization is the percentage of resources used by corporations and factories to produce finished goods.

As you can see in the chart, the capacity utilization rate has been trending down in regular stair-step fashion for more than fifty years. A possible reason could be an increase in the efficient use of the available resources. Rather, though, the declining capacity utilization rate is more reflective of an ongoing decline in the demand for finished goods.

Neither of those reasons are consistent with the expectations from ongoing inflation that the Fed creates. The actual results are indicative of a multi-decade decline in the demand for finished goods; a long-term slowdown in economic activity.

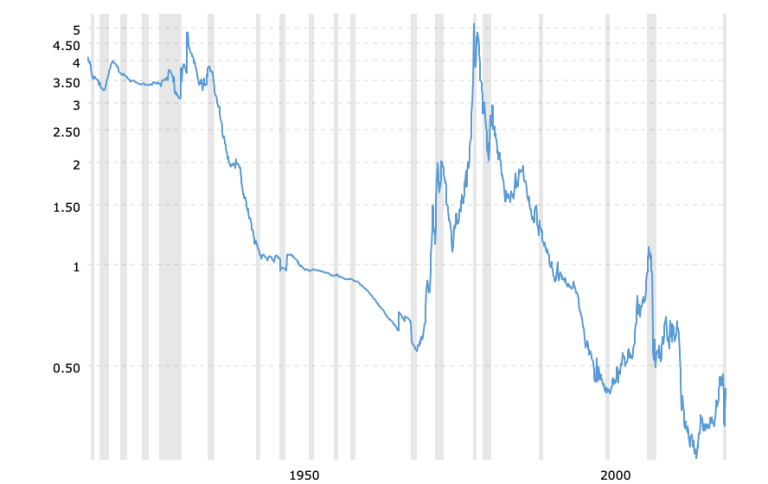

Here is another chart. This one shows the relationship of gold’s price to the monetary base…

Gold’s Price To The Monetary Base – 100 Year Historical Chart

In the chart immediately above, we see that the ratio of gold’s price to the monetary base is in a long-term decline that has lasted for over one hundred years. This seems somewhat contradictory when compared to what some think they know about gold.

Gold’s higher price over time is a reflection of the ongoing decline of the U.S. dollar. The decline (loss of purchasing power) in the value of the U.S. dollar is the result of the inflation created by the government and the Federal Reserve.

The increase in the monetary base is an indicator of the extent to which the government and the Fed have debased the money supply. The continual expansion of the supply of money and credit leads to the loss in purchasing power of the dollar.

Some gold analysts and investors believe that increases in the monetary base lead to similarly proportionate increases in gold’s price. But that is not what is happening.

Gold’s price increase for the past one hundred years does not correlate with the increase in the monetary base. The price of gold reflects the actual loss in purchasing power of the U.S. dollar.

Inflation created by the Fed is losing its intended effect. It’s resulting effects on the economy are similar to those of drug addiction. Over time, each subsequent fix yields less and less of the desired results.

THE FED KEEPS TRYING

Jerome Powell’s announcement of a ‘major policy shift’ is borne out of fear and frustration. The intention of moving towards “average inflation targeting” while allowing inflation to run higher than the standard 2% target is meaningless.

If you continually fall short of your original 2% target, how can you possibly “allow inflation to run higher”? That is like saying that your car will only go forty mph but you want it to go fifty mph. Nothing you have done so far has been successful in getting your car to go fifty mph. As a result, you announce that you are going to allow you car to go sixty mph for awhile. Huh?

Mr. Powell’s statement is an admission that the Fed has lost control. This does not mean that they necessarily had much control over things in the past, either; but the Fed definitely can influence the financial markets. For example…

“…as the Fed slashed interest rates to nearly record lows from 2001 until mid-2004, housing prices climbed far faster than inflation or household income year after year. By 2004, a growing number of economists were warning that a speculative bubble in home prices and home construction was under way, which posed the risk of a housing bust.” (source)

Fed Chairman Alan Greenspan’s response to the potential threat of a housing bust was that housing prices had never endured a nationwide decline and that a bust was highly unlikely.

Even after the fact, during his testimony before the House Committee on Oversight and Government Reform, Greenspan referred to his own reaction to the credit crisis and its economic destruction as one of “shocked disbelief”. The former Fed chairman is blamed by some for the credit crisis of 2007-08.

The Federal Reserve has a history of implication regarding causes of financial and economic disaster; and, on occasion, they have admitted their part:

“Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna: Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.”…Remarks by Governor Ben S. Bernanke (At the Conference to Honor Milton Friedman, University of Chicago -Chicago, Illinois November 8, 2002)

Three years later, Mr. Bernanke had succeeded Mr. Greenspan and was at the helm as Chairman of the Federal Reserve when storm-tossed seas amid waves of financial debt threatened to destroy the ship completely – again.

I wonder if Mr. Bernanke regrets his public admission in behalf of the Federal Reserve; he seemed to be in a hurry to leave his post at the end of his initial term as Chairman.

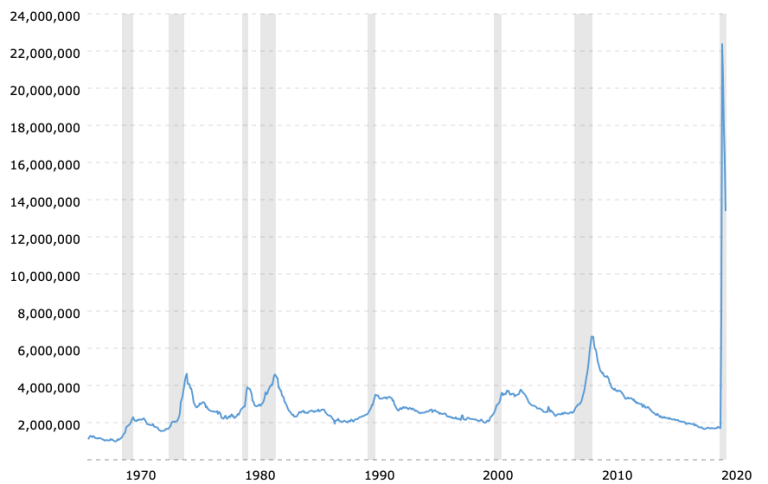

As The Depression Of The 21st Century unfolds, here are some charts of various economic indicators that bear watching…

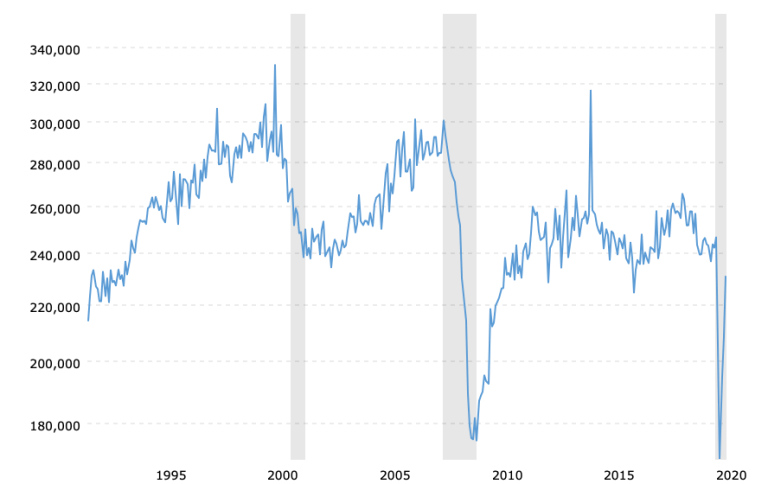

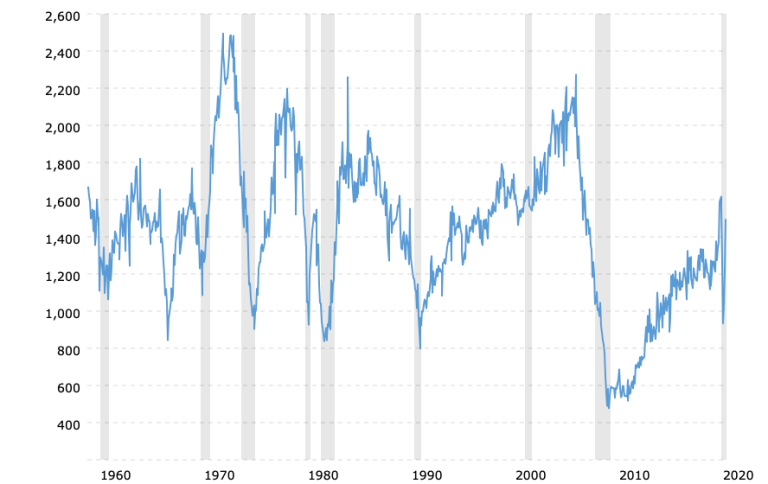

Continued Jobless Claims Historical Chart

The chart above (source) shows that the current level of continued jobless claims is twice as high as it was at its peak in June 2009; and that is after declining forty percent from its peak earlier this year in April.

Housing Starts Historical Chart

The above chart of Historical Housing Starts (source) puts into perspective the action and attention in today’s market for new homes. It is true that housing starts are nearly back to their peak from just before economic fallout from the Covid-19 response. Nevertheless, they are still thirty percent lower than their peak in 2006 prior to the mortgage crisis associated with the Great Recession. In addition, the activity level of new housing starts for the past decade is lower than any decade as far back as the 1960s.

Durable Goods Orders – Historical Chart

As the above chart shows (source) even at their post-pandemic recovery highs, durable goods orders are still lower than at any other point dating back to the early 1990s (the exception being the brief spike downwards in 2009).

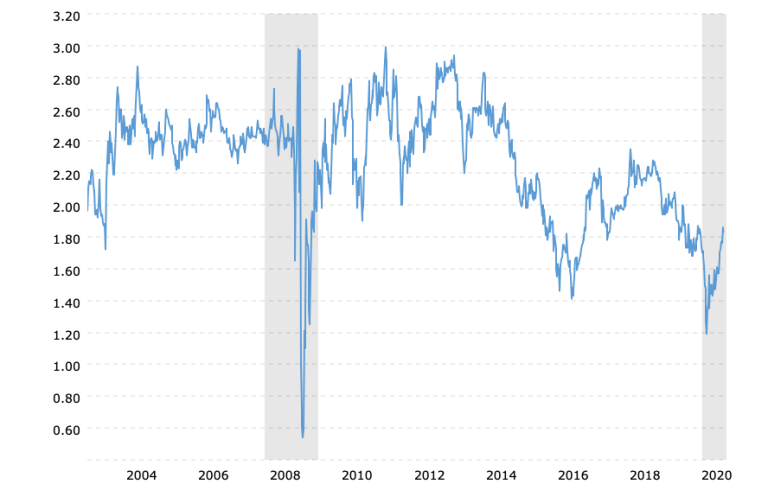

5 Year 5 Year Forward Inflation Expectation

The chart above (source) measures the expected average inflation rate over the five-year period that begins five years from today. Expectations for the future rate of inflation continue to decline and reached their lowest point since December 2008, and lower than any other point in this century.

Expectations for lower rates of inflation are consistent with the trend of actual rates of inflation shown on the chart below…

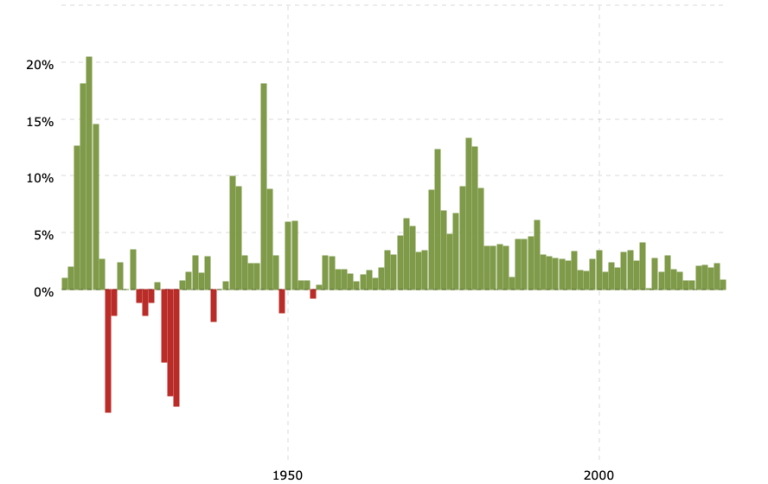

Historical Inflation Rate by Year

Inflation rates in this century are lower than any comparable period of time going back to the 1950s-60s. (source)

We spoke earlier in this article about declining demand for finished goods. Raw goods have been affected by lack of demand, too. One of these is crude oil.

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2020 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.